- United States

- /

- Basic Materials

- /

- NYSE:LOMA

Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA) Might Not Be As Mispriced As It Looks

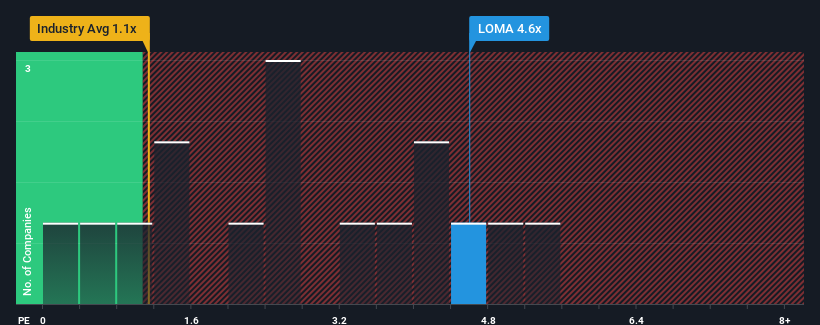

With a median price-to-sales (or "P/S") ratio of close to 3.9x in the Basic Materials industry in the United States, you could be forgiven for feeling indifferent about Loma Negra Compañía Industrial Argentina Sociedad Anónima's (NYSE:LOMA) P/S ratio of 4.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Loma Negra Compañía Industrial Argentina Sociedad Anónima

How Loma Negra Compañía Industrial Argentina Sociedad Anónima Has Been Performing

Loma Negra Compañía Industrial Argentina Sociedad Anónima hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Loma Negra Compañía Industrial Argentina Sociedad Anónima's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Loma Negra Compañía Industrial Argentina Sociedad Anónima's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 50%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 153% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 238% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 11%, which is noticeably less attractive.

In light of this, it's curious that Loma Negra Compañía Industrial Argentina Sociedad Anónima's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Loma Negra Compañía Industrial Argentina Sociedad Anónima's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Loma Negra Compañía Industrial Argentina Sociedad Anónima that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LOMA

Loma Negra Compañía Industrial Argentina Sociedad Anónima

Manufactures and sells cement and its derivatives in Argentina.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives