- United States

- /

- Banks

- /

- NasdaqGM:FINW

September 2025's Leading Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As the U.S. stock market continues to reach new heights with the S&P 500 and Nasdaq setting all-time records, investors are keenly observing how recent economic shifts, such as the Federal Reserve's interest rate cut, will impact future growth trajectories. In this buoyant environment, stocks with robust insider ownership often attract attention due to their potential for alignment between management and shareholder interests, making them appealing candidates for those seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.3% | 59.3% |

| Hippo Holdings (HIPO) | 14.1% | 41.2% |

| Hesai Group (HSAI) | 15.5% | 41.5% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.3% | 33% |

| Cloudflare (NET) | 10.5% | 46.1% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.8% |

Here we highlight a subset of our preferred stocks from the screener.

Bank First (BFC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bank First Corporation operates as a holding company for Bank First, N.A., with a market cap of approximately $1.25 billion.

Operations: The company's revenue is primarily derived from its banking operations, totaling $166 million.

Insider Ownership: 10.2%

Revenue Growth Forecast: 35.8% p.a.

Bank First Corporation demonstrates strong growth potential with forecasted earnings and revenue growth significantly outpacing the US market. Recent index inclusions, such as the S&P Regional Banks Select Industry Index, highlight its growing recognition. Despite a lack of substantial insider buying recently, more shares have been acquired than sold by insiders over the past three months. The company trades below its estimated fair value and has shown consistent financial performance with increased net interest income and net income in recent quarters.

- Delve into the full analysis future growth report here for a deeper understanding of Bank First.

- In light of our recent valuation report, it seems possible that Bank First is trading beyond its estimated value.

FinWise Bancorp (FINW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: FinWise Bancorp is the bank holding company for FinWise Bank, offering a range of banking products and services to individuals and businesses in Utah, with a market cap of $304.05 million.

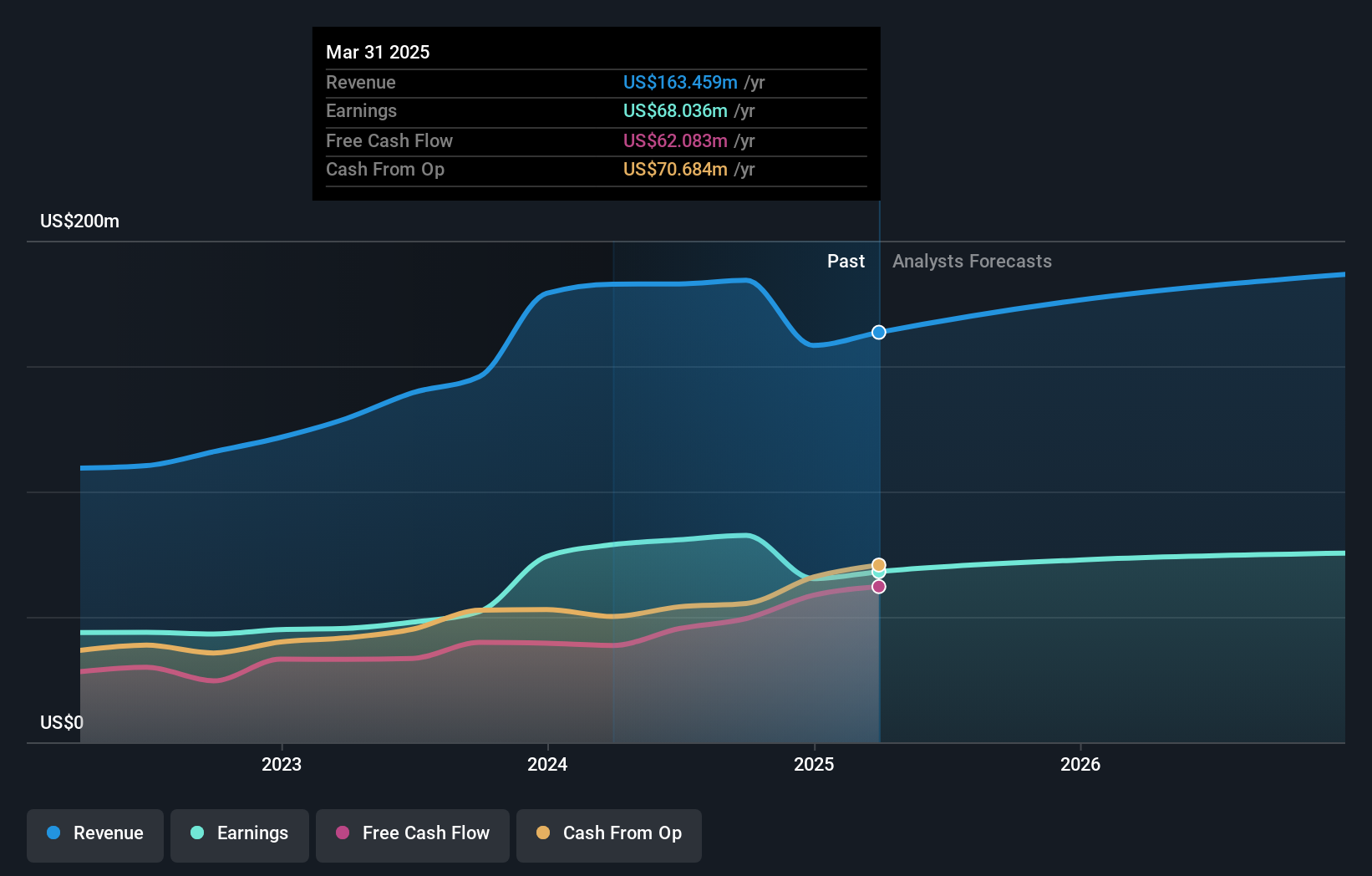

Operations: The company generates revenue primarily from its banking segment, which accounts for $75 million.

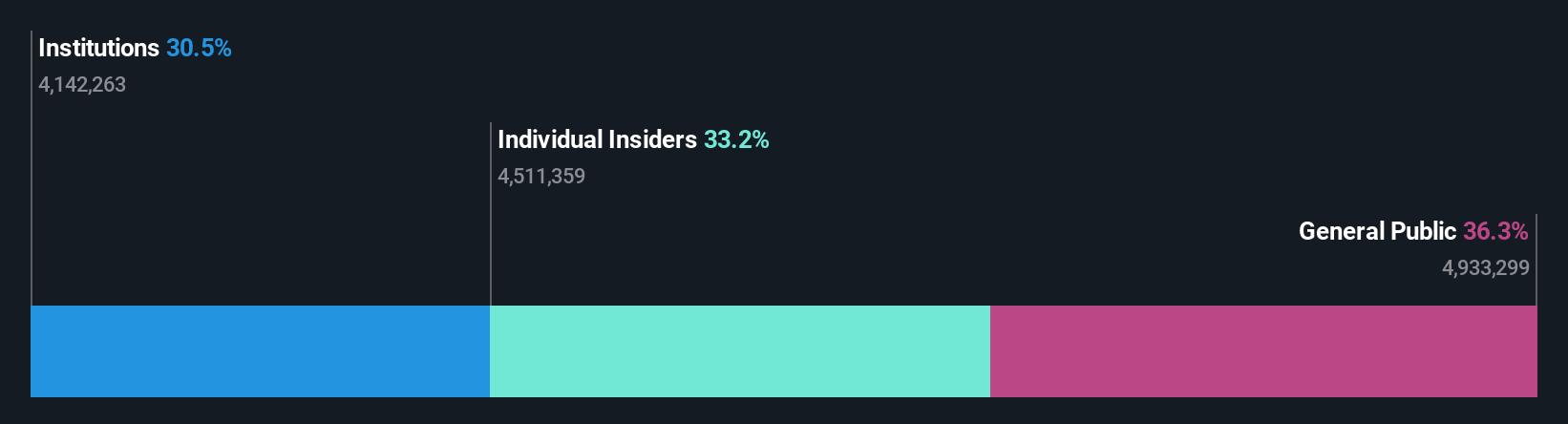

Insider Ownership: 34.8%

Revenue Growth Forecast: 31.7% p.a.

FinWise Bancorp exhibits robust growth potential with forecasted earnings and revenue growth surpassing the US market. Recent inclusions in multiple indices, including the S&P Global BMI Index, underscore its expanding recognition. Insider activity shows more purchases than sales recently, although not in substantial volumes. Despite trading below estimated fair value, challenges include a high level of bad loans (7.4%) and a low allowance for these loans (41%). Net income has shown improvement year-over-year.

- Take a closer look at FinWise Bancorp's potential here in our earnings growth report.

- Our valuation report here indicates FinWise Bancorp may be undervalued.

McEwen (MUX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: McEwen Inc. is involved in the exploration, development, production, and sale of gold and silver deposits across the United States, Canada, Mexico, and Argentina with a market cap of $785.63 million.

Operations: The company's revenue segments include $67.75 million from Canada and $100.10 million from the United States.

Insider Ownership: 15.8%

Revenue Growth Forecast: 31.2% p.a.

McEwen Inc. is poised for strong growth, with forecasted revenue growth of 31.2% annually, outpacing the US market. Recent drilling results at the Windfall and Grey Fox projects indicate significant resource expansion potential, bolstering long-term production goals. The appointment of Ian Ball as Vice-Chairman aims to drive strategic growth initiatives, including doubling production by 2030. While insider buying exceeds selling in recent months, volumes remain modest; shares trade significantly below estimated fair value (US$).

- Get an in-depth perspective on McEwen's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that McEwen's current price could be quite moderate.

Next Steps

- Gain an insight into the universe of 203 Fast Growing US Companies With High Insider Ownership by clicking here.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FINW

FinWise Bancorp

Operates as the bank holding company for FinWise Bank that provides various banking products and services to individual and corporate customers in Utah.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives