- United States

- /

- Metals and Mining

- /

- NYSE:FCX

Is Grasberg Mine Disruption Reshaping the Investment Case for Freeport-McMoRan (FCX)?

Reviewed by Sasha Jovanovic

- In October 2025, Freeport-McMoRan reported that a mudslide and a fatal accident at its Grasberg mine in Indonesia caused significant operational disruptions, resulting in lower copper and gold production for the third quarter and a phased restart plan not expected to fully restore output until 2027.

- This disruption has intensified concerns around global copper supply, coming at a time when demand is robust and the market balance is tight, which may have broader implications for the industry and Freeport-McMoRan's near-term performance.

- We'll now examine how the Grasberg incident and resulting production delays could impact Freeport-McMoRan's investment narrative and future outlook.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Freeport-McMoRan Investment Narrative Recap

To be a shareholder in Freeport-McMoRan, one needs to believe in the long-term potential for copper demand, the company’s operating leverage from integrated production, and its ability to manage complex assets like Grasberg. The recent mine disruption directly impacts near-term copper production, currently the most important short-term catalyst, while reinforcing the risk tied to Freeport’s heavy Indonesian exposure. This incident makes operational risk at Grasberg the most immediate concern for investors.

Most relevant to this situation, the company’s October 2025 production results showed a quarter-over-quarter decline in both copper and gold output, reflecting Grasberg’s impact. This tangible drop in production places even greater focus on how quickly Freeport can phase in a restart while managing ongoing safety and regulatory scrutiny, key to sustaining investor confidence given tight global supply expectations.

By contrast, some investors may not fully appreciate the ongoing exposure to changes in Indonesian government policy…

Read the full narrative on Freeport-McMoRan (it's free!)

Freeport-McMoRan is projected to reach $31.1 billion in revenue and $3.3 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 6.4% and a $1.4 billion increase in earnings from the current level of $1.9 billion.

Uncover how Freeport-McMoRan's forecasts yield a $46.76 fair value, a 14% upside to its current price.

Exploring Other Perspectives

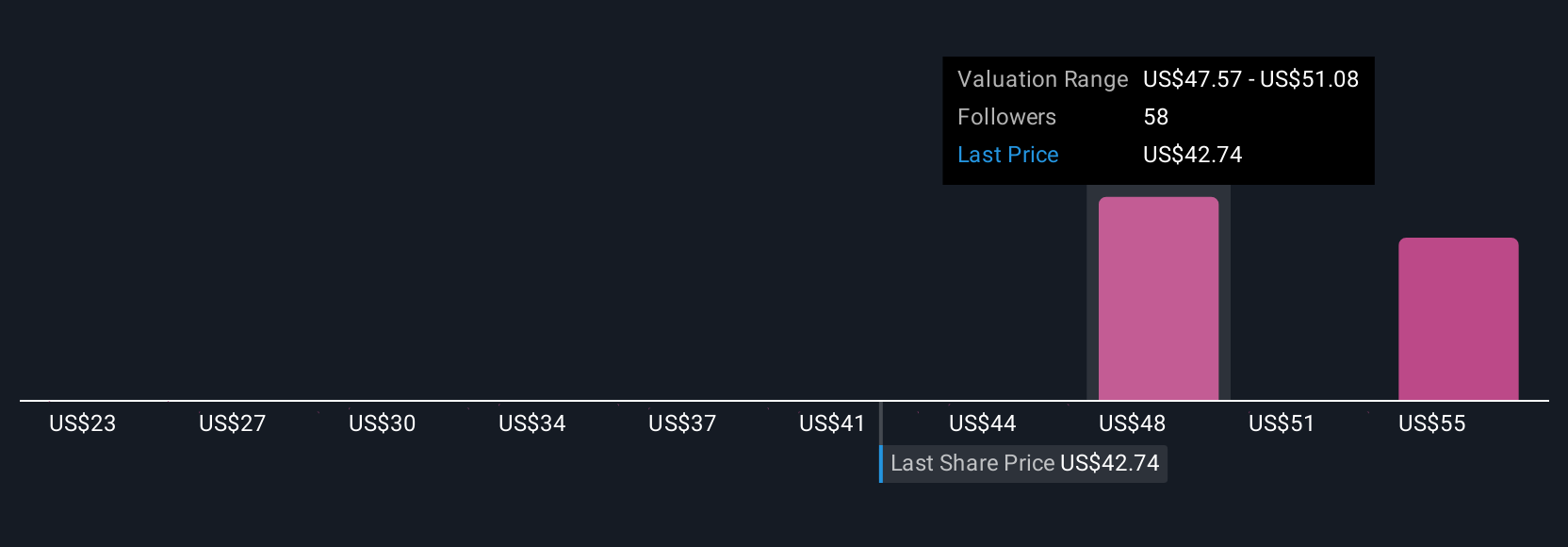

Eleven individual fair value estimates from the Simply Wall St Community span US$25.20 to US$75.14 per share, highlighting sharply differing assessments. With Grasberg’s operational delays now in focus, many are watching to see how production risk could affect future earnings and long-term valuations.

Explore 11 other fair value estimates on Freeport-McMoRan - why the stock might be worth as much as 83% more than the current price!

Build Your Own Freeport-McMoRan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freeport-McMoRan research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freeport-McMoRan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freeport-McMoRan's overall financial health at a glance.

No Opportunity In Freeport-McMoRan?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives