- United States

- /

- Consumer Durables

- /

- NYSE:BZH

Undervalued Small Caps With Insider Buying Across Regions

Reviewed by Simply Wall St

The United States market has experienced a positive trend, climbing 2.8% in the last week and showing a 9.3% increase over the past year, with earnings projected to grow by 14% annually. In this environment, identifying stocks that are potentially undervalued can be advantageous, especially when there is insider buying activity suggesting confidence in their future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.1x | 2.9x | 48.92% | ★★★★★☆ |

| Flowco Holdings | 6.9x | 1.0x | 34.02% | ★★★★★☆ |

| S&T Bancorp | 10.8x | 3.7x | 44.74% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 36.11% | ★★★★☆☆ |

| Forestar Group | 6.0x | 0.7x | -406.13% | ★★★★☆☆ |

| Columbus McKinnon | 48.2x | 0.5x | 39.31% | ★★★☆☆☆ |

| MVB Financial | 12.1x | 1.6x | 31.79% | ★★★☆☆☆ |

| Franklin Financial Services | 15.4x | 2.5x | 35.15% | ★★★☆☆☆ |

| Union Bankshares | 17.4x | 3.2x | 28.36% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -20.80% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

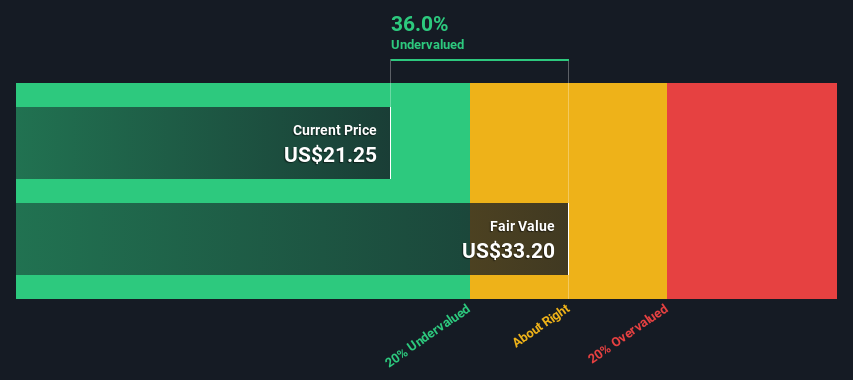

Beazer Homes USA (NYSE:BZH)

Simply Wall St Value Rating: ★★★★★★

Overview: Beazer Homes USA is a home construction company focusing on building single-family homes across the East, West, and Southeast regions of the United States, with a market capitalization of approximately $1.04 billion.

Operations: The company's revenue is primarily derived from its homebuilding operations across three regions: East, West, and Southeast. The gross profit margin has shown varied performance over the periods, reaching 23.33% at one point before declining to 16.64%. Operating expenses include significant allocations towards general and administrative costs as well as sales and marketing efforts.

PE: 6.6x

Beazer Homes USA, a company with a focus on expanding its home insurance business, recently reported earnings for Q2 2025. Sales increased to US$565 million from US$542 million the previous year, yet net income fell significantly. Despite lower profit margins and reliance on external borrowing, insider confidence is evident as an insider purchased 22,500 shares valued at approximately US$510K. The company's recent share repurchase of over 900K shares underscores its commitment to enhancing shareholder value amidst these challenges.

- Delve into the full analysis valuation report here for a deeper understanding of Beazer Homes USA.

Assess Beazer Homes USA's past performance with our detailed historical performance reports.

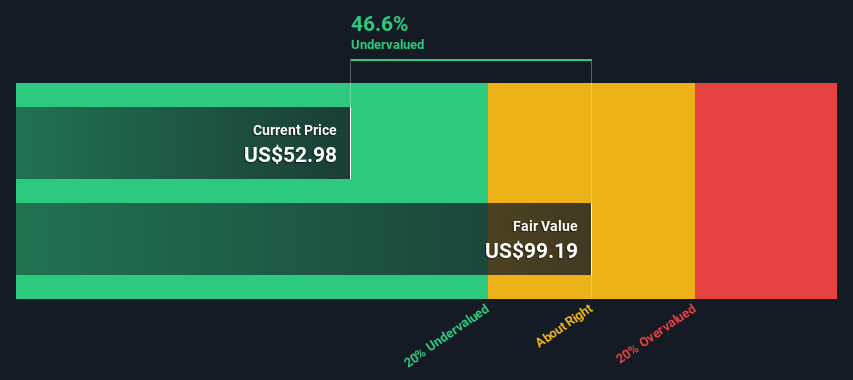

Minerals Technologies (NYSE:MTX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Minerals Technologies operates in the engineered solutions and consumer & specialties segments, with a market cap of approximately $2.23 billion.

Operations: Minerals Technologies generates revenue from two key segments: Engineered Solutions and Consumer & Specialties, with the latter contributing more to total revenue. Over recent periods, the gross profit margin has shown a trend of decline, reaching 23.66% in 2024-06-30 before slightly rebounding to 25.60% by 2025-03-30. The company faces significant costs primarily from COGS and operating expenses, impacting net income margins which have fluctuated notably over time.

PE: -71.3x

Minerals Technologies, a smaller company in the U.S., recently reported a challenging Q1 2025 with sales at US$491.8 million and a net loss of US$144 million. Despite these setbacks, the company shows insider confidence through recent share purchases. Although earnings guidance was revised downwards, indicating potential hurdles ahead, Minerals Technologies has been actively managing its capital structure through share repurchases totaling US$75 million since October 2023. This suggests management's belief in future growth potential despite current financial pressures.

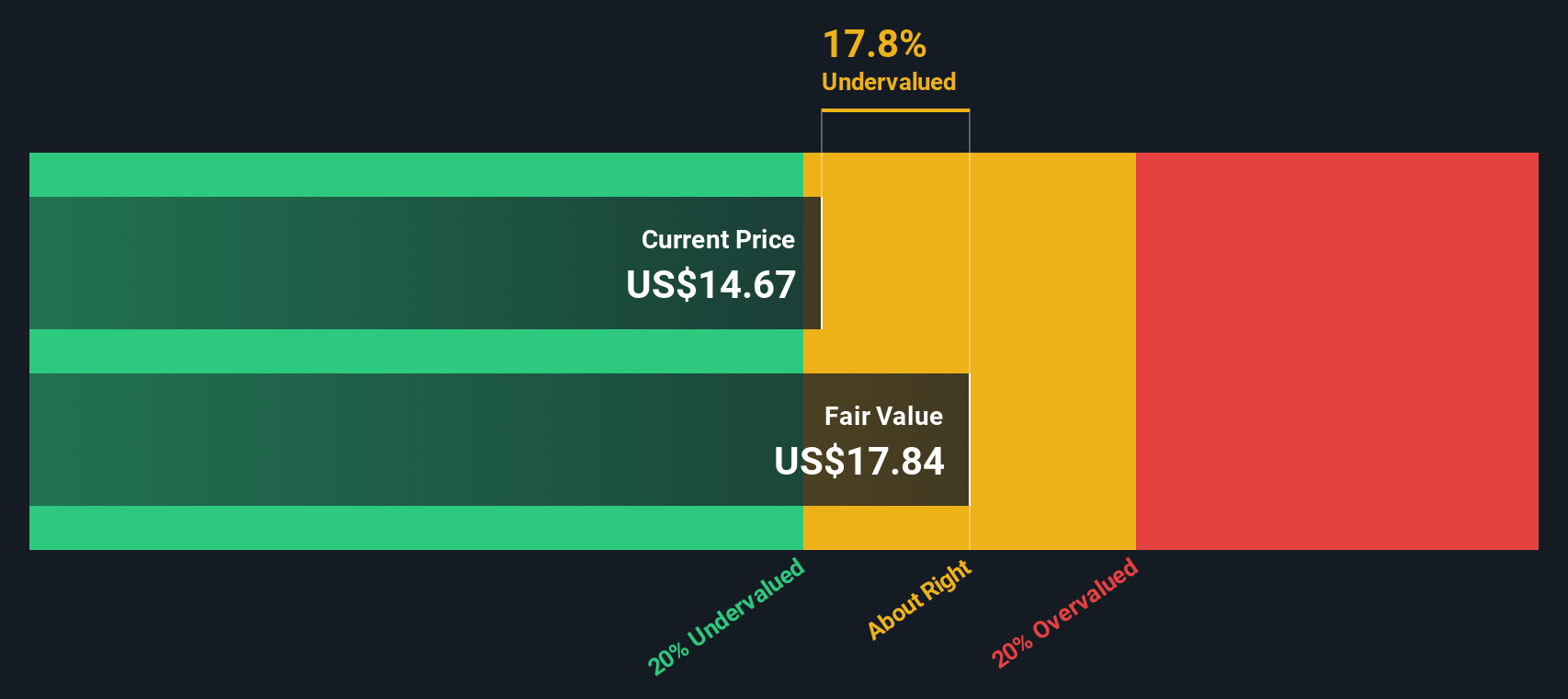

Myers Industries (NYSE:MYE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Myers Industries operates as a diversified manufacturing and distribution company focusing on material handling products and solutions, with a market cap of approximately $0.79 billion.

Operations: The company generates revenue primarily through its Material Handling segment, contributing $627.10 million, and its Distribution segment, with $209.12 million in revenues. The gross profit margin has shown variability over the years but reached 33.11% by March 2025. Operating expenses have been a significant cost component, with general and administrative expenses consistently being a major part of these costs.

PE: 41.3x

Myers Industries, a small company in the U.S., recently reported Q1 2025 earnings with net income rising to US$6.81 million from US$3.5 million last year, despite stable sales at US$206.75 million. The company's profit margins have improved but remain modest at 1.3%. Insider confidence is evident with recent share purchases, signaling potential growth prospects. However, reliance on external borrowing poses financial risks as interest payments aren't well-covered by earnings, and the share price has been volatile recently.

- Dive into the specifics of Myers Industries here with our thorough valuation report.

Explore historical data to track Myers Industries' performance over time in our Past section.

Key Takeaways

- Investigate our full lineup of 91 Undervalued US Small Caps With Insider Buying right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Beazer Homes USA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beazer Homes USA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BZH

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives