- United States

- /

- Metals and Mining

- /

- NYSE:FCX

Freeport-McMoRan (FCX): Reassessing Valuation After Grasberg Safety Incident and Mounting Legal Risks

Reviewed by Simply Wall St

The latest move in Freeport-McMoRan (FCX) shares is being driven by a tragic safety incident at its Grasberg Block Cave mine in Indonesia, which triggered a production halt and a wave of securities class action lawsuits.

See our latest analysis for Freeport-McMoRan.

Even with the legal overhang and the Grasberg disruption in focus, investors have pushed Freeport-McMoRan back toward $44.61. A solid year to date share price return has helped offset the softer 1 year total shareholder return and suggests that sentiment is stabilizing rather than accelerating.

If this kind of risk and momentum mix has your attention, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With legal claims mounting, earnings still growing, and the share price sitting below analyst and intrinsic estimates, is Freeport-McMoRan quietly undervalued or already reflecting all the risk and future copper demand upside?

Most Popular Narrative: 6.8% Undervalued

With Freeport McMoRan last closing at $44.61 against a narrative fair value of $47.87, the current price sits below the story that consensus expects.

Brownfield expansions in North and South America (e.g., Bagdad, El Abra, Lone Star) leverage existing infrastructure and Freeport's experience to deliver low risk, high return volume growth. These initiatives are positioned to bring 2.5 billion pounds of new copper supply online in structurally tight markets directly impacting future revenues and earnings growth.

Want to see how this supply surge, margin uplift, and earnings ramp supposedly stack up into one price tag for FCX? The narrative leans on layered growth assumptions, expanding profitability, and a punchy future earnings multiple that rivals faster growing sectors. Curious which numbers have to click perfectly into place to hit that fair value? Read on to unpack the full blueprint behind this call.

Result: Fair Value of $47.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing operational uncertainty at Grasberg and potential policy shifts in Indonesia could quickly challenge these growth assumptions and put pressure on the valuation case.

Find out about the key risks to this Freeport-McMoRan narrative.

Another Angle on Valuation

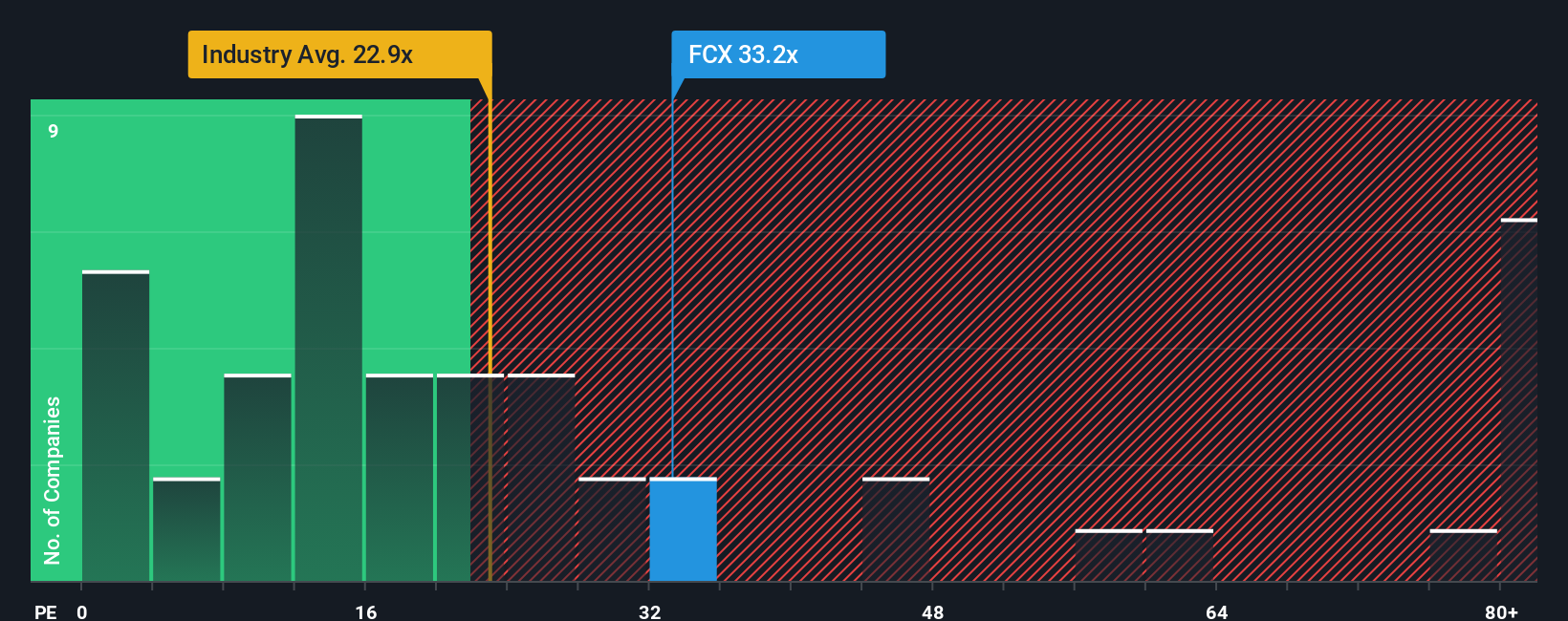

On earnings, the picture looks very different. FCX trades on about 31 times earnings compared with a fair ratio of 28 times, and peers closer to 22 times. That leaves today’s price looking stretched and raises a harder question: how much Grasberg risk is really in the multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Freeport-McMoRan Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Freeport-McMoRan.

Looking for more investment ideas?

Before you move on, lock in your next move with targeted ideas from our screeners so you do not miss opportunities beyond Freeport-McMoRan.

- Capture potential mispricings by scanning these 911 undervalued stocks based on cash flows that combine strong cash flow support with compelling upside narratives.

- Ride the next wave of innovation by zeroing in on these 26 AI penny stocks positioned at the heart of machine learning and automation growth.

- Boost your portfolio's income engine by focusing on these 15 dividend stocks with yields > 3% that balance yield, stability, and long term fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026