- United States

- /

- Metals and Mining

- /

- NYSE:HCC

A Look at Warrior Met Coal’s (HCC) Valuation Following its Upgraded 2025 Growth Outlook

Reviewed by Simply Wall St

Warrior Met Coal (HCC) just raised its full-year 2025 production and sales guidance by about 10%, signaling greater confidence in ongoing operations. The update follows the company's third quarter earnings announcement.

See our latest analysis for Warrior Met Coal.

Despite some earnings volatility in recent quarters, Warrior Met Coal has seen strong momentum build over the past few months. The company has achieved a 34% share price return in the last 90 days and a 19.6% surge over the past month. Long-term holders have also benefited, as the company’s total shareholder return now stands at 146% over three years and 431% over five years.

If you're interested in discovering what else could be gathering steam, now might be the perfect time to broaden your search and explore fast growing stocks with high insider ownership.

The company’s upgraded guidance adds fresh optimism, but its recent earnings show some volatility. Is Warrior Met Coal’s current price leaving room for further upside, or are markets already taking all the future growth into account?

Most Popular Narrative: 8.6% Overvalued

With Warrior Met Coal's fair value pegged at $74 and shares closing at $80.38, the most widely followed narrative considers the price moderately outpacing analyst growth expectations. This sets up a revealing look at what underpins this fair value assessment.

“Warrior's focus on premium, low-volatility, high-quality met coal with geographic proximity to Gulf export terminals enhances its ability to command price premiums and deliver reliably. This makes the company a preferred supplier amid global infrastructure growth, especially as Western and allied nations prioritize secure, non-sanctioned materials. This supports higher long-term realized prices and margin resilience.”

Want to see what’s actually fueling this valuation? The big growth call here is built on ambitious projections for profits and margins that would change the entire earnings picture. Which future numbers could justify the current price premium? Uncover the bold assumptions that put Warrior Met Coal in the spotlight.

Result: Fair Value of $74 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in global steel demand or a shift in Warrior Met Coal's sales mix could still challenge these bullish growth assumptions.

Find out about the key risks to this Warrior Met Coal narrative.

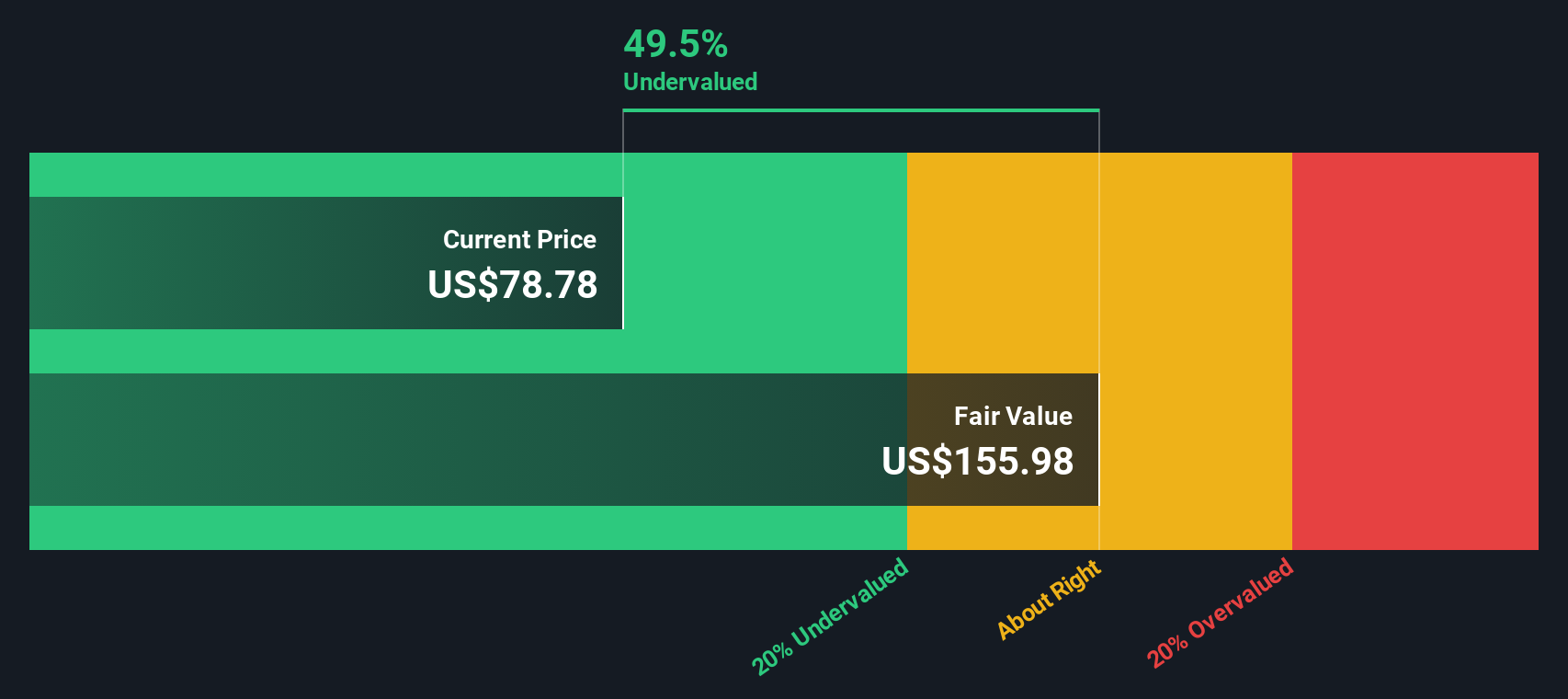

Another View: SWS DCF Model Suggests Deep Value

Looking at Warrior Met Coal through the lens of our DCF model offers a very different perspective. The SWS DCF model estimates a fair value of $155.83 per share, which is nearly double the current share price and significantly above analyst targets. Could traditional valuation methods be underestimating future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Warrior Met Coal for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Warrior Met Coal Narrative

If you’d rather follow your own logic or challenge the consensus view, you can investigate the data yourself and assemble a personal narrative in just a few minutes: Do it your way.

A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

There is a world of opportunities out there, and missing these next moves could mean missing out on tomorrow's biggest winners. Use the Simply Wall Street Screener to get ahead of the crowd and identify companies with huge potential, solid growth, or stable income streams.

- Catch market upswings and take advantage of high-yield payments by backing companies featured in these 15 dividend stocks with yields > 3%.

- Tap into booming demand and rewarding volatility with these 3590 penny stocks with strong financials that are recognized for their strong financials.

- Ride the wave of artificial intelligence and enhance your portfolio with cutting-edge opportunities found in these 28 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warrior Met Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCC

Warrior Met Coal

Engages in the production and export of non-thermal steelmaking coal for the steel production by metal manufacturers in Europe, South America, and Asia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives