- United States

- /

- Metals and Mining

- /

- NYSE:HL

Can Hecla Mining’s Rally Continue After Silver Surge and Positive Earnings Forecast for 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with your Hecla Mining shares or considering whether the recent rally has legs? You are hardly alone, and the numbers over the last year demand a closer look. Hecla Mining’s stock has skyrocketed 137.1% year-to-date and delivered an impressive 94.2% gain over the past 12 months. In fact, if you zoom out to three and five years, the returns stand at 195.8% and 131.1%, respectively. Such dramatic movement is often tied to shifting investor sentiment. Lately, changing dynamics in the precious metals market have added fuel to the fire, as increased silver demand and supply constraints have captured traders’ attention.

With last week’s 4.9% climb and an eye-catching 38.2% surge over the past month, it is clear more investors are reconsidering the risk and growth case for Hecla. But what about value? With a value score of 2 out of a possible 6, meaning Hecla is considered undervalued in 2 of the standard valuation checks, the story here is not just about price momentum.

Let’s unpack how analysts decide whether a company is undervalued by diving into key valuation methods. These can sometimes tell a different story than the share chart does. As we will see later, there might be an even smarter way to judge Hecla’s worth.

Hecla Mining scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hecla Mining Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value based on its projected future cash flows, which are then discounted back to today’s dollars. This method helps investors assess whether a stock is trading below or above its estimated true value.

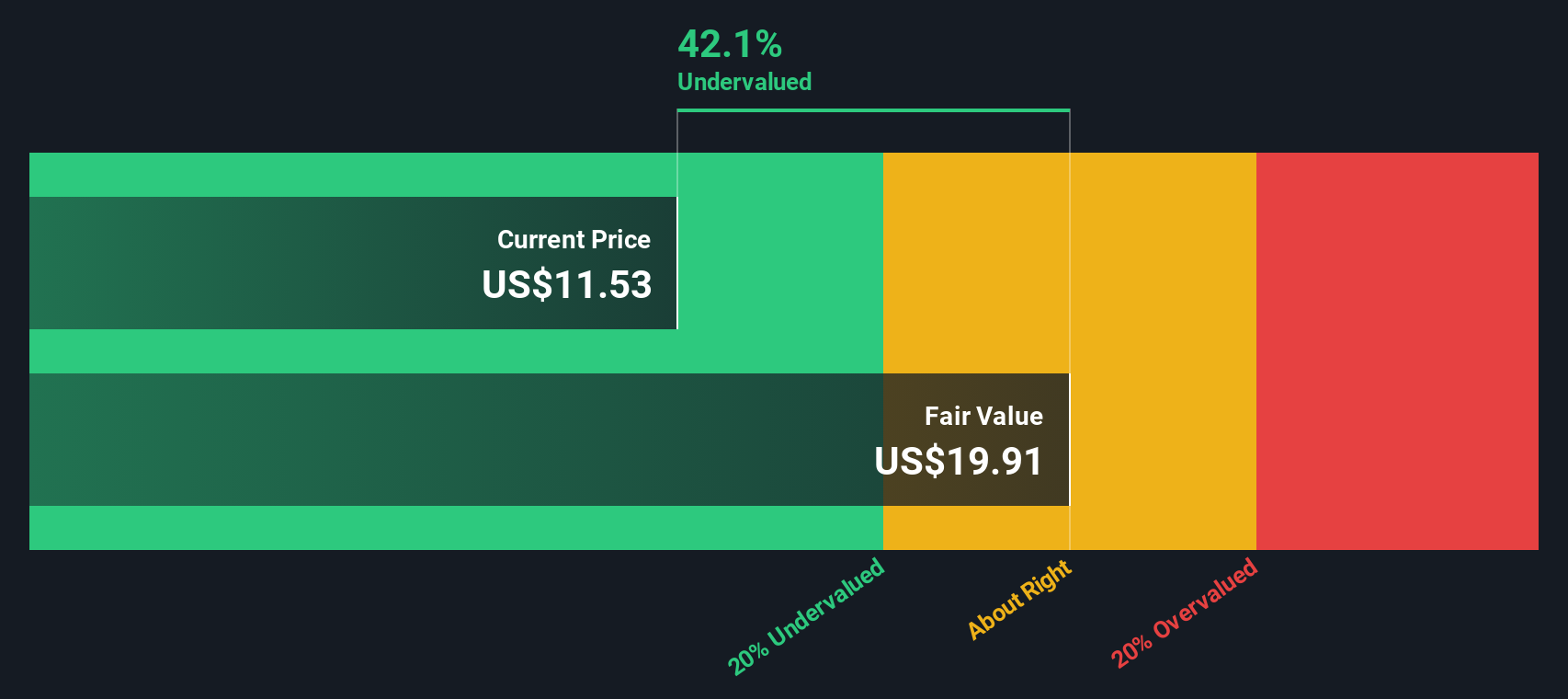

For Hecla Mining, analysts use a 2 Stage Free Cash Flow to Equity approach. The company’s last twelve months of free cash flow totaled approximately $53 million. Looking ahead, analyst forecasts and model extrapolation suggest that annual free cash flow will rise significantly, reaching about $722 million by 2035. These cash flows represent a robust growth outlook, with each year’s projection reflecting both analyst expectations and trend-based estimates by Simply Wall St.

Given these projections, the DCF model calculates an intrinsic value of $17.50 per share. Compared to the current market price, this model implies that Hecla Mining shares are trading at a 28.7 percent discount. In other words, the stock appears considerably undervalued when measured by discounted future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hecla Mining is undervalued by 28.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hecla Mining Price vs Earnings

The price-to-earnings (PE) ratio is often favored for valuing profitable companies, as it relates a company’s share price directly to its per-share earnings. PE is widely used because it quickly tells investors how much they are paying today for a dollar of the company’s current earnings, which is especially relevant when the company is generating sustainable profits.

It is important to note that what is considered a “fair” or “normal” PE ratio can vary based on growth expectations and risk. Rapidly growing companies often justify higher PE multiples as investors anticipate bigger profits in the future, whereas businesses facing higher risks or slower growth typically command lower PE ratios.

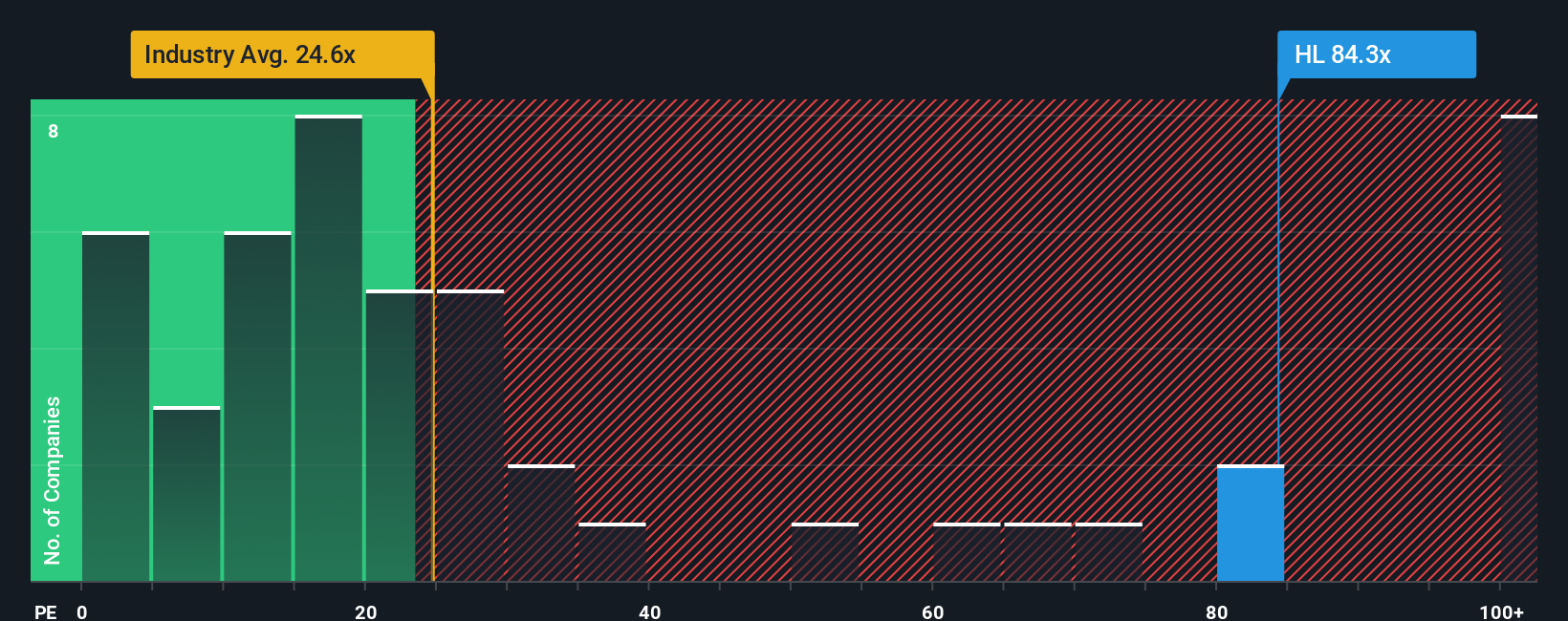

For Hecla Mining, the current PE ratio stands at a steep 83.8x. This is considerably higher than both the metals and mining industry average of 24.1x and the peer group average of 24.6x. At first glance, this premium could signal overvaluation. However, Simply Wall St’s proprietary “Fair Ratio,” which weighs in additional factors such as Hecla’s earnings growth prospects, industry conditions, profit margins, market capitalization and risks, pegs the fair PE multiple at 47.2x.

Unlike plain peer or industry comparisons, the Fair Ratio provides a more tailored benchmark by accounting for what truly drives the stock’s valuation. This makes it a more holistic and insightful measure, particularly for companies in dynamic industries or those with unique growth and risk profiles.

Comparing the Fair Ratio of 47.2x with Hecla’s actual PE of 83.8x indicates the stock is trading well above its justified valuation on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hecla Mining Narrative

Earlier, we hinted at an even better way to understand valuation. Let’s introduce Narratives, a more dynamic and user-friendly method to frame your investment decisions. A Narrative is simply your story about a company, connecting your perspective and expectations (such as where you think Hecla Mining’s revenue, profits, or margins are headed) with your fair value estimate. This approach allows you to see how your beliefs about the business link to real, forward-looking financial forecasts and ultimately to a specific target price.

With Narratives, you can easily capture your viewpoint, whether bullish or cautious, and the platform instantly translates these into financial outcomes. This helps you decide if the current price is attractive or stretched. Available on Simply Wall St’s Community page and used by millions, Narratives are updated dynamically as new news or earnings are released, so your analysis is always current without extra effort.

For example, some Hecla investors are highly optimistic, assuming strong silver demand and margin expansion to justify a price target as high as $12.50. Others see regulatory hurdles and cost risks that lead them to set it as low as $6.50. Narratives empower you to understand these different perspectives and test your own, enabling smarter, more personalized investment decisions.

Do you think there's more to the story for Hecla Mining? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hecla Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HL

Hecla Mining

Provides precious and base metal properties in the United States, Canada, Japan, Korea, and China.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives