- United States

- /

- Basic Materials

- /

- NYSE:LOMA

Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA) Soars 28% But It's A Story Of Risk Vs Reward

Loma Negra Compañía Industrial Argentina Sociedad Anónima (NYSE:LOMA) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 50%.

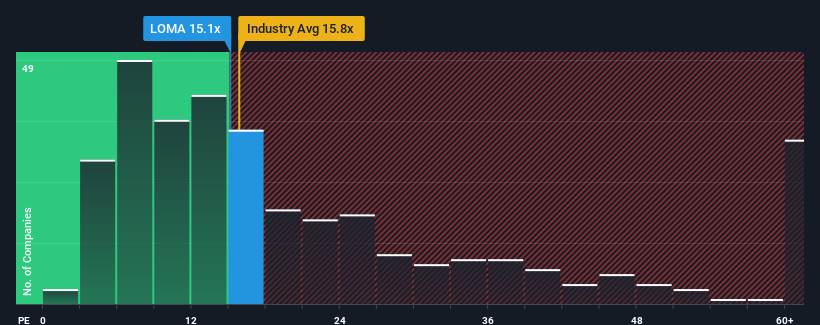

Even after such a large jump in price, Loma Negra Compañía Industrial Argentina Sociedad Anónima's price-to-earnings (or "P/E") ratio of 15.1x might still make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been pleasing for Loma Negra Compañía Industrial Argentina Sociedad Anónima as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Loma Negra Compañía Industrial Argentina Sociedad Anónima

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Loma Negra Compañía Industrial Argentina Sociedad Anónima's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 206% last year. The latest three year period has also seen an excellent 480% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 24% each year over the next three years. That's shaping up to be materially higher than the 10% per annum growth forecast for the broader market.

With this information, we find it odd that Loma Negra Compañía Industrial Argentina Sociedad Anónima is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Loma Negra Compañía Industrial Argentina Sociedad Anónima's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Loma Negra Compañía Industrial Argentina Sociedad Anónima's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Loma Negra Compañía Industrial Argentina Sociedad Anónima.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LOMA

Loma Negra Compañía Industrial Argentina Sociedad Anónima

Manufactures and sells cement and its derivatives in Argentina.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives