- United States

- /

- Chemicals

- /

- NYSE:FMC

Will FMC’s (FMC) Innovation Push Offset Operational Risks Amid Recent Facility Incident?

Reviewed by Sasha Jovanovic

- Earlier this week, two workers were hospitalized following a hazmat incident at FMC's Lexington facility, where a suspicious substance in the mailroom was contained and isolated by onsite officials.

- Shortly after, at the Jefferies Mining and Industrials Conference 2025, FMC highlighted its innovation pipeline and expanded biological portfolio as part of its response to regulatory and patent challenges.

- Now we'll assess how FMC's renewed emphasis on innovation and biologicals shapes the investment narrative moving forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

FMC Investment Narrative Recap

To be confident as an FMC shareholder, you need to believe in the company's ability to innovate, commercializing new actives and scaling its biologicals business to offset patent expirations and protect margins from regulatory and generic headwinds. The recent hazmat incident at the Lexington facility appears immaterial to the company's primary near-term catalyst, which is the commercial ramp of new products and execution in Latin America; however, it underscores operational risks that could distract from those efforts if not well managed.

The most relevant recent announcement is FMC's expansion of its biologicals and innovation pipeline, presented at the Jefferies Mining and Industrials Conference. This is critical for mitigating pipeline and regulatory risk, particularly as FMC strives to maintain volume growth and margin recovery post-Rynaxypyr patent expiration, amid ongoing margin and pricing pressures.

By contrast, investors should be aware that successful innovation alone may not fully offset the margin pressures from ...

Read the full narrative on FMC (it's free!)

FMC's narrative projects $4.8 billion revenue and $542.8 million earnings by 2028. This requires 5.5% yearly revenue growth and a $413.1 million earnings increase from $129.7 million today.

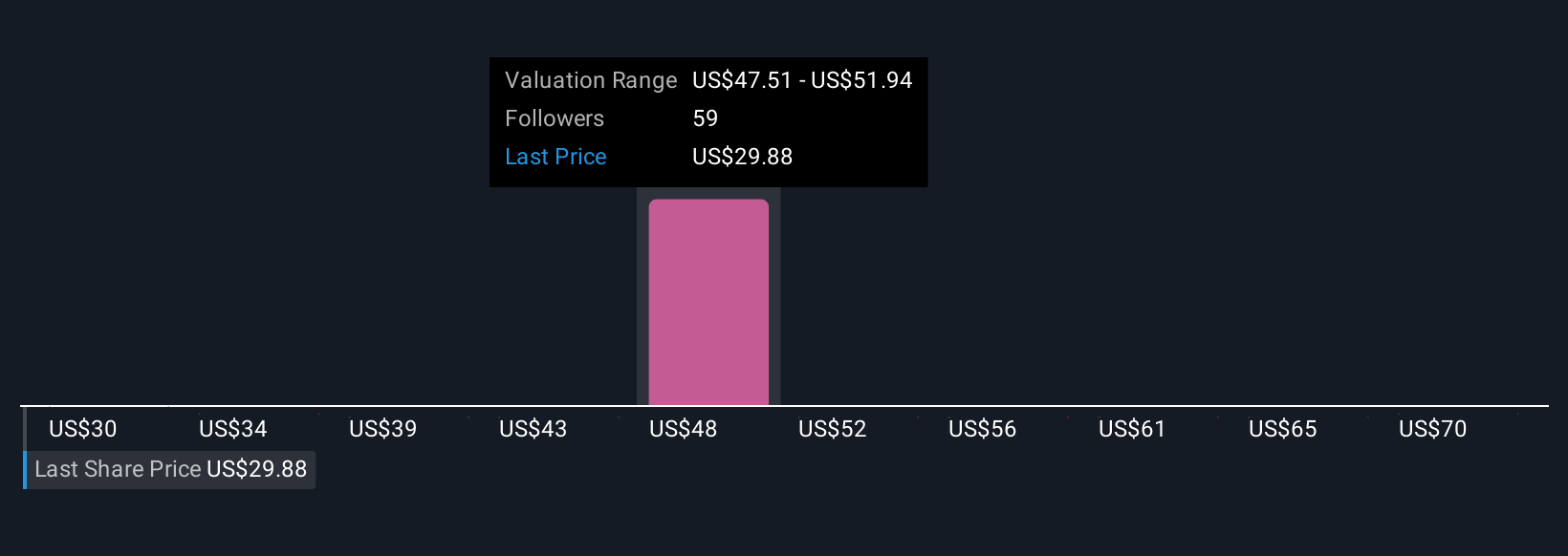

Uncover how FMC's forecasts yield a $48.94 fair value, a 56% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community provided fair value estimates for FMC between US$29.78 and US$74.11 per share. Community perspectives vary widely, and with execution on the new product pipeline in focus, you can explore multiple viewpoints on just how much innovation might drive future returns.

Explore 7 other fair value estimates on FMC - why the stock might be worth 5% less than the current price!

Build Your Own FMC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FMC research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free FMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FMC's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection solutions to farmers in Latin America, North America, Europe, the Middle East, Africa, and Asia.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives