- United States

- /

- Basic Materials

- /

- NYSE:MLM

Martin Marietta Materials (MLM): Assessing Valuation After Dividend Boost and Renewed Shareholder Confidence

Reviewed by Simply Wall St

If you own Martin Marietta Materials (MLM) stock or have been keeping an eye on it, the company just gave investors something to talk about. The Board has approved a higher quarterly dividend, bumping the payout up to $0.83 per share. This kind of move generally signals confidence from management in the underlying business, and the timing is interesting, especially with investors still searching for reliable income plays as the Federal Reserve holds off on cutting rates.

In the bigger picture, Martin Marietta Materials has been on a steady climb. The stock is up roughly 13% in the past year, with nearly 19% gains year to date. Even the past 3 months show positive momentum, which suggests investors have been rewarding the company for both its growth and financial discipline. Other recent events, such as similar dividend increases across the sector, highlight that stability and shareholder returns are clearly in focus during turbulent market conditions.

Still, with shares near recent highs, investors have to wonder whether the boosted dividend signals a buying opportunity, or if the market has already factored in Martin Marietta Materials’ next phase of growth.

Most Popular Narrative: 5.2% Undervalued

According to the community narrative, Martin Marietta Materials is considered modestly undervalued by analysts. The current share price sits just below the calculated fair value, hinting at underlying confidence in the company's future prospects, even as the stock nears record levels.

Sustained, multi-year demand for aggregates is expected due to ongoing U.S. federal and state infrastructure investment, with state and local highway, bridge, and tunnel contract awards recently hitting record highs. Anticipated extensions to federal spending packages would further increase revenue visibility and support continued top-line and EBITDA growth.

Curious what’s driving this upbeat valuation? There is a well-defined path, based on ambitious growth projections and high-margin assumptions, that could push earnings further. The real surprise is that it all comes down to a set of forecasts that go beyond simple revenue gains. Want to know the specific targets behind the analysts’ confidence? This narrative has the details.

Result: Fair Value of $641.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent affordability headwinds or a slowdown in federal infrastructure funding could undermine the optimistic outlook that is driving Martin Marietta's current valuation.

Find out about the key risks to this Martin Marietta Materials narrative.Another View: Multiples Tell a Different Story

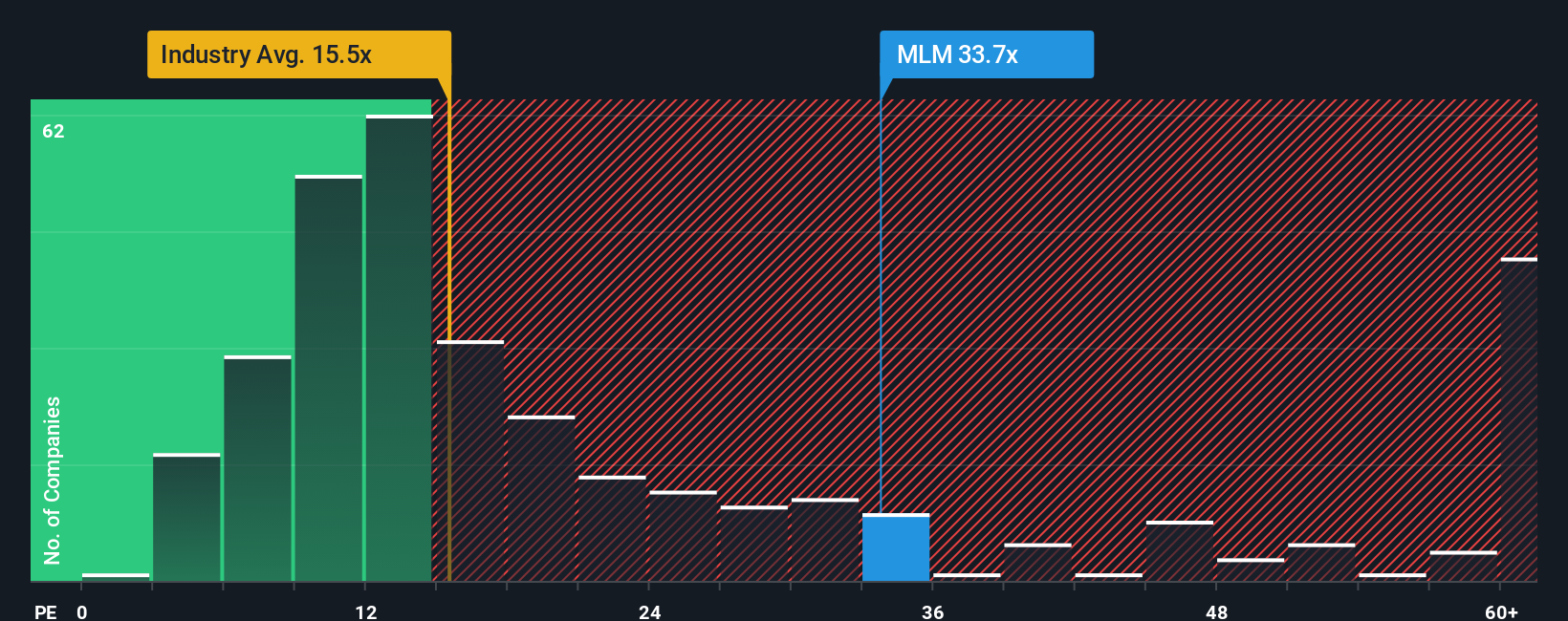

Looking from a different angle, when we use the commonly tracked earnings multiple, Martin Marietta Materials appears more expensive than the industry average. This suggests investors are paying a premium for its growth or stability. Is there something the market sees that others do not?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Martin Marietta Materials Narrative

If you are not entirely convinced by these perspectives or want to dig into the numbers yourself, you can easily craft your own narrative in just a few minutes: do it your way.

A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investing opportunities?

Don’t let standout ideas pass you by. Arm yourself with insights that could seriously boost your portfolio. Ensure you are always in the know with these handpicked approaches to finding promising stocks through the Simply Wall Street Screener:

- Tap into the next wave of innovation as you uncover AI penny stocks poised to transform industries with breakthrough artificial intelligence advances.

- Secure stable income streams by targeting dividend stocks with yields > 3% delivering reliable yields above 3%. This can be a smart choice for combatting market uncertainty.

- Stay ahead of the curve by researching undervalued stocks based on cash flows the market may have missed, giving you a shot at buying remarkable companies for less.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives