- United States

- /

- Chemicals

- /

- NYSE:IFF

Risks To Shareholder Returns Are Elevated At These Prices For International Flavors & Fragrances Inc. (NYSE:IFF)

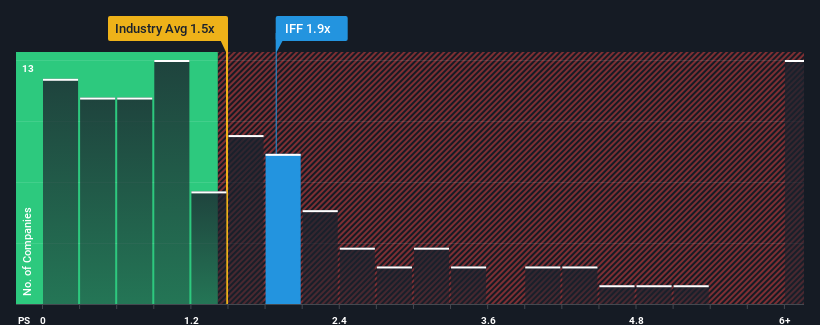

With a median price-to-sales (or "P/S") ratio of close to 1.5x in the Chemicals industry in the United States, you could be forgiven for feeling indifferent about International Flavors & Fragrances Inc.'s (NYSE:IFF) P/S ratio of 1.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for International Flavors & Fragrances

How International Flavors & Fragrances Has Been Performing

With revenue that's retreating more than the industry's average of late, International Flavors & Fragrances has been very sluggish. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think International Flavors & Fragrances' future stacks up against the industry? In that case, our free report is a great place to start.How Is International Flavors & Fragrances' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like International Flavors & Fragrances' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 7.7% decrease to the company's top line. Still, the latest three year period has seen an excellent 126% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 0.07% per year as estimated by the analysts watching the company. That's not great when the rest of the industry is expected to grow by 8.2% per annum.

With this in consideration, we think it doesn't make sense that International Flavors & Fragrances' P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

While International Flavors & Fragrances' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You should always think about risks. Case in point, we've spotted 2 warning signs for International Flavors & Fragrances you should be aware of, and 1 of them is potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:IFF

International Flavors & Fragrances

Manufactures and sells cosmetic active and natural health ingredients for use in various consumer products in the United States, Europe, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives