- United States

- /

- Chemicals

- /

- NYSE:KOP

Earnings Working Against Koppers Holdings Inc.'s (NYSE:KOP) Share Price

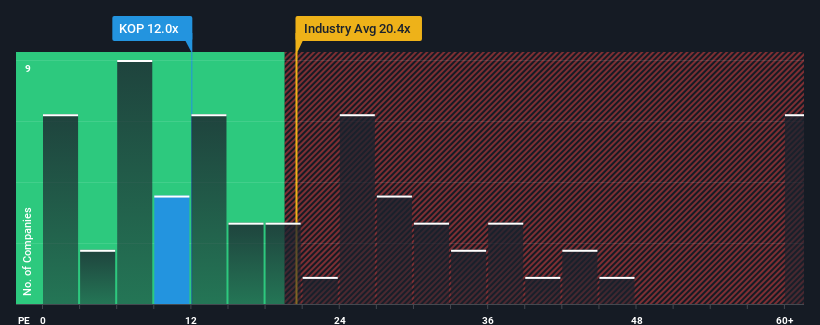

With a price-to-earnings (or "P/E") ratio of 12x Koppers Holdings Inc. (NYSE:KOP) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 17x and even P/E's higher than 33x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Koppers Holdings as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Koppers Holdings

Is There Any Growth For Koppers Holdings?

The only time you'd be truly comfortable seeing a P/E as low as Koppers Holdings' is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 26% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 2.9% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 2.8% as estimated by the dual analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 10%, which is noticeably more attractive.

In light of this, it's understandable that Koppers Holdings' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Koppers Holdings maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Koppers Holdings (2 are a bit concerning) you should be aware of.

If these risks are making you reconsider your opinion on Koppers Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Koppers Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KOP

Koppers Holdings

Provides treated wood products, wood preservation chemicals, and carbon compounds in the United States, Australasia, Europe, and internationally.

Fair value with moderate growth potential.