- United States

- /

- Chemicals

- /

- NYSE:KRO

Here's Why We're Wary Of Buying Kronos Worldwide's (NYSE:KRO) For Its Upcoming Dividend

Kronos Worldwide, Inc. (NYSE:KRO) is about to trade ex-dividend in the next 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. In other words, investors can purchase Kronos Worldwide's shares before the 4th of June in order to be eligible for the dividend, which will be paid on the 17th of June.

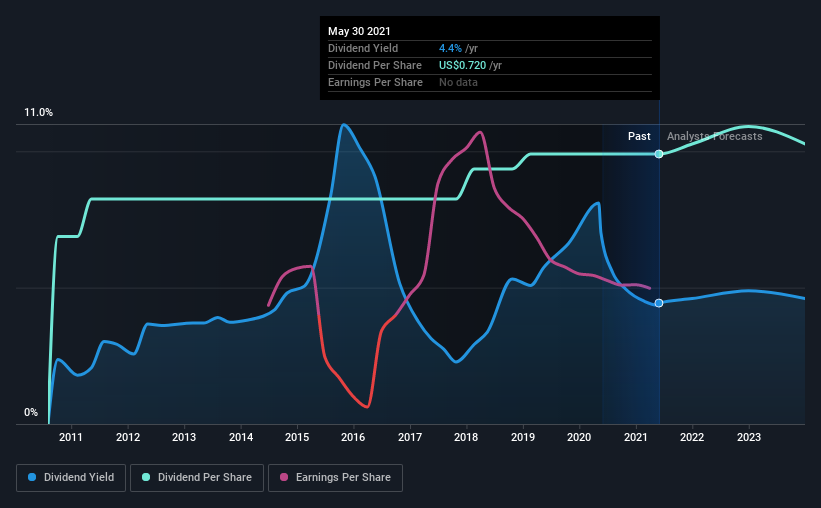

The company's next dividend payment will be US$0.18 per share, and in the last 12 months, the company paid a total of US$0.72 per share. Based on the last year's worth of payments, Kronos Worldwide stock has a trailing yield of around 4.4% on the current share price of $16.24. If you buy this business for its dividend, you should have an idea of whether Kronos Worldwide's dividend is reliable and sustainable. As a result, readers should always check whether Kronos Worldwide has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for Kronos Worldwide

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Kronos Worldwide distributed an unsustainably high 147% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. A useful secondary check can be to evaluate whether Kronos Worldwide generated enough free cash flow to afford its dividend. It paid out 75% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and Kronos Worldwide fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Click here to see how much of its profit Kronos Worldwide paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. This is why it's a relief to see Kronos Worldwide earnings per share are up 3.5% per annum over the last five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Since the start of our data, 10 years ago, Kronos Worldwide has lifted its dividend by approximately 3.7% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Should investors buy Kronos Worldwide for the upcoming dividend? Earnings per share have not grown all that much, and the company is paying out an uncomfortably high percentage of its income. Fortunately it paid out a lower percentage of its cash flow. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Although, if you're still interested in Kronos Worldwide and want to know more, you'll find it very useful to know what risks this stock faces. To help with this, we've discovered 3 warning signs for Kronos Worldwide that you should be aware of before investing in their shares.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Kronos Worldwide, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kronos Worldwide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:KRO

Kronos Worldwide

Produces and markets titanium dioxide pigments (TiO2) in Europe, North America, the Asia Pacific, and internationally.

Slight with mediocre balance sheet.