- United States

- /

- Packaging

- /

- NYSE:IP

International Paper Company's (NYSE:IP) P/S Is Still On The Mark Following 28% Share Price Bounce

International Paper Company (NYSE:IP) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 44%.

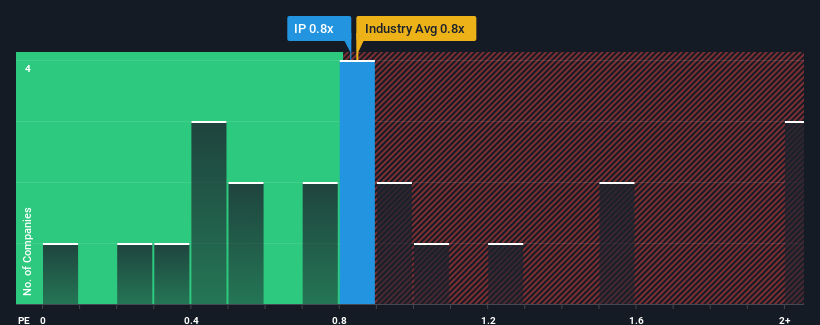

In spite of the firm bounce in price, it's still not a stretch to say that International Paper's price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Packaging industry in the United States, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for International Paper

What Does International Paper's P/S Mean For Shareholders?

International Paper has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on International Paper.Do Revenue Forecasts Match The P/S Ratio?

International Paper's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 10% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 3.0% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 2.8% per year, which is not materially different.

With this information, we can see why International Paper is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On International Paper's P/S

International Paper appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A International Paper's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Packaging industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Having said that, be aware International Paper is showing 4 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of International Paper's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IP

International Paper

Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives