- United States

- /

- Healthtech

- /

- NYSE:CTEV

Undervalued Small Caps With Insider Action To Consider In March 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen 1.7%, contributing to a 10.0% increase over the past year, with earnings projected to grow by 14% annually. In this context of positive market momentum, identifying small-cap stocks with insider activity can provide valuable insights into potential opportunities for investors seeking growth in undervalued segments.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First Mid Bancshares | 10.8x | 2.7x | 40.45% | ★★★★★★ |

| First United | 9.6x | 2.6x | 47.99% | ★★★★★☆ |

| S&T Bancorp | 11.1x | 3.8x | 41.07% | ★★★★☆☆ |

| German American Bancorp | 17.3x | 5.8x | 48.57% | ★★★☆☆☆ |

| Quanex Building Products | 78.2x | 0.6x | 39.90% | ★★★☆☆☆ |

| Columbus McKinnon | 55.9x | 0.5x | 42.06% | ★★★☆☆☆ |

| Union Bankshares | 15.0x | 2.8x | 31.90% | ★★★☆☆☆ |

| Franklin Financial Services | 14.3x | 2.3x | 28.21% | ★★★☆☆☆ |

| PDF Solutions | 210.3x | 4.8x | 11.68% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -198.16% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Claritev (NYSE:CTEV)

Simply Wall St Value Rating: ★★★☆☆☆

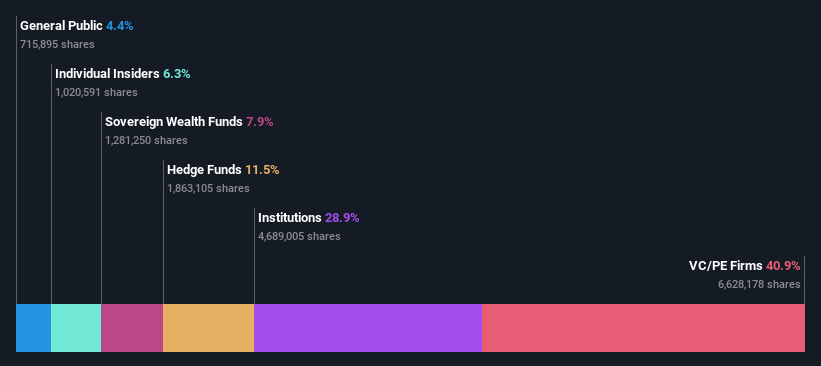

Overview: Claritev operates in the business services sector with a focus on providing comprehensive solutions, and it has a market capitalization of $2.75 billion.

Operations: CTEV's revenue primarily stems from its Business Services segment, with a recent figure of $930.62 million. The company has faced fluctuations in net income margin, notably reaching -1.77% at the end of 2024, while gross profit margin was recorded at 74.27%. Operating expenses and non-operating expenses have significantly impacted profitability, contributing to recent negative net income figures.

PE: -0.2x

Claritev, recently renamed from MultiPlan Corporation, is navigating a challenging landscape with its analytics solution, BenInsights, now integrated with Oracle Cloud. Despite reporting a net loss of US$1.65 billion for 2024 and anticipating flat to slightly declining revenues for 2025, insider confidence is evident as Michael Kim purchased 40,000 shares worth US$249,588 in March 2025. The company's volatile share price and reliance on external borrowing highlight potential risks amidst these strategic developments.

- Take a closer look at Claritev's potential here in our valuation report.

Assess Claritev's past performance with our detailed historical performance reports.

Camping World Holdings (NYSE:CWH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Camping World Holdings operates as a leading retailer of recreational vehicles (RVs) and related outdoor products, with a market capitalization of approximately $1.71 billion.

Operations: RV and Outdoor Retail is the primary revenue stream, generating $5.92 billion, while Good Sam Services and Plans contribute $195.63 million. The gross profit margin has fluctuated over the years, reaching 35.78% in March 2022 before decreasing to 29.93% by December 2024. Operating expenses have consistently been a significant cost component, with General & Administrative Expenses being a major part of it, amounting to $1.57 billion by December 2024.

PE: -27.7x

Camping World Holdings, a smaller company in the U.S. market, has been navigating financial challenges with a full-year revenue of US$6.1 billion for 2024 but reported a net loss of US$38.64 million compared to last year's profit. Despite these setbacks, earnings are projected to grow significantly at 107.85% annually. Insider confidence is evident as insiders have been purchasing shares recently, signaling potential belief in future growth despite current losses and asset impairments totaling US$2.7 million last quarter.

Kronos Worldwide (NYSE:KRO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kronos Worldwide is a company engaged in the production and sale of titanium dioxide pigments, with a market capitalization of approximately $1.30 billion.

Operations: The primary revenue stream for Kronos Worldwide is the production and sale of titanium dioxide pigments, with recent quarterly revenues reaching $1.89 billion. The company's gross profit margin has experienced fluctuations, most notably peaking at 37.25% in mid-2018 before decreasing to 19.15% by the end of 2024. Operating expenses consistently impact profitability, with general and administrative expenses forming a significant portion of these costs over various periods.

PE: 10.4x

Kronos Worldwide, a smaller player in the U.S. market, has shown signs of being undervalued with recent financial improvements. For 2024, it reported sales of US$1.89 billion and net income of US$86.2 million, a turnaround from last year's loss. Despite a challenging debt profile reliant on external borrowing and earnings impacted by significant one-off items, insider confidence is evident with recent share purchases this quarter. A modest dividend continues to attract investors seeking income stability amidst growth potential.

- Unlock comprehensive insights into our analysis of Kronos Worldwide stock in this valuation report.

Understand Kronos Worldwide's track record by examining our Past report.

Next Steps

- Explore the 71 names from our Undervalued US Small Caps With Insider Buying screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTEV

Claritev

Provides data analytics and technology-enabled cost management, payment, and revenue integrity solutions to the healthcare industry in the United States.

Fair value low.

Similar Companies

Market Insights

Community Narratives