- United States

- /

- Commercial Services

- /

- NYSE:NL

Exploring Undervalued Small Caps With Insider Action In May 2025

Reviewed by Simply Wall St

Over the past week, the United States market has risen by 2.7% and is up 9.6% over the last year, with earnings projected to grow by 14% annually. In this environment, identifying small-cap stocks that are perceived as undervalued and exhibit insider buying can provide unique opportunities for investors seeking to capitalize on potential growth within a dynamic market landscape.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 10.0x | 2.8x | 49.41% | ★★★★★☆ |

| Flowco Holdings | 6.2x | 0.9x | 40.07% | ★★★★★☆ |

| Shore Bancshares | 9.3x | 2.3x | -24.08% | ★★★★☆☆ |

| S&T Bancorp | 10.5x | 3.6x | 46.17% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 20.97% | ★★★★☆☆ |

| Forestar Group | 5.8x | 0.7x | -393.37% | ★★★★☆☆ |

| West Bancorporation | 12.6x | 4.0x | 40.18% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -14.04% | ★★★☆☆☆ |

| Tandem Diabetes Care | NA | 1.2x | -3281.22% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -326.42% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

SolarEdge Technologies (NasdaqGS:SEDG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SolarEdge Technologies focuses on the development and sale of solar energy solutions and related products, with a market capitalization of approximately $6.62 billion.

Operations: The company's primary revenue stream is from its solar segment, generating $842.44 million. It has experienced fluctuations in gross profit margin, which reached a high of 36.64% and later dropped to -92.84%. Operating expenses have consistently increased over time, with significant allocations towards R&D and sales & marketing efforts.

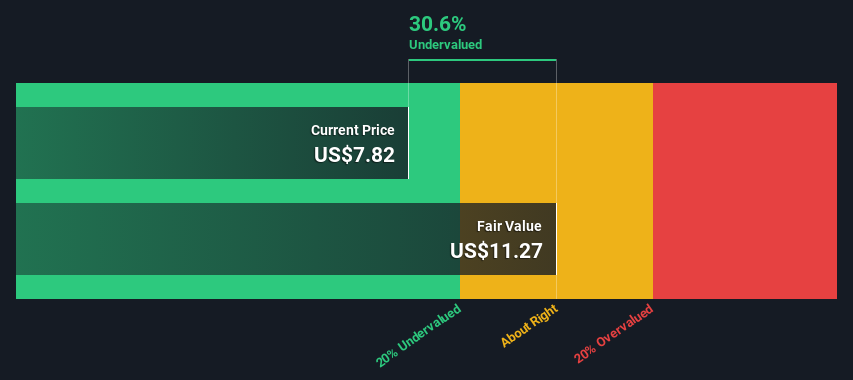

PE: -0.4x

SolarEdge Technologies, amidst a volatile share price over the past three months, is navigating challenges with a significant net loss of US$1.81 billion for 2024 against previous profits. Despite being unprofitable and reliant on external borrowing, insider confidence is evident through recent purchases. The company recently launched the ONE Controller in Germany, aligning with regulatory shifts to enhance solar integration. While revenue forecasts suggest growth at 16.87% annually, profitability remains elusive for the next three years.

- Delve into the full analysis valuation report here for a deeper understanding of SolarEdge Technologies.

Gain insights into SolarEdge Technologies' past trends and performance with our Past report.

Magnera (NYSE:MAGN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Magnera is a global company specializing in diversified industrial solutions with operations primarily across the Americas and other international markets, boasting a market capitalization of $4.75 billion.

Operations: Revenue is primarily generated from the Americas and Rest of World segments, totaling $2.37 billion as of the latest period. The company has seen a decline in its gross profit margin from 19.95% to 11.22% over recent periods, reflecting increased costs relative to revenue. Operating expenses have decreased slightly, with general and administrative expenses consistently being a significant part of this category.

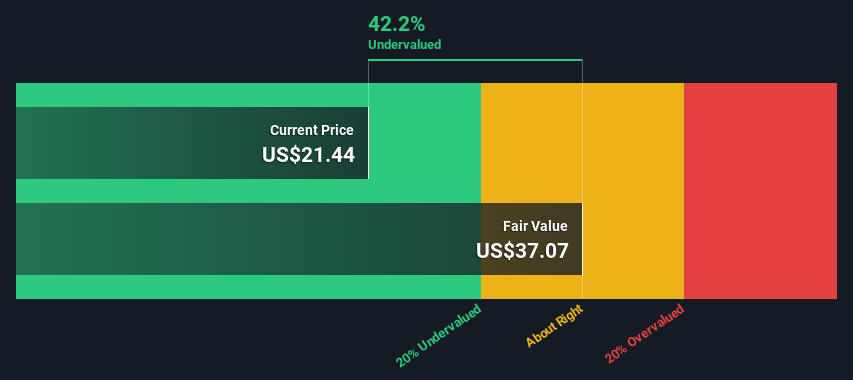

PE: -2.5x

Magnera, a smaller company in the U.S., recently reported first-quarter sales of US$702 million, up from US$519 million the previous year. Despite this growth, they faced a net loss of US$60 million compared to US$8 million previously. Insider confidence is evident as Curtis Begle purchased 23,786 shares worth over US$501K between February and April 2025. While their funding relies on external borrowing, earnings are expected to grow significantly by over 100% annually.

- Take a closer look at Magnera's potential here in our valuation report.

Gain insights into Magnera's historical performance by reviewing our past performance report.

NL Industries (NYSE:NL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NL Industries operates in the component products sector with a focus on manufacturing and distributing precision-engineered components, and has a market capitalization of approximately $0.49 billion.

Operations: Comp X generates revenue primarily from component products, with a notable fluctuation in net income margins over time. The company's cost structure is heavily influenced by cost of goods sold (COGS), which impacts its gross profit margin, observed to be 39.77% at its peak and 28.31% at its lowest during the period analyzed.

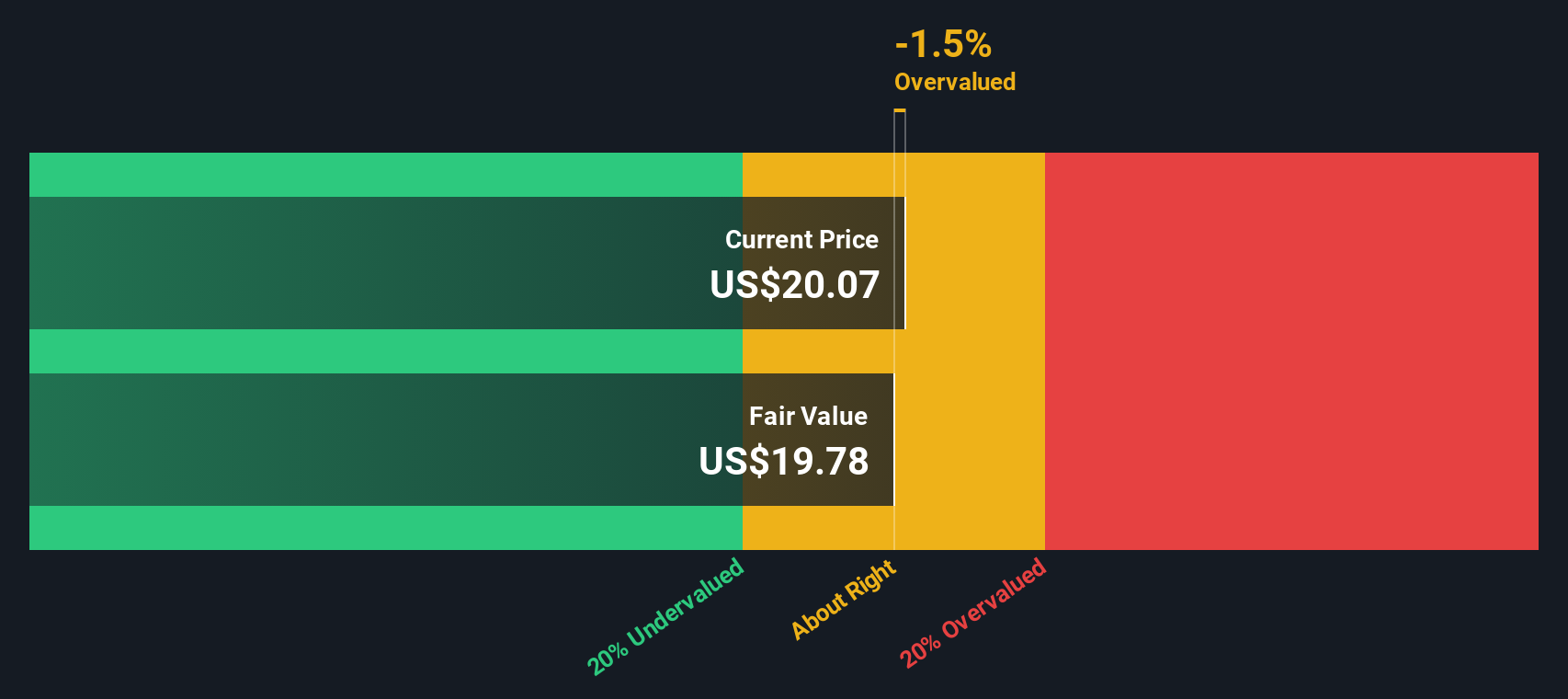

PE: 6.2x

NL Industries, a smaller company in the U.S., reported a turnaround with net income of US$67.23 million for 2024, contrasting with last year's loss. Despite sales declining to US$145.94 million from US$161.29 million, insider confidence is evident as they increased their holdings recently. The firm faces financial obligations due to a legal settlement requiring payment of US$56.1 million plus interest but expects to recognize an income boost from related settlements in Q1 2025.

- Get an in-depth perspective on NL Industries' performance by reading our valuation report here.

Explore historical data to track NL Industries' performance over time in our Past section.

Taking Advantage

- Discover the full array of 90 Undervalued US Small Caps With Insider Buying right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NL Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NL

NL Industries

Through its subsidiaries, operates in the component products industry in Europe, North America, the Asia Pacific, and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion