- United States

- /

- Metals and Mining

- /

- NYSE:NEM

Newmont Corporation's (NYSE:NEM) 26% Share Price Surge Not Quite Adding Up

Newmont Corporation (NYSE:NEM) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 42% in the last year.

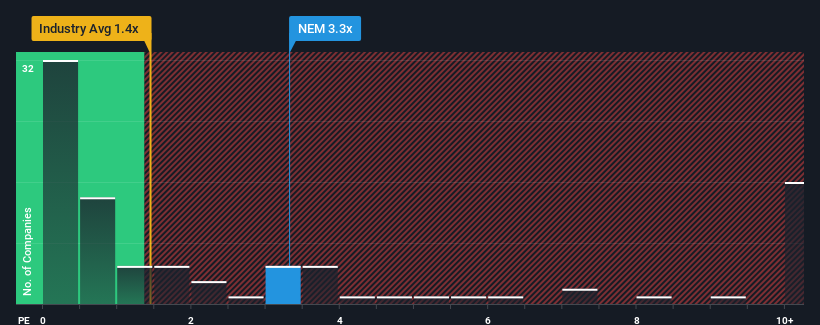

Since its price has surged higher, given close to half the companies operating in the United States' Metals and Mining industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Newmont as a stock to potentially avoid with its 3.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Newmont

What Does Newmont's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Newmont has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Newmont .What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Newmont would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 58% gain to the company's top line. The latest three year period has also seen an excellent 53% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 1.7% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 7.0% per annum, which is noticeably more attractive.

In light of this, it's alarming that Newmont's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Newmont's P/S is on the rise since its shares have risen strongly. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It comes as a surprise to see Newmont trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Newmont that you need to be mindful of.

If you're unsure about the strength of Newmont's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Newmont might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NEM

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives