- United States

- /

- Paper and Forestry Products

- /

- NYSE:LPX

Some Confidence Is Lacking In Louisiana-Pacific Corporation's (NYSE:LPX) P/S

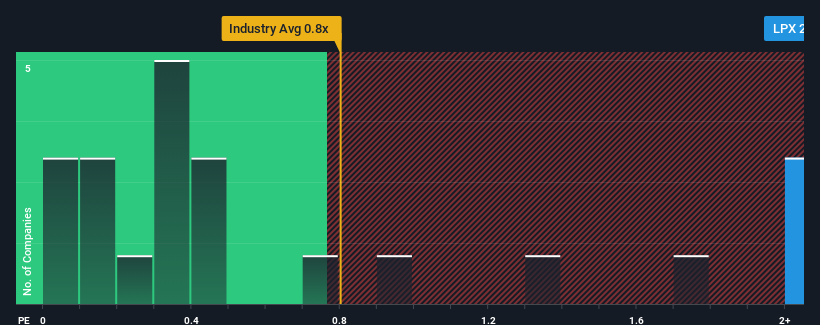

When you see that almost half of the companies in the Forestry industry in the United States have price-to-sales ratios (or "P/S") below 0.3x, Louisiana-Pacific Corporation (NYSE:LPX) looks to be giving off some sell signals with its 2.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Louisiana-Pacific

How Louisiana-Pacific Has Been Performing

Louisiana-Pacific has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Louisiana-Pacific.Is There Enough Revenue Growth Forecasted For Louisiana-Pacific?

Louisiana-Pacific's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 33%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 7.6% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 5.9% per annum during the coming three years according to the ten analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 5.5% each year, which is not materially different.

In light of this, it's curious that Louisiana-Pacific's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does Louisiana-Pacific's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Louisiana-Pacific currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about this 1 warning sign we've spotted with Louisiana-Pacific.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LPX

Louisiana-Pacific

Provides building solutions for applications in new home construction, repair and remodeling, and outdoor structure markets.

Outstanding track record with flawless balance sheet.