- United States

- /

- Chemicals

- /

- NYSE:IFF

Assessing International Flavors & Fragrances (IFF) Valuation After Product Launches and Facility Expansion

Reviewed by Kshitija Bhandaru

If you’ve been keeping an eye on International Flavors & Fragrances (IFF), recent headlines may have caught your attention. The company just rolled out SipScape, a new trend-driven platform aimed at adult beverage innovation, and also cut the ribbon on an expanded LMR Naturals facility in Grasse. Taken together, these moves showcase IFF’s ambition to capture evolving consumer preferences for natural and functional ingredients, especially as brands scramble to tap into the wellness and premiumization buzz that is circulating through both food and beverage markets.

These product and portfolio decisions arrive at a challenging moment for IFF’s stock. Over the past year, shares have drifted down roughly 37%, with momentum continuing to lag in recent months despite the company’s push into innovation and sustainability. The launch of SipScape and the Grasse site’s upgrade now join a series of recent steps, from business expansion to investments in biotech, all aimed at carving out a stronger position for IFF in a fast-changing landscape. Still, the market’s response suggests lingering caution over the company’s short-term prospects.

This leaves investors weighing a classic dilemma: Is the market offering a reset price that undervalues IFF’s longer-term growth, or is it reflecting expectations of what lies ahead? Let’s dig into the valuation signals and see where the stock really stands.

Most Popular Narrative: 24.8% Undervalued

The leading narrative suggests International Flavors & Fragrances is currently undervalued compared to its calculated fair value. Analysts point to a range of future opportunities and catalysts that could unlock significant value for the company in the long term.

"Ongoing investments in R&D and capacity (especially in Health & Biosciences, Taste, and Specialty Fragrance Ingredients) are strengthening the company's innovation pipeline. Management expects these initiatives to accelerate revenue and profit growth beginning in 2026 and reaching full impact by 2027."

Curious about what's fueling this bold undervaluation call? The narrative's foundation rests on transformative projects and a projected leap in profitability often associated with industry disruptors. Want to see which specific growth metrics and controversial assumptions drive this bullish outlook? Discover what numbers are powering this consensus and decide if the hype holds water.

Result: Fair Value of $84.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in key markets and slow progress in high-margin segments could challenge the optimistic outlook for IFF's long-term value recovery.

Find out about the key risks to this International Flavors & Fragrances narrative.Another View: Checking Value Through a Different Lens

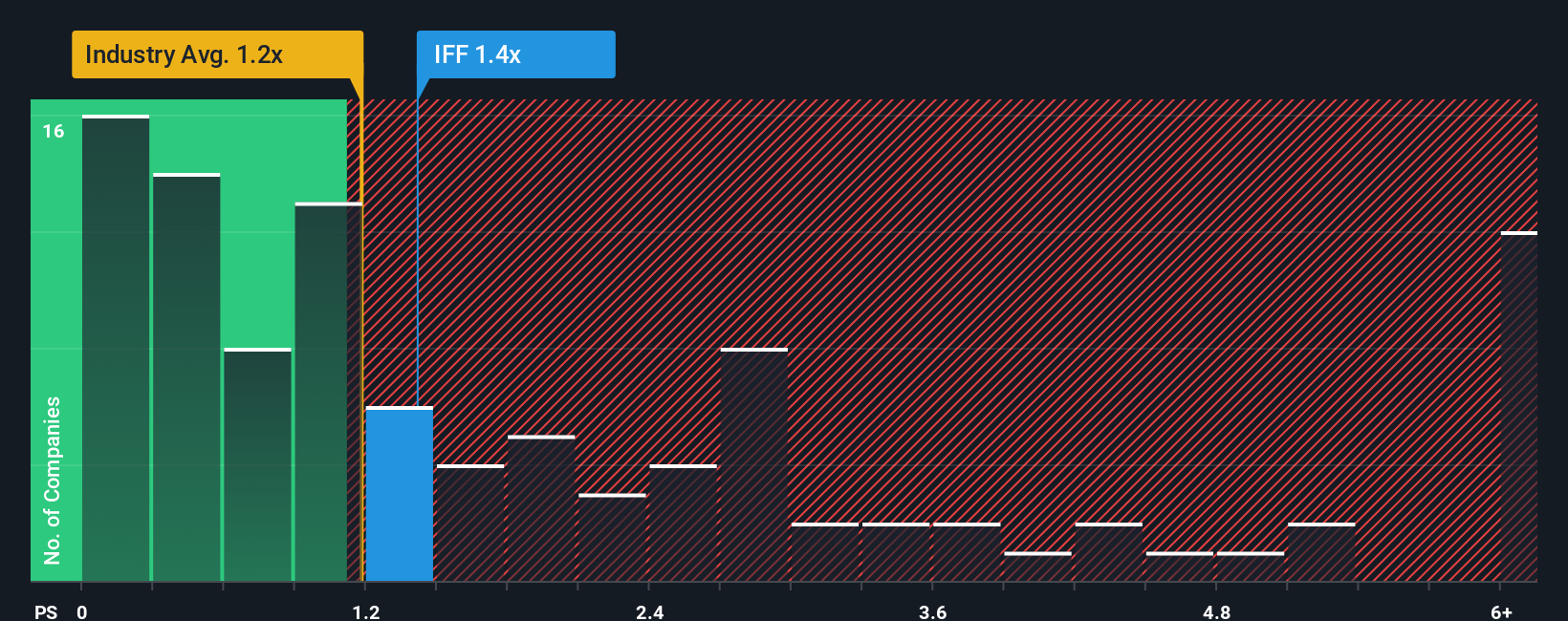

While analyst estimates point toward undervaluation, a look at the company’s revenue-to-share price ratio tells a more cautious story. By this measure, the stock looks more expensive than the rest of its industry. Is optimism about future profits justified, or is the market already pricing in a big turnaround?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding International Flavors & Fragrances to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own International Flavors & Fragrances Narrative

If you have a different perspective or want to dive deeper on your own, you can quickly build your own view from the data in just a few minutes. Do it your way.

A great starting point for your International Flavors & Fragrances research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make sure you’re not missing out on the next big opportunity. Take action now and find companies that match your strategy before the rest of the market catches up.

- Snap up income potential with companies offering higher yields. See top picks in our dividend stocks with yields > 3%.

- Get ahead in the race for smarter tech by browsing fast-moving opportunities in AI penny stocks.

- Uncover hidden bargains that could deliver strong returns using our deep value selection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IFF

International Flavors & Fragrances

Manufactures and markets food, beverage, health and biosciences, scent, pharma solutions, and complementary adjacent products in the United States, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives