- United States

- /

- Basic Materials

- /

- NYSE:MLM

Martin Marietta Materials (NYSE:MLM) Declares US$0.79 Cash Dividend for Q2 2025

Reviewed by Simply Wall St

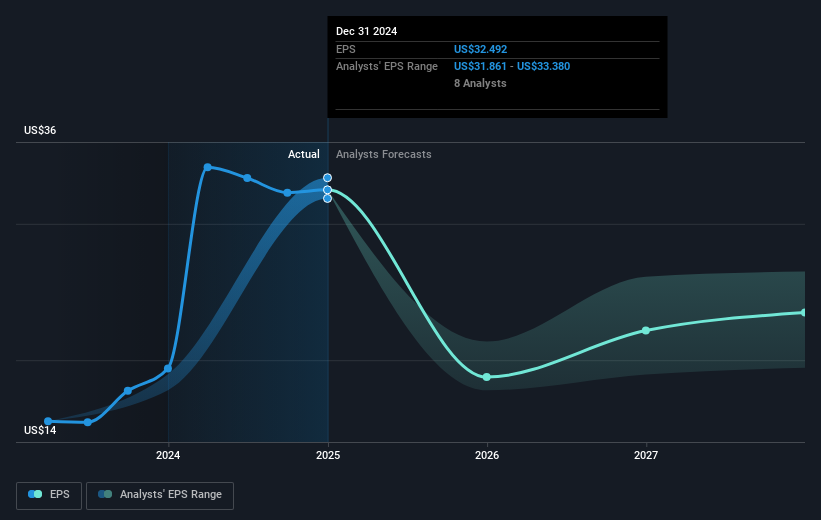

Martin Marietta Materials (NYSE:MLM) recently affirmed its quarterly dividend, maintaining a payout of $0.79 per share, and declared intentions for value-enhancing acquisitions, which might have supported its 11% share price increase over the past month. Recent earnings showed increased sales, but net income and EPS declined significantly from the previous year. Additionally, the company repurchased a significant number of shares, further bolstering shareholder value. While these company-specific developments unfolded, the overall market experienced upward momentum, indicating that Martin Marietta's actions likely aligned with broader positive trends.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Martin Marietta Materials' recent affirmation of its quarterly dividend and its pursuit of value-enhancing acquisitions may significantly impact its near-term revenue and earnings forecasts. While increased sales were noted, the decline in net income and EPS points to pressures that may need strategic management. The company's commitment to acquisitions could bolster margins and support sustainable earnings growth, as indicated by the narrative of rising infrastructure investments and AI-driven data centers.

Over the longer term, the company achieved a substantial total return of 220.45% over the past five years, highlighting a strong historical performance. However, compared to the past year's returns, Martin Marietta underperformed the US Basic Materials industry, which saw a return of 3.1%, and the broader US market, which returned 10.6%. This underperformance in the recent period contrasts with the more robust longer-term growth, posing a consideration for investors assessing the company's future potential.

The current share price increase, supported by recent actions, aligns closely with analyst expectations. Despite a moderate 0.06267937633000001 share price discount to the consensus price target of US$587.51, there is still room for further examination. The company's efforts in strategic acquisitions, discipline in cost management, and focus on optimizing their portfolio play into expectations of revenue growth and margin enhancement, but the immediate impact remains tempered by market conditions and internal shifts such as leadership changes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives