- United States

- /

- Chemicals

- /

- NYSE:LYB

LyondellBasell Industries (NYSE:LYB) Reports Strong Q2 Earnings and Declares $1.34 Dividend Amid Strategic Growth Plans

Reviewed by Simply Wall St

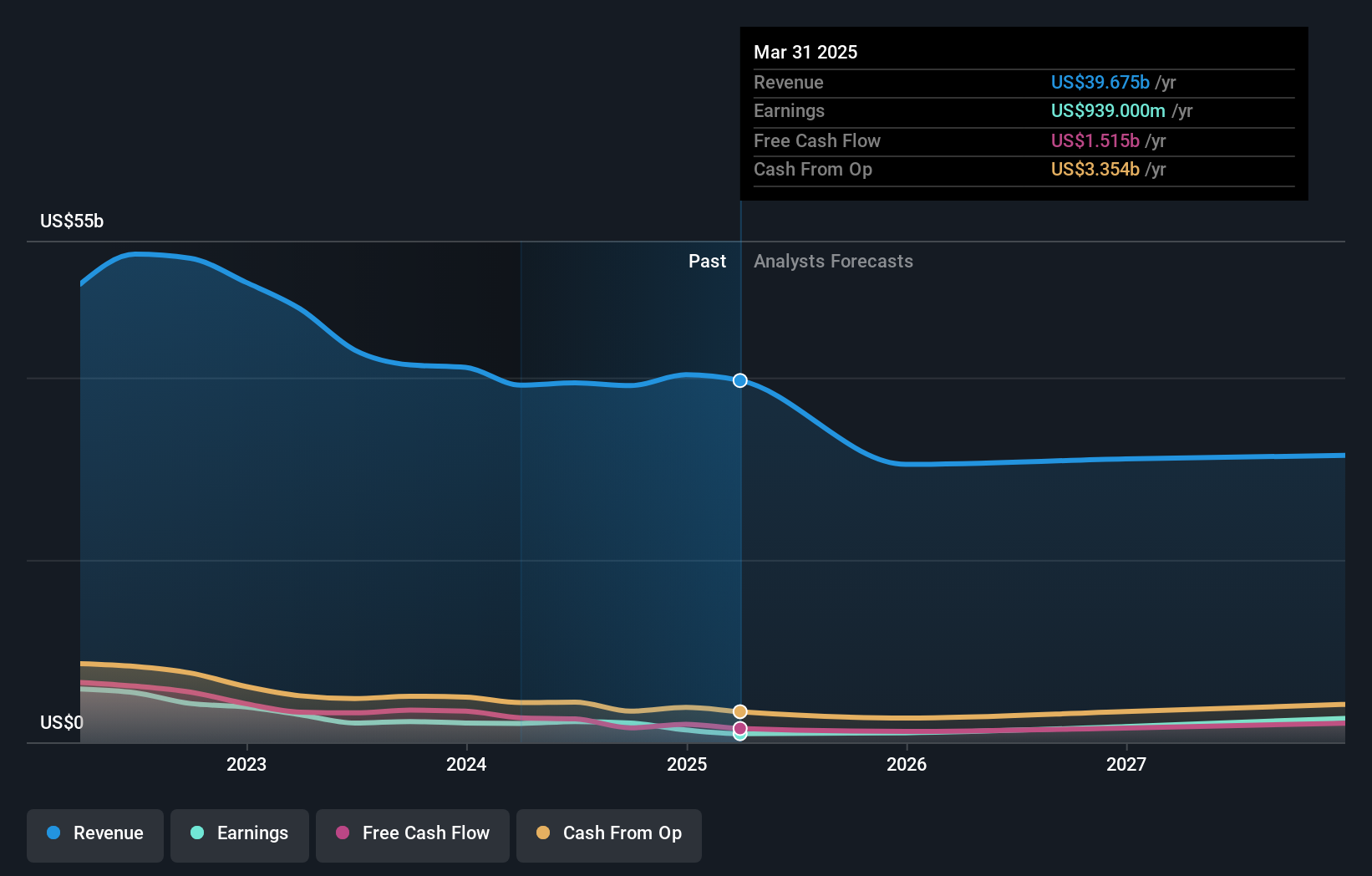

LyondellBasell Industries (NYSE:LYB) is navigating a dynamic period marked by both opportunities and challenges. Recent highlights include a notable 7% increase in quarterly dividends and strategic growth initiatives, juxtaposed against a forecasted 6% annual revenue decline and high debt levels. In the discussion that follows, we will explore LYB's financial health, operational efficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Click to explore a detailed breakdown of our findings on LyondellBasell Industries.

Competitive Advantages That Elevate LyondellBasell Industries

LyondellBasell Industries (LYB) demonstrates strong financial health, with a total shareholder equity of $13.6 billion and an EBIT of $3.2 billion, resulting in a solid interest coverage ratio of 9.4. The company's operational excellence is highlighted by its impressive 95% cash conversion rate of EBITDA into cash over the last 12 months, as noted by CFO Michael McMurray. Furthermore, LYB's dividend growth is noteworthy, with a recent 7% increase in quarterly dividends to $1.34 per share. This commitment to shareholder returns is supported by a high and reliable dividend yield of 5.59%, placing it in the top 25% of dividend payers in the US market. Additionally, LYB is trading at a favorable Price-To-Earnings Ratio of 13.4x versus the peer average of 34.2x, and significantly below its estimated fair value of $183.6.

Vulnerabilities Impacting LyondellBasell Industries

LYB faces several vulnerabilities that could impact its performance. The company has a high level of debt, with a debt-to-equity ratio of 82.8%, and 100% of its liabilities are sourced from higher-risk external borrowing. Additionally, LYB's revenue is forecast to decline by 6% per year over the next three years, which is concerning given the industry's average growth. The company's earnings growth, projected at 10.2% per year, also lags behind the US market average of 15.2% per year. Furthermore, LYB's Return on Equity (ROE) is considered low at 17.1%, below the 20% threshold. These factors highlight potential financial challenges and risks that could hinder LYB's long-term growth.

Future Prospects for LyondellBasell Industries in the Market

LYB has several opportunities to enhance its market position and capitalize on emerging trends. The company is actively pursuing strategic growth initiatives, aiming to add $3 billion in incremental normalized EBITDA by 2027, as mentioned by CEO Peter Z. Vanacker. Additionally, LYB is making significant progress in building a profitable circular and low-carbon solutions business, aligning with global sustainability trends. The demand for North American polyolefins is strengthening, with industry polyethylene sales up by nearly 11% over the first half of 2023. LYB's ongoing strategic review of its European assets could also reposition its footprint for future sustainable success, providing further growth opportunities.

Competitive Pressures and Market Risks Facing LyondellBasell Industries

LYB faces several external factors that could threaten its growth and market share. The company is experiencing competitive pressures, particularly from the growth in polypropylene production in China. Economic factors, such as high inflation and interest rates, continue to impact consumer confidence, especially for durable goods. Regulatory risks are also a concern, with potential bans on certain technologies in China that could affect LYB's operations. Additionally, the U.S. Gulf Coast hurricane season poses operational risks, with potential for further disruptions in the coming months. These threats underscore the need for LYB to navigate a complex and challenging market environment.To gain deeper insights into LyondellBasell Industries's historical performance, explore our detailed analysis of past performance.To dive deeper into how LyondellBasell Industries's valuation metrics are shaping its market position, check out our detailed analysis of LyondellBasell Industries's Valuation.

Conclusion

LyondellBasell Industries exhibits strong financial health and operational excellence, as evidenced by its solid interest coverage ratio and high cash conversion rate. However, the company faces significant challenges, including high debt levels and forecasted revenue decline, which could impede its long-term growth. These vulnerabilities are counterbalanced by LYB's strategic initiatives in low-carbon solutions and its advantageous market position in North American polyolefins, which present substantial growth opportunities. Trading below its estimated fair value of $183.6, LYB appears to be an attractive investment, but potential investors should carefully weigh its financial challenges and market risks against its competitive advantages and future prospects.

Make It Happen

- Have a stake in LyondellBasell Industries? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:LYB

LyondellBasell Industries

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives