- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

3 Stocks Estimated To Be Undervalued By Up To 48.9%

Reviewed by Simply Wall St

As the U.S. stock market grapples with renewed concerns over AI valuations and a record-breaking government shutdown, major indices like the Nasdaq, S&P 500, and Dow Jones Industrial Average have recently closed lower. Amidst this volatility, investors are increasingly seeking opportunities in stocks that appear undervalued based on their intrinsic value relative to current market prices. Identifying such stocks requires careful consideration of financial health, growth potential, and market sentiment—factors that can help reveal hidden value even in uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Super Group (SGHC) (SGHC) | $11.75 | $22.95 | 48.8% |

| Old National Bancorp (ONB) | $20.59 | $40.90 | 49.7% |

| Oddity Tech (ODD) | $39.96 | $79.51 | 49.7% |

| MoneyHero (MNY) | $1.23 | $2.42 | 49.1% |

| Huntington Bancshares (HBAN) | $15.42 | $30.83 | 50% |

| Genius Sports (GENI) | $10.21 | $20.14 | 49.3% |

| First Busey (BUSE) | $22.76 | $45.34 | 49.8% |

| Corpay (CPAY) | $278.00 | $544.18 | 48.9% |

| Caris Life Sciences (CAI) | $24.61 | $48.22 | 49% |

| AbbVie (ABBV) | $219.04 | $434.82 | 49.6% |

Let's review some notable picks from our screened stocks.

Corpay (CPAY)

Overview: Corpay, Inc. is a payments company facilitating the management of vehicle-related expenses, lodging expenses, and corporate payments for businesses and consumers across the United States, Brazil, the United Kingdom, and internationally; it has a market cap of $18.48 billion.

Operations: Corpay's revenue is generated from managing expenses related to vehicles, lodging, and corporate payments for both businesses and consumers in various regions including the United States, Brazil, the United Kingdom, and internationally.

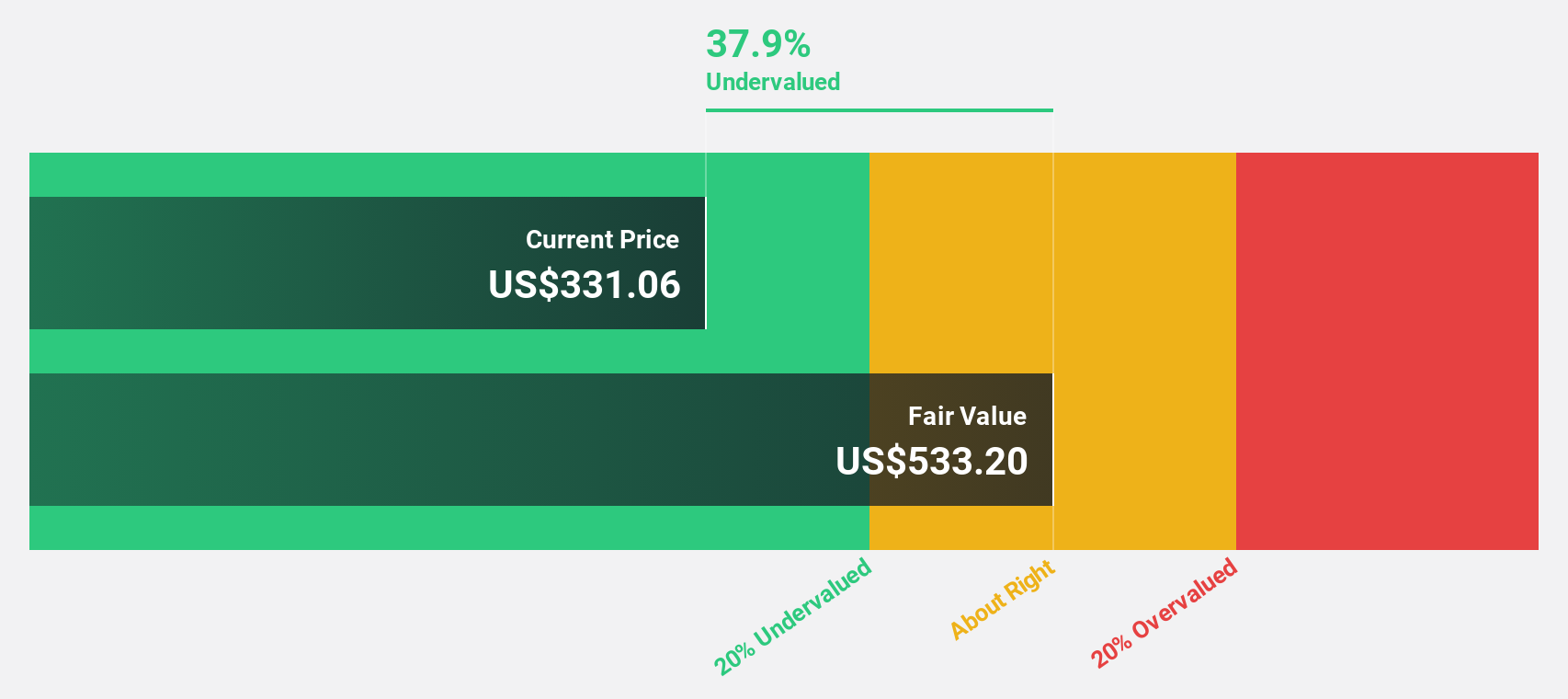

Estimated Discount To Fair Value: 48.9%

Corpay, Inc. is trading significantly below its estimated fair value, with a price of US$278 compared to a fair value estimate of US$544.18. Despite debt not being well covered by operating cash flow, the company has strong revenue and earnings growth forecasts, outpacing the broader market. Recent strategic acquisitions and partnerships enhance its global payments capabilities, while an aggressive share repurchase plan supports shareholder value amidst plans for further deleveraging by year-end 2025.

- Our earnings growth report unveils the potential for significant increases in Corpay's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Corpay.

Warrior Met Coal (HCC)

Overview: Warrior Met Coal, Inc. produces and exports non-thermal steelmaking coal for metal manufacturers in Europe, South America, and Asia, with a market cap of approximately $3.47 billion.

Operations: Warrior Met Coal generates revenue primarily through the production and export of non-thermal steelmaking coal to metal manufacturers across Europe, South America, and Asia.

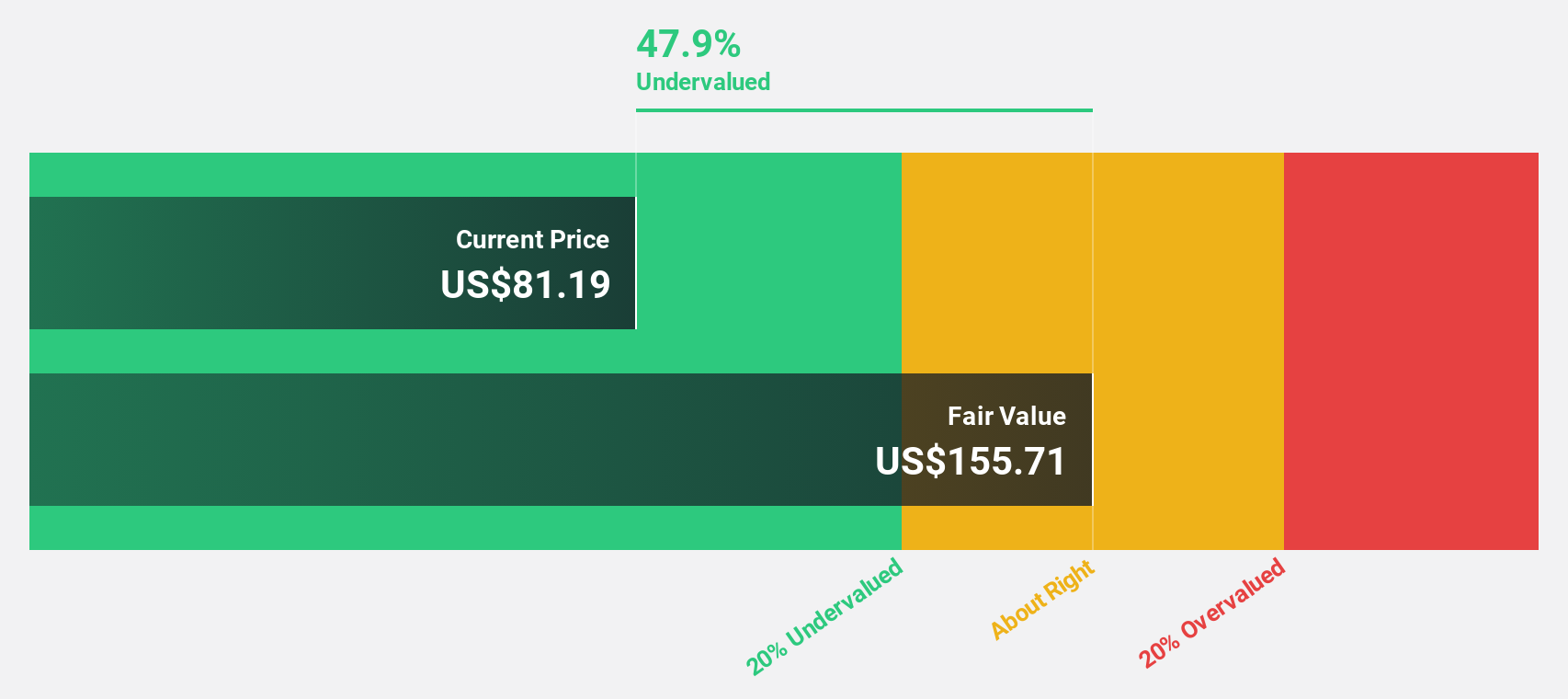

Estimated Discount To Fair Value: 47.5%

Warrior Met Coal is trading at US$81.3, well below its estimated fair value of US$154.75, indicating significant undervaluation based on cash flows. Despite a recent decline in net income and earnings per share compared to the previous year, the company forecasts robust annual earnings growth of 85.6% and revenue growth exceeding market expectations at 20.6%. Recent increases in production and sales volume guidance further support its long-term operational expansion strategy.

- The analysis detailed in our Warrior Met Coal growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Warrior Met Coal's balance sheet health report.

Procore Technologies (PCOR)

Overview: Procore Technologies, Inc. offers a cloud-based construction management platform and related services globally, with a market cap of approximately $10.74 billion.

Operations: Procore Technologies generates revenue through its cloud-based construction management platform and associated services offered both domestically and internationally.

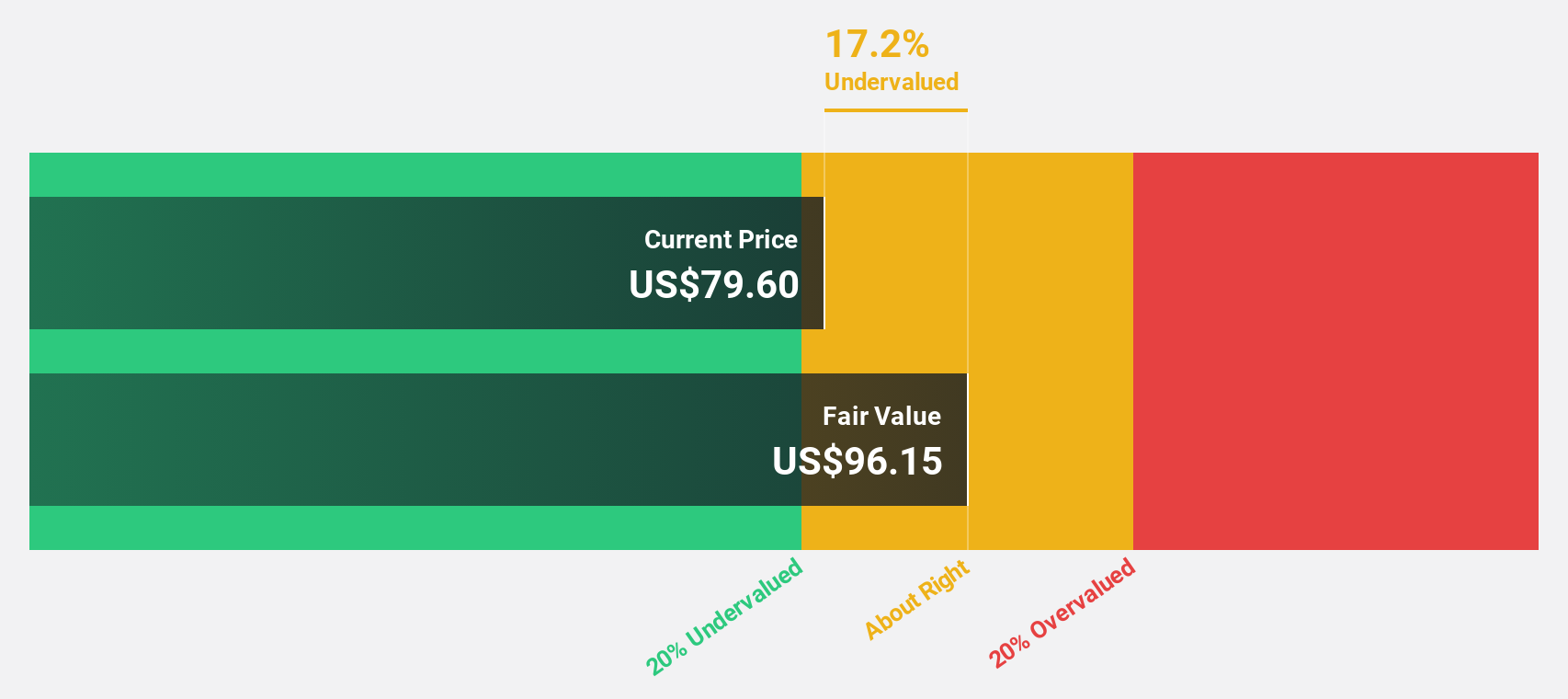

Estimated Discount To Fair Value: 18%

Procore Technologies is trading at US$79.09, below its estimated fair value of US$96.43, suggesting it may be undervalued based on cash flows. The company anticipates becoming profitable within three years with earnings projected to grow significantly annually. Recent Q3 results showed improved sales and reduced net losses compared to last year. Procore's strategic initiatives, such as AI enhancements and a share buyback program up to US$300 million, underscore its commitment to innovation and shareholder value enhancement.

- In light of our recent growth report, it seems possible that Procore Technologies' financial performance will exceed current levels.

- Navigate through the intricacies of Procore Technologies with our comprehensive financial health report here.

Taking Advantage

- Investigate our full lineup of 180 Undervalued US Stocks Based On Cash Flows right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives