- United States

- /

- Metals and Mining

- /

- NYSE:MUX

Could Froome West Drill Success Reshape McEwen (MUX)’s Long-Term Fox Complex Strategy?

Reviewed by Sasha Jovanovic

- McEwen Inc. recently reported new high-grade drill results from the Froome Mine at its Fox Complex in Timmins, Ontario, extending gold mineralization by 100 meters vertically and 50 meters west while advancing underground development on multiple levels.

- The combination of deeper, open-at-depth mineralization and near-term mineable zones could meaningfully enhance Froome’s mine life, production flexibility, and unit cost profile within the broader Fox Complex.

- We’ll now examine how these Froome West drilling results, and their potential to extend high-grade mine life, influence McEwen’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

McEwen Investment Narrative Recap

To own McEwen, you need to believe that its mix of producing gold assets and copper upside at Los Azules can transition the company from persistent losses to sustainable cash generation. The Froome West drill results reinforce Fox Complex as a near term operational pillar, but they do not change that the key short term catalyst remains delivery against production and cost guidance, while the biggest risk is continued operational underperformance and capital needs at major projects.

The most relevant recent announcement alongside Froome West is McEwen’s Q3 2025 result, which showed the company still posting a small net loss of US$0.462 million for the quarter. Against that backdrop, higher grade, near term mineable ounces at Froome and future mill feed from the Stock Mine could be important supports for cash flow as McEwen advances capital intensive projects like Los Azules and the Tartan restart.

However, investors should also be aware that continued project execution risks, particularly around Los Azules and Tartan, could still...

Read the full narrative on McEwen (it's free!)

McEwen's narrative projects $446.1 million revenue and $201.4 million earnings by 2028.

Uncover how McEwen's forecasts yield a $22.20 fair value, a 18% upside to its current price.

Exploring Other Perspectives

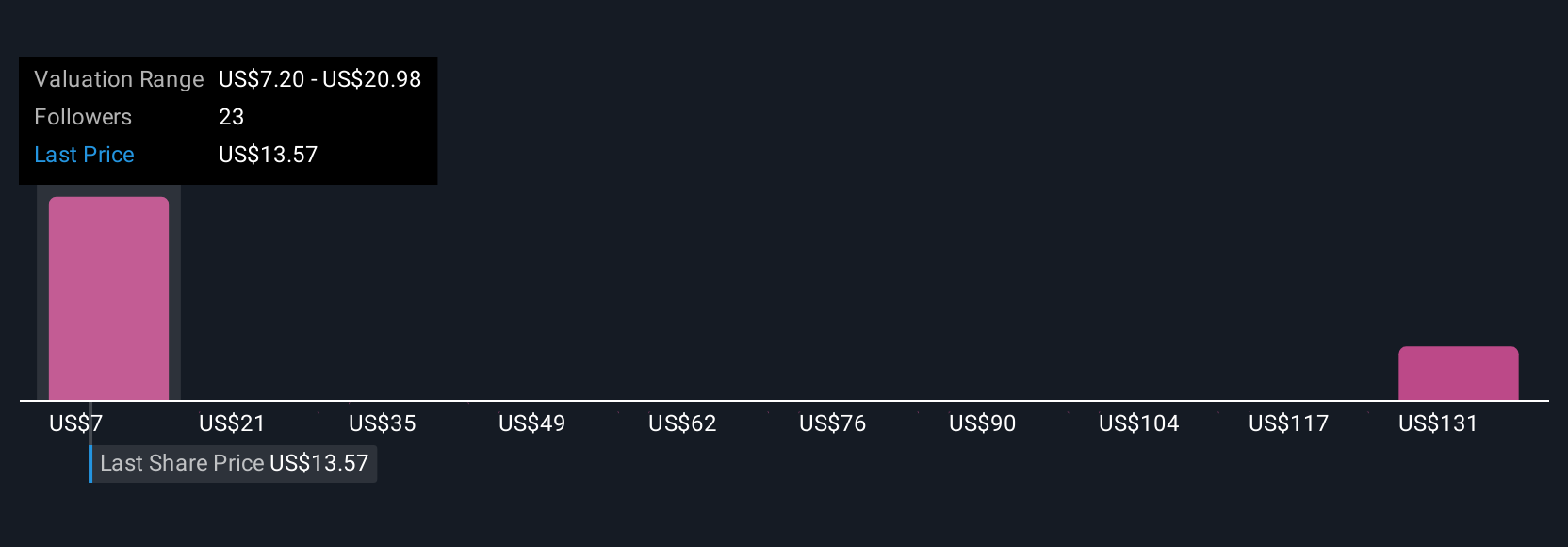

Seven members of the Simply Wall St Community currently estimate McEwen’s fair value between US$8.69 and US$161.77, highlighting very different expectations. Set against this wide range, the company’s reliance on successful execution at Los Azules and other major developments could materially shape whether those more optimistic forecasts are ever approached, so it is worth weighing several viewpoints before forming your own.

Explore 7 other fair value estimates on McEwen - why the stock might be worth less than half the current price!

Build Your Own McEwen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your McEwen research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free McEwen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate McEwen's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MUX

McEwen

Engages in the exploration, development, production, and sale of gold and silver deposits in the United States, Canada, Mexico, and Argentina.

High growth potential and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026