- United States

- /

- Chemicals

- /

- NYSE:HUN

Three Undervalued Small Caps With Insider Buying To Consider For Your Portfolio

Reviewed by Simply Wall St

In recent days, the U.S. stock market has experienced significant volatility, with major indices such as the Nasdaq and S&P 500 closing sharply lower due to a decline in technology shares. This downturn highlights the importance of diversifying portfolios, and small-cap stocks can offer unique opportunities for growth when carefully evaluated for potential value and insider interest.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanmi Financial | 11.1x | 3.2x | 31.74% | ★★★★★☆ |

| PCB Bancorp | 8.9x | 2.9x | 29.64% | ★★★★★☆ |

| Peoples Bancorp | 10.0x | 1.8x | 46.47% | ★★★★★☆ |

| Trinity Capital | 7.9x | 4.2x | 21.19% | ★★★★★☆ |

| S&T Bancorp | 11.0x | 3.8x | 39.45% | ★★★★☆☆ |

| Farmland Partners | 6.4x | 7.9x | -39.06% | ★★★★☆☆ |

| Citizens & Northern | 12.9x | 3.2x | 45.00% | ★★★☆☆☆ |

| CNB Financial | 17.0x | 3.2x | 48.32% | ★★★☆☆☆ |

| Washington Trust Bancorp | NA | 4.5x | 23.94% | ★★★☆☆☆ |

| Shore Bancshares | 9.5x | 2.5x | -51.54% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Civista Bancshares (CIVB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Civista Bancshares operates as a financial holding company providing community banking services, with a market cap of approximately $0.36 billion.

Operations: Civista Bancshares generates revenue primarily from its banking operations, with the latest quarterly revenue reported at $163.10 million. The company has consistently achieved a gross profit margin of 100%, indicating that all its revenue translates into gross profit. Operating expenses are significant, with general and administrative costs forming a substantial portion, amounting to $88.04 million in the most recent quarter. The net income margin was recorded at 26.64% for the same period, reflecting the company's profitability after accounting for all expenses.

PE: 10.5x

Civista Bancshares, a smaller U.S. financial entity, recently demonstrated insider confidence with share purchases in the past year. Despite recent net charge-offs of US$0.6 million for Q3 2025, their financials show resilience; net interest income rose to US$34.55 million from US$29.23 million year-over-year, and net income increased to US$12.76 million from US$8.37 million in the same period last year. A steady dividend yield of 3.35% complements potential earnings growth forecasts of 14% annually, suggesting room for value appreciation amidst sector challenges.

- Navigate through the intricacies of Civista Bancshares with our comprehensive valuation report here.

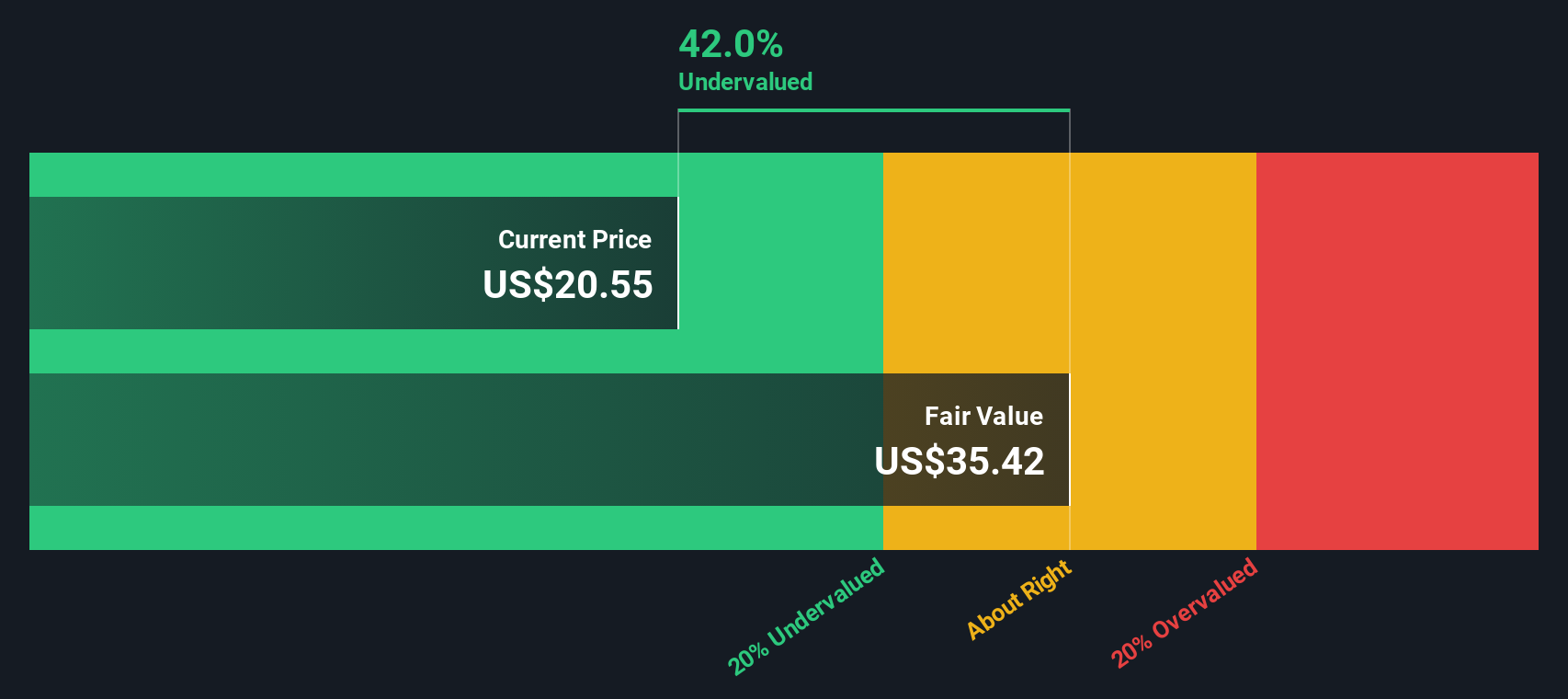

Dine Brands Global (DIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Dine Brands Global operates as a franchisor and operator of full-service restaurants, including well-known brands like IHOP and Applebee's, with a market presence supported by rental, company restaurant, financing, and franchise operations across various segments.

Operations: Dine Brands Global generates revenue primarily from franchise operations, including IHOP, Applebee's, and Fuzzy's Taco Shop, along with rental and company restaurant operations. The company experienced fluctuations in its gross profit margin over the years, with a notable high of 60.64% in Q2 2016 and a low of 37.83% in Q1 2021. Operating expenses are a significant component of costs, consistently impacting profitability across periods analyzed.

PE: 11.6x

Dine Brands, a smaller U.S. company, is capturing attention with its strategic growth and insider confidence. Despite recent earnings showing net income of US$7.33 million for Q3 2025 compared to US$19.06 million last year, the company is expanding rapidly with about 30 new locations planned by year-end 2025 and an additional 50 in 2026. The company's buyback program repurchased nearly one million shares recently, reflecting strong internal belief in future prospects despite current challenges like lower profit margins at 3.8% compared to last year's 11.1%.

- Click to explore a detailed breakdown of our findings in Dine Brands Global's valuation report.

Examine Dine Brands Global's past performance report to understand how it has performed in the past.

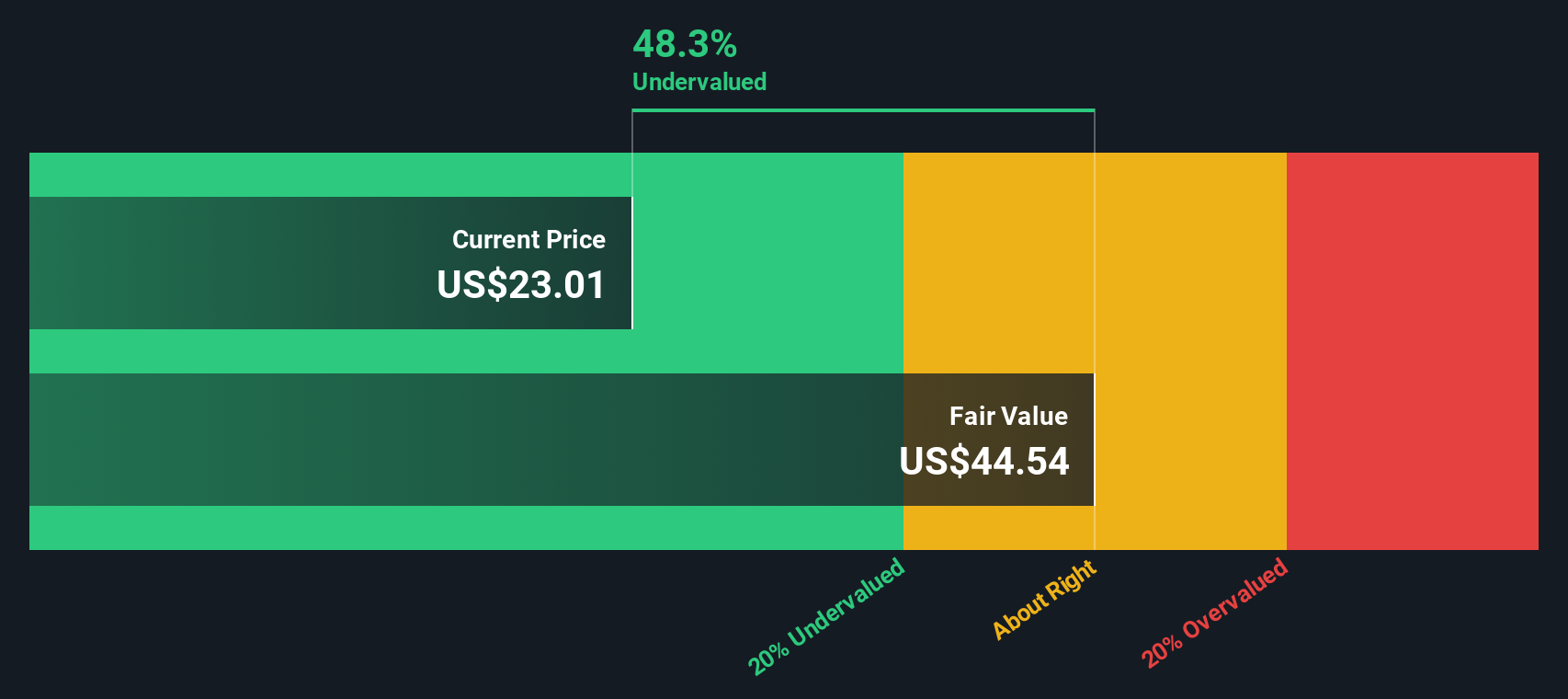

Huntsman (HUN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Huntsman is a global manufacturer and marketer of differentiated and specialty chemicals, with operations primarily in polyurethanes, advanced materials, and performance products, boasting a market capitalization of approximately $5.90 billion.

Operations: Huntsman's revenue is primarily derived from its Polyurethanes segment, followed by Advanced Materials and Performance Products. Over recent periods, the company has experienced a decline in its gross profit margin, reaching 13.41% as of the latest quarter. Operating expenses have remained significant, with General & Administrative Expenses being a notable component.

PE: -4.9x

Huntsman, a smaller company in the U.S. market, recently reported a third-quarter net loss of US$25 million on sales of US$1.46 billion, showing improvement from the previous year's loss of US$33 million despite lower sales. The company's funding relies entirely on external borrowing, considered riskier than customer deposits. However, insider confidence is evident with recent share purchases between September and October 2025. While dividends have decreased to $0.0875 per share, earnings are projected to grow significantly by over 113% annually, indicating potential for future growth amidst current challenges.

- Dive into the specifics of Huntsman here with our thorough valuation report.

Assess Huntsman's past performance with our detailed historical performance reports.

Make It Happen

- Navigate through the entire inventory of 66 Undervalued US Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntsman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUN

Huntsman

Manufactures and sells diversified organic chemical products worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives