- United States

- /

- Metals and Mining

- /

- NYSE:HL

Is It Too Late To Consider Hecla Mining After Its 223% Year To Date Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Hecla Mining is still worth buying after its huge run up, you are not alone. This article is going to unpack what the current price really implies about future returns.

- The stock has slipped about 2.1% over the last week, but it is still up 13.2% over the past month, 223.2% year to date, and 191.2% over the last year. This naturally raises questions about how much upside is left versus how much risk has crept in.

- Behind these big moves, investors have been reacting to a stronger silver price environment and growing interest in precious metals as a hedge, along with company specific developments around production and growth projects. Together, these themes have shifted sentiment from viewing Hecla as a niche silver producer to seeing it as a more central way to play the metals cycle.

- Yet despite the excitement, Hecla currently scores just 0/6 on our valuation checks, suggesting that traditional models do not flag it as obviously undervalued. Next, we will walk through those valuation approaches and then finish with an even more intuitive way to think about what the market is really pricing in.

Hecla Mining scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hecla Mining Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting those back to today, using a required rate of return. For Hecla Mining, the model used is a 2 Stage Free Cash Flow to Equity approach.

Hecla generated about $124.46 million in free cash flow over the last twelve months, and analysts expect this to grow meaningfully over the next few years. For example, projected free cash flow reaches roughly $592.74 million in 2026, before tapering down to around $201.24 million by 2035 as Simply Wall St extrapolates beyond the limited analyst coverage window.

When all of these projected cash flows are discounted back to today in $, the model arrives at an estimated intrinsic value of about $6.10 per share. Compared with the current share price, this implies the stock is around 178.7% overvalued on a DCF basis. This suggests investors are paying a steep premium for future growth and higher silver prices.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hecla Mining may be overvalued by 178.7%. Discover 903 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Hecla Mining Price vs Earnings

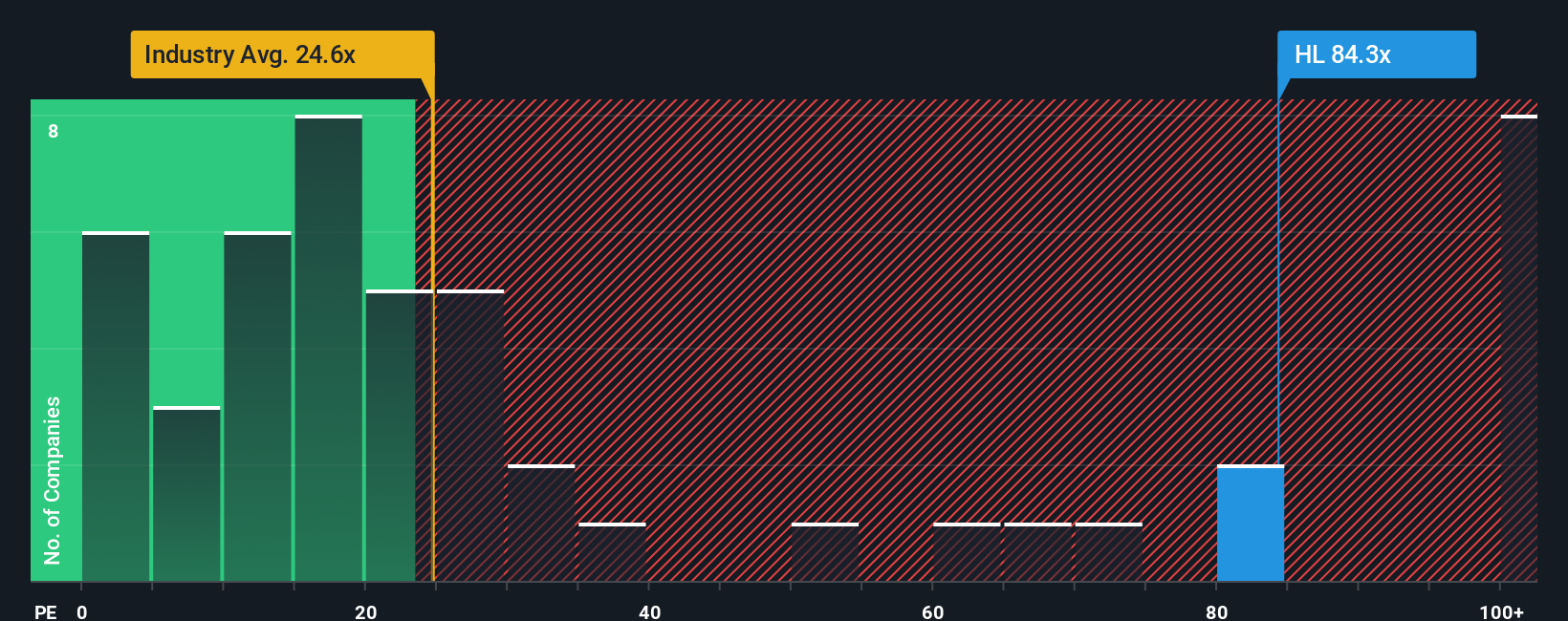

For profitable companies like Hecla, the price to earnings ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current earnings. In general, faster growing and lower risk businesses deserve a higher PE ratio, while slower growth or higher uncertainty should be reflected in a lower multiple.

Hecla currently trades on a PE of about 57.34x, which is far above both the wider Metals and Mining industry average of roughly 22.14x and the peer average of around 21.59x. On those simple comparisons, the stock looks expensive and implies the market is baking in very strong growth and favorable conditions.

Simply Wall St also calculates a Fair Ratio for Hecla of about 24.67x. This proprietary metric estimates what a reasonable PE should be after accounting for the company’s earnings growth outlook, profitability profile, risk factors, industry characteristics and market capitalization. Because it blends these fundamentals, the Fair Ratio is more tailored than a basic peer or sector comparison. When we set Hecla’s actual 57.34x PE against this 24.67x Fair Ratio, the shares look richly valued on an earnings multiple basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

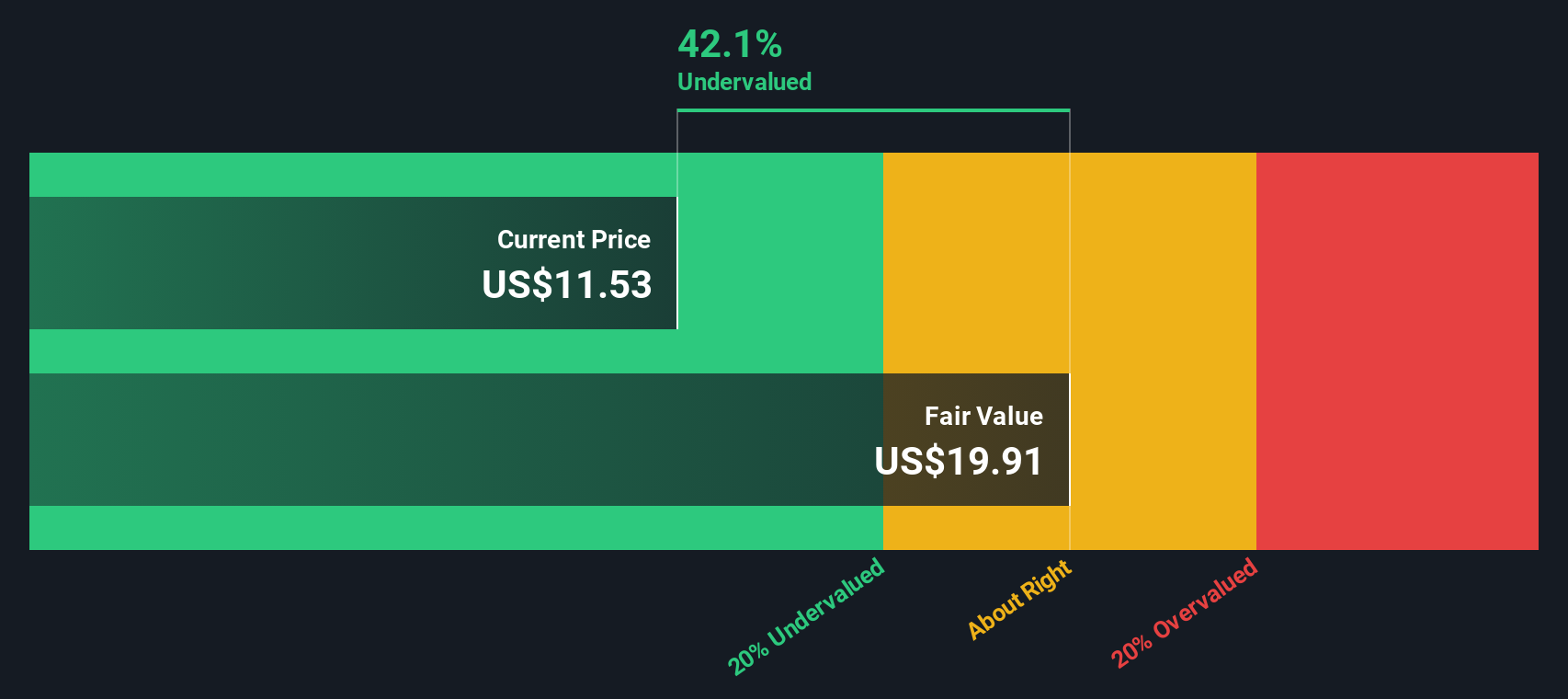

Upgrade Your Decision Making: Choose your Hecla Mining Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework where you describe the story you believe about a company, then connect that story to specific forecasts for revenue, earnings and margins, which in turn generate a Fair Value you can compare to today’s price. On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to link a company’s fundamentals and competitive position to a structured financial outlook, helping them decide whether to buy, hold, or sell based on how much upside or downside they see between Fair Value and the current share price. Narratives are dynamic, automatically updating when new information like earnings releases, project updates or commodity price moves comes in, so your view does not go stale. For Hecla Mining, one bullish Narrative might lean heavily on exploration success, rising silver demand and margin expansion to support a Fair Value close to $14.55. In contrast, a more cautious Narrative could stress cost, permitting and dilution risks to anchor a Fair Value nearer $6.50, showing how reasonable investors can disagree yet stay disciplined using the same decision making framework.

Do you think there's more to the story for Hecla Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hecla Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HL

Hecla Mining

Provides precious and base metals in the United States, Canada, Japan, Korea, and China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026