- United States

- /

- Metals and Mining

- /

- NYSE:HCC

Can HCC’s Lower Guidance Reveal the Real Challenge Facing Warrior Met Coal’s Long-Term Strategy?

Reviewed by Simply Wall St

- Warrior Met Coal reported its second quarter 2025 financial results, showing a decline in both revenue and net income compared to the previous year, alongside updated full-year coal production and sales guidance.

- The company also announced an amendment to its bylaws, reaffirmed its regular quarterly dividend, and addressed shifting market expectations for coal sales volumes in 2025.

- We’ll explore how Warrior Met Coal’s lower earnings and revised sales guidance could alter its long-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Warrior Met Coal Investment Narrative Recap

To be a shareholder in Warrior Met Coal, you need to believe in a rebound in global steelmaking coal prices and the company’s ability to execute the Blue Creek project for future growth. Despite the recent earnings miss, with revenue dropping to US$297.52 million and net income falling sharply, the updated sales guidance signals the company still expects solid production and coal sales in 2025. The most important short-term catalyst remains coal price recovery, while weak steel and raw material markets are the primary risk; based on this quarter, neither appears to fundamentally shift in the near term.

One relevant announcement is Warrior Met Coal’s reaffirmed regular quarterly dividend of US$0.08 per share, which demonstrates management’s ongoing commitment to shareholder returns despite weaker financial results. While not a substitute for earnings growth, consistent dividends can provide some stability for existing investors as the company navigates through current market pressures and awaits potential price recovery.

On the other hand, investors should be alert to how prolonged weak global steel demand could continue to challenge Warrior’s profitability and future earnings...

Read the full narrative on Warrior Met Coal (it's free!)

Warrior Met Coal's narrative projects $2.0 billion in revenue and $395.2 million in earnings by 2028. This requires 15.7% yearly revenue growth and a $289.8 million earnings increase from $105.4 million today.

Uncover how Warrior Met Coal's forecasts yield a $60.33 fair value, a 10% upside to its current price.

Exploring Other Perspectives

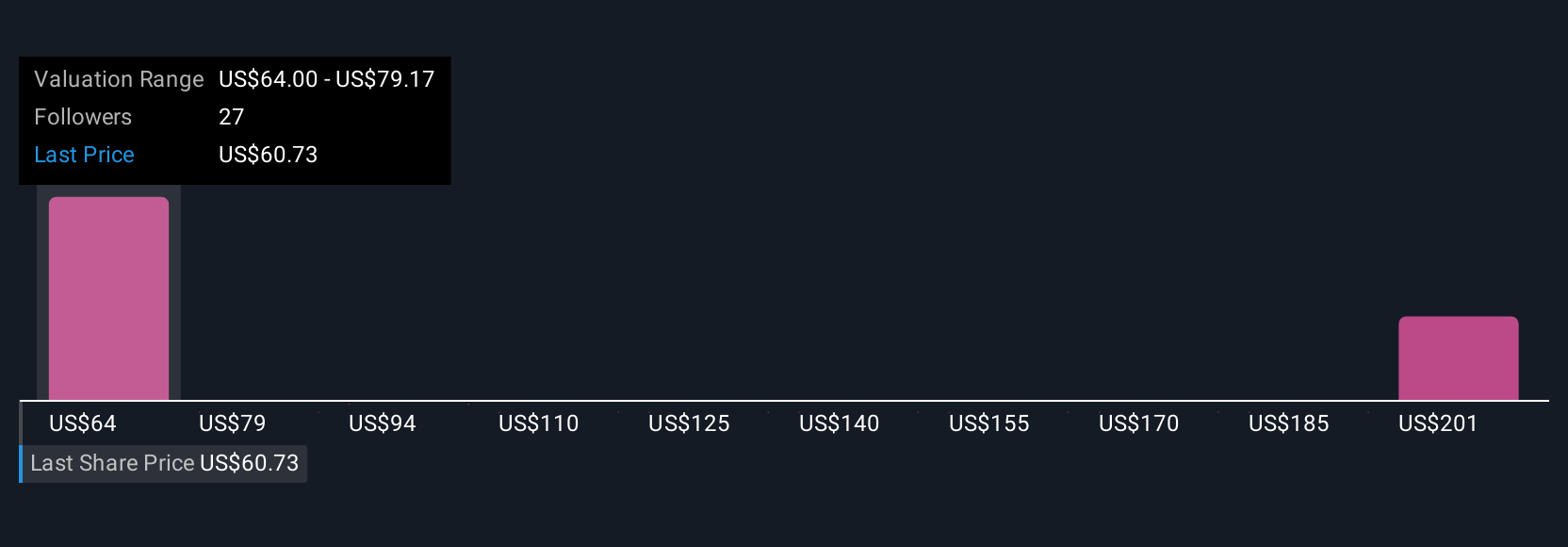

Five fair value estimates from the Simply Wall St Community place Warrior Met Coal's worth between US$60 and US$158 per share. Against this diversity of views, persistent weak pricing in the global steelmaking coal market remains a key issue for the company’s prospects, so consider several interpretations before reaching a conclusion.

Explore 5 other fair value estimates on Warrior Met Coal - why the stock might be worth over 2x more than the current price!

Build Your Own Warrior Met Coal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Warrior Met Coal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warrior Met Coal's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warrior Met Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCC

Warrior Met Coal

Engages in the production and export of non-thermal steelmaking coal for the steel production by metal manufacturers in Europe, South America, and Asia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives