- United States

- /

- Chemicals

- /

- NYSE:FMC

FMC (NYSE:FMC) Exits S&P 500 Value Following 3% Share Price Drop

Reviewed by Simply Wall St

FMC (NYSE:FMC) saw an 8.5% price increase over the past month amid several key developments. The company was removed from the S&P 500 Value Index and the S&P 500 as a whole, with subsequent inclusion in other indices like the S&P 1000 and S&P 600. Additionally, FMC declared a quarterly dividend of 58 cents per share, impacting shareholder returns. The broader market also showed resilience, with the Dow and other indexes seeing gains largely due to positive investor sentiment following news on tariffs, which may have supported the company's share price momentum despite its exclusion from the S&P 500.

We've identified 4 weaknesses for FMC (1 is potentially serious) that you should be aware of.

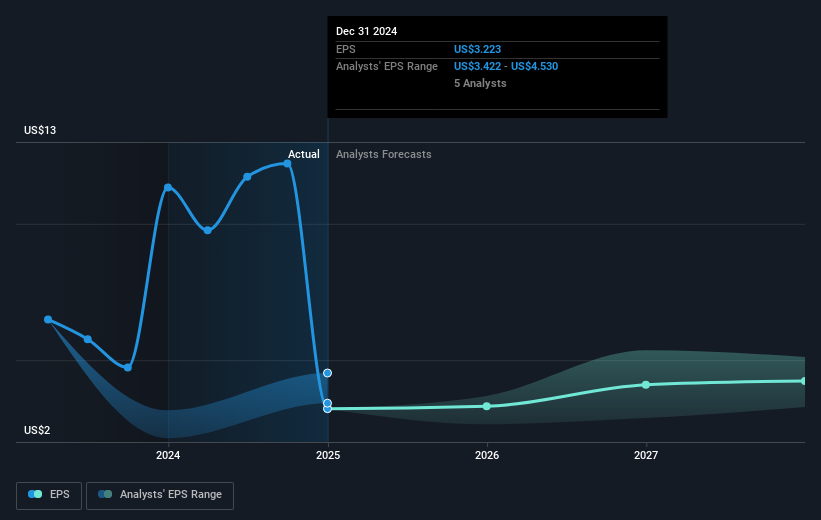

Over the past year, FMC Corporation's total shareholder return, including share price and dividends, saw a decline of 31.20%. This underperformance contrasts sharply with the broader US market, which returned 8.1% during the same period. Notably, FMC also lagged behind the US Chemicals industry's return of 7.9%. Key events impacting the company's share performance included a significant net loss of US$16.3 million in Q4 2024, compared to a net income of US$1,098.5 million the previous year, and legal challenges with a class-action lawsuit filed in February 2025.

Contributing to the operational adjustments, FMC made several changes in leadership with the appointment of Pierre R. Brondeau as CEO in mid-2024. Additionally, it entered strategic collaborations in Brazil to improve sustainability and pest management, reflecting a broader focus on new market strategies. Index realignments, including the removal from the S&P 500 and addition to the S&P 1000 and S&P 600, further illustrate the changes within the company's broader financial landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection solutions to farmers in Latin America, North America, Europe, the Middle East, Africa, and Asia.

6 star dividend payer and undervalued.