- United States

- /

- Metals and Mining

- /

- NYSE:HCC

How Investors Are Reacting To Warrior Met Coal (HCC) Raising 2025 Production and Sales Guidance

Reviewed by Sasha Jovanovic

- Warrior Met Coal, Inc. recently reported third quarter 2025 results, showing revenues of US$328.59 million and net income of US$36.6 million, with sales and earnings per share slightly lower than the prior year but generally flat in overall sales performance.

- In tandem with earnings, the company raised its 2025 full-year guidance for both production and sales volumes by approximately 10%, reflecting management’s confidence in improved operational capabilities for the year.

- Next, we’ll examine how Warrior Met Coal’s increased 2025 production guidance could influence its future earnings narrative and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Warrior Met Coal Investment Narrative Recap

To be a shareholder in Warrior Met Coal, investors typically need to believe in a recovery of global steel demand, the company’s ability to capitalize on increased production, and resilience to price and margin pressures. The recent guidance hike for 2025 production and sales may support optimism around operational execution, but persistent weakness in coal markets remains the biggest near-term risk, and this news does not appear to materially change that outlook.

Of the latest announcements, the 10% boost in full-year production and sales guidance stands out as most relevant. This adjustment reinforces the company’s near-term earning’s story by demonstrating operational improvement, which could help counteract recent earnings pressure and aligns with anticipated catalysts around volume-driven revenue growth.

Still, in contrast, investors should be mindful of the risk that higher output may not fully offset the impact of weak global steel demand and...

Read the full narrative on Warrior Met Coal (it's free!)

Warrior Met Coal's outlook projects $2.0 billion in revenue and $636.5 million in earnings by 2028. This assumes 18.8% annual revenue growth and an earnings increase of $596.2 million from the current $40.3 million.

Uncover how Warrior Met Coal's forecasts yield a $80.00 fair value, in line with its current price.

Exploring Other Perspectives

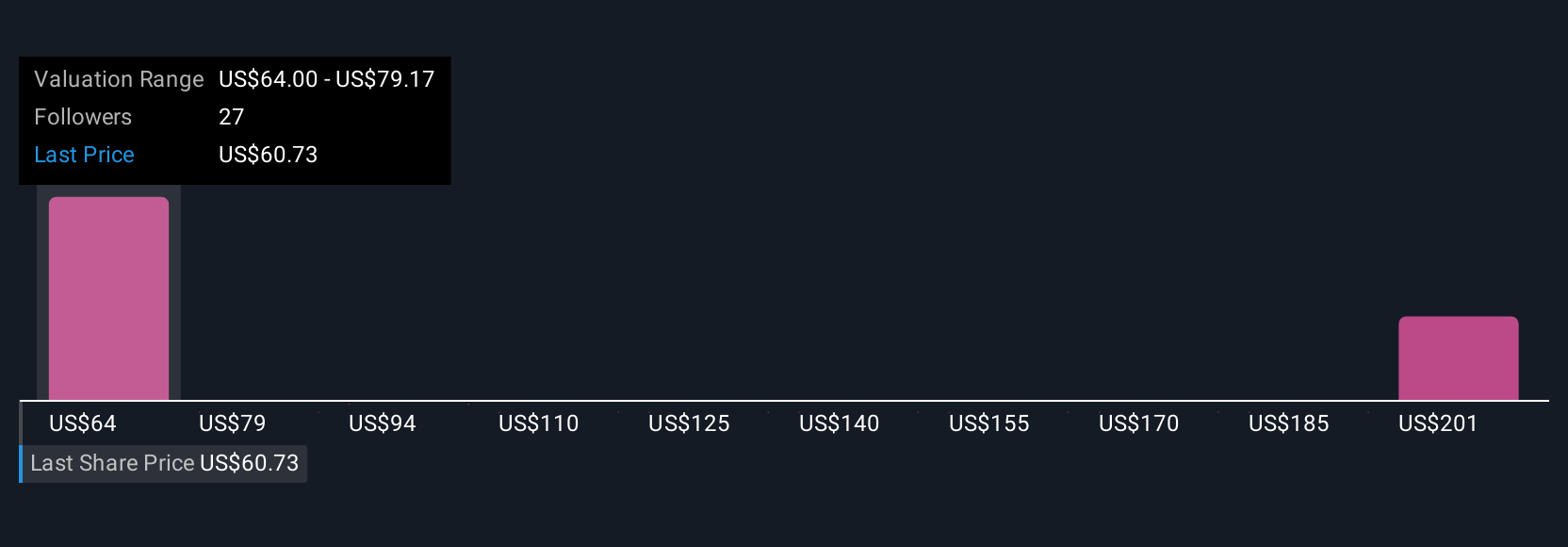

Four members of the Simply Wall St Community offered fair value estimates for Warrior Met Coal between US$75 and US$155.98 per share. As you weigh these diverse views, remember that even rising production volumes may not guarantee stronger results if coal prices or regional demand remain under pressure.

Explore 4 other fair value estimates on Warrior Met Coal - why the stock might be worth just $75.00!

Build Your Own Warrior Met Coal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Warrior Met Coal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warrior Met Coal's overall financial health at a glance.

No Opportunity In Warrior Met Coal?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warrior Met Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCC

Warrior Met Coal

Engages in the production and export of non-thermal steelmaking coal for the steel production by metal manufacturers in Europe, South America, and Asia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives