- United States

- /

- Metals and Mining

- /

- NYSE:NEM

How Investors May Respond To Newmont (NEM) CFO Departure and Interim Appointment

Reviewed by Simply Wall St

- Newmont Corporation recently announced that Chief Financial Officer Karyn F. Ovelmen has resigned and will be departing the company as of July 11, 2025, with no disagreements cited regarding company operations or financial policies.

- Interim CFO responsibilities have been assumed by Peter Wexler, Newmont's Executive Vice President and Chief Legal Officer, highlighting the organization’s focus on continuity and leveraging experienced leadership during this transition.

- Given the CFO transition and interim leadership appointment, we'll explore what this change could mean for Newmont's corporate stability and investment outlook.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

Newmont Investment Narrative Recap

To be a Newmont shareholder, you need to believe that the company’s focus on high-margin, Tier 1 gold assets, its disciplined capital allocation, and its ability to sustain strong free cash flow are central to creating value, particularly as gold prices remain elevated. The recent CFO resignation, with no operational disagreements cited and a seasoned executive stepping in as interim, does not materially change the company’s most important near-term catalyst, execution on its project pipeline and maintaining operational stability. However, the biggest risk continues to be the company’s increasing reliance on fewer mines, which could amplify the impact of any production or jurisdictional hiccups.

Among recent announcements, the retirement of nearly US$1.4 billion in debt over the past year stands out. This initiative, part of a broader capital structure optimization, directly supports Newmont’s ability to weather transitional periods like the current CFO change by reinforcing its balance sheet, which remains a core strength underlying its investment case.

By contrast, investors should be aware of increasing operational concentration risk at core mines and how...

Read the full narrative on Newmont (it's free!)

Newmont's outlook anticipates $20.5 billion in revenue and $5.5 billion in earnings by 2028. This scenario assumes a 1.4% annual revenue growth rate and an increase in earnings of $0.5 billion from the current earnings of $5.0 billion.

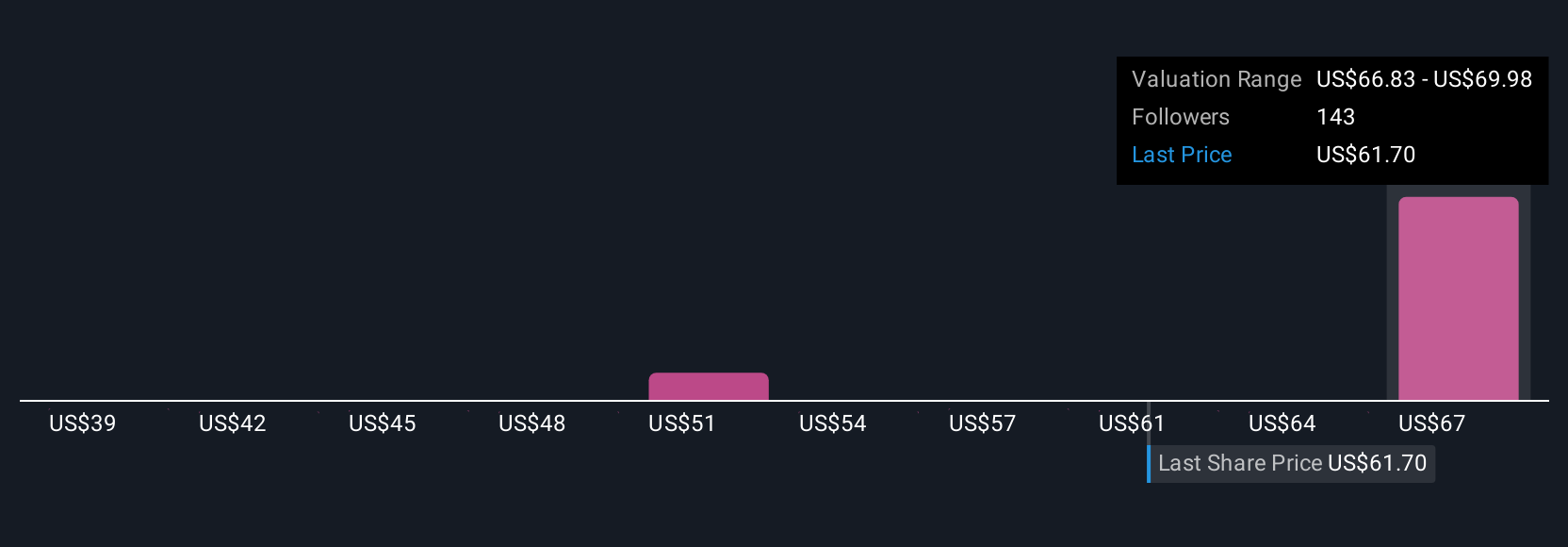

Uncover how Newmont's forecasts yield a $67.22 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 11 unique fair value estimates for Newmont, ranging from US$38.50 to US$69.77. While opinions vary, many are watching how Newmont’s tighter portfolio and project execution could affect both earnings and risk going forward; consider multiple views before forming your own.

Build Your Own Newmont Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newmont research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Newmont research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newmont's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmont might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NEM

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives