- United States

- /

- Basic Materials

- /

- NYSE:EXP

Eagle Materials (EXP): Assessing Valuation After Return on Capital Surges Without Additional Investment

Reviewed by Simply Wall St

Eagle Materials (EXP) is back in focus after new numbers revealed its return on capital employed has jumped 68% over the last five years, all without expanding its capital base. For investors, this is about more than just a financial ratio—it is a concrete signal that management’s investments are driving higher profits from the same resources. The company’s ability to compound earnings efficiently can turn heads, especially in an industry where growth often means pouring in more capital first.

This backdrop helps explain why Eagle Materials has delivered such an outsized return, up 186% over five years, despite a recent dip of 10% over the past year. Momentum in the past three months has ticked up again by 12%, suggesting recent optimism is building as these growth signals catch the market’s attention. While year-to-date results remain slightly negative, that has not shaken the company’s longer-term trajectory as it continues to post steady growth in both revenue and net income.

With all this in mind, investors have to ask: does Eagle Materials have more room to run, or is the market already pricing in its future prospects?

Most Popular Narrative: 3.2% Undervalued

According to community narrative, Eagle Materials is seen as trading slightly below its estimated fair value. Analyst forecasts suggest a modest upside potential.

Modernization and expansion projects, such as the Laramie, Wyoming cement plant and Duke, Oklahoma wallboard facility, are on track and are expected to unlock further operational efficiency, enhance production capacity, and provide full expensing tax benefits. These factors are all likely to improve net margins and cash flow in coming years.

What bold assumptions are fueling this valuation? There is a surprising mix of projected growth in revenue, profit margins, and future profit multiples that are typically reserved for leading names. The analysts behind this narrative are focusing on a strategic combination of efficiency upgrades, margin improvement, and capital discipline. Interested in the specific targets that back up this price prediction? Explore the narrative to see the numbers driving this fair value call.

Result: Fair Value of $246.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent housing affordability challenges and concentrated regional exposure could threaten revenue growth if demand weakens or if local economies falter.

Find out about the key risks to this Eagle Materials narrative.Another View: SWS DCF Model Challenges the Market Perspective

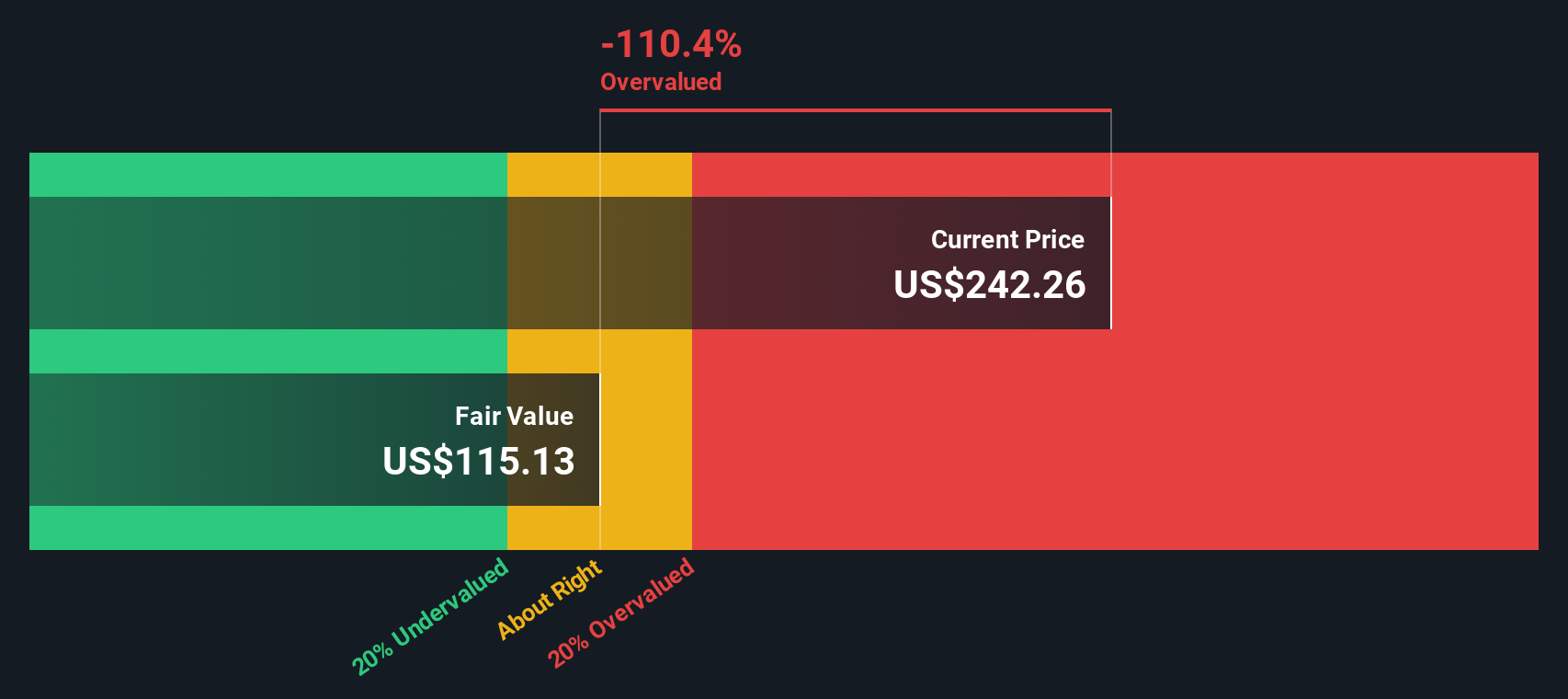

Taking a step back from market-based valuation, our DCF model arrives at a much more conservative estimate. This approach suggests Eagle Materials could be overvalued by a wide margin. Does this raise red flags for confidence in the current consensus, or does it highlight the limitations of discount models in fast-evolving markets?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Eagle Materials Narrative

If you see the story differently or want to dig into the data on your own terms, it takes just a few minutes to craft your own perspective. do it your way.

A great starting point for your Eagle Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities abound beyond Eagle Materials, and it pays to be selective in today's market. For investors who want to get ahead of the next big move, these handpicked stock lists are designed to give you an edge. If you want to stay sharp, you really should not ignore these ideas.

- Tap into the future of artificial intelligence by reviewing AI penny stocks, where emerging companies combine tech prowess with growth potential.

- Maximize your passive income by assessing dividend stocks with yields > 3%, a selection of stocks that regularly pay higher yields and may help you build wealth steadily.

- Seize opportunities in a rapidly evolving healthcare sector by evaluating healthcare AI stocks, a set of companies at the forefront of medical innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagle Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXP

Eagle Materials

Through its subsidiaries, manufactures and sells heavy construction products and light building materials in the United States.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives