- United States

- /

- Chemicals

- /

- NYSE:ESI

Element Solutions (ESI): Examining Valuation as Analysts Turn Bullish and Insiders Sell Shares

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 9.2% Undervalued

The prevailing narrative sees Element Solutions as undervalued, emphasizing growth potential supported by a mix of industry trends and company-specific catalysts.

Accelerating investment in data centers and high-performance computing infrastructure is driving demand for advanced electronics materials and wafer-level packaging solutions. This positions Element Solutions as a key supplier for leading-edge semiconductor and circuit board applications and supports robust future revenue growth.

Curious what is powering this bullish outlook? Get ready to see the bold assumptions for future profits and the kind of margin leap often reserved for fast-moving disruptors. There is a blueprint in this narrative that puts advanced technology and next-generation applications at the center of future returns. Think the story is all baked in at today’s stock price? The full details may challenge what you thought was possible.

Result: Fair Value of $29.1 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent uncertainty in tech demand and tougher competition from low-cost rivals could quickly challenge these bullish assumptions about Element Solutions’ future growth.

Find out about the key risks to this Element Solutions narrative.Another View: What Does Our DCF Model Say?

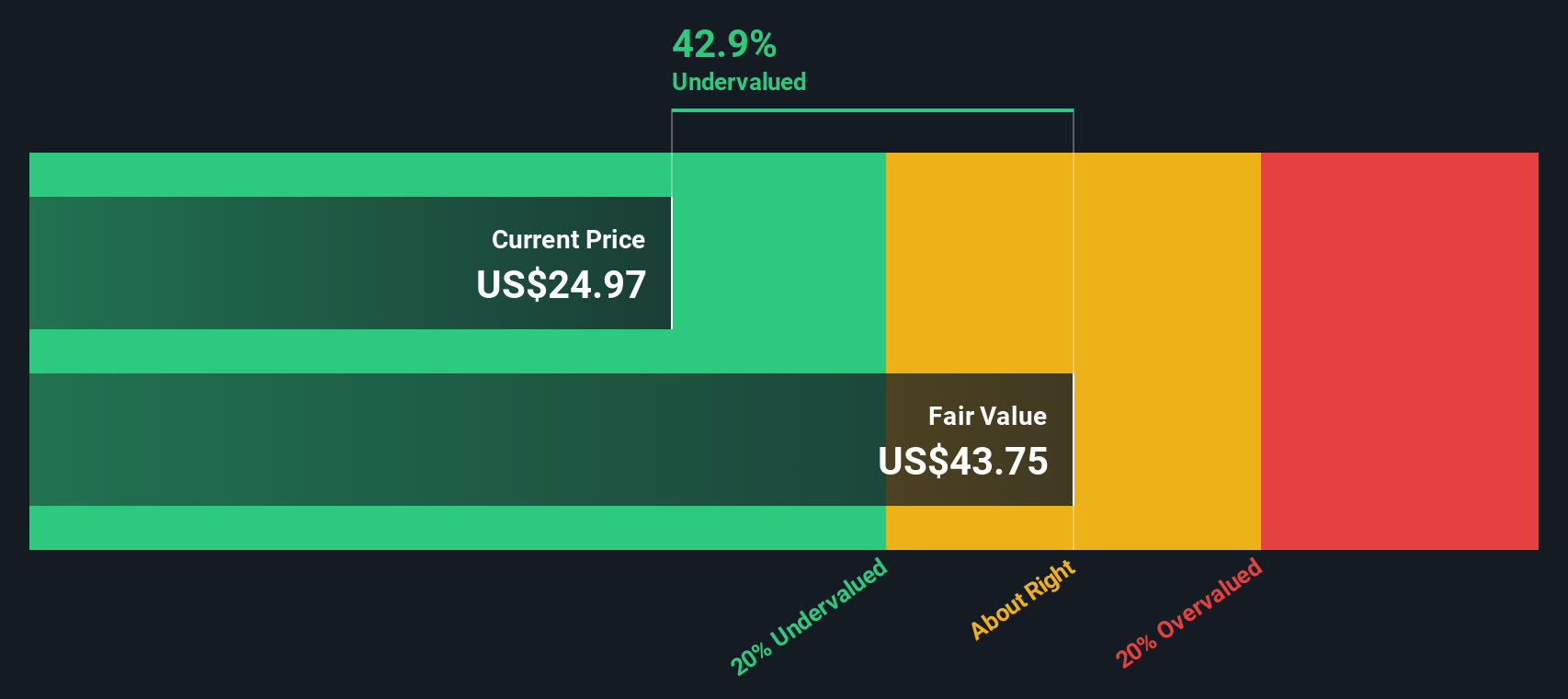

Taking another approach, our DCF model also evaluates Element Solutions as undervalued. This model weighs future cash flows rather than focusing on profit multiples. Does this method give you more conviction, or more questions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Element Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Element Solutions Narrative

If you see things differently, or want your own angle on the numbers, you can craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your Element Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Stock Opportunities?

Don’t let the best picks pass you by; elevate your watchlist with ideas tailored for forward-thinking investors. Act now to spot potential market leaders before everyone else does.

- Uncover hidden value and secure your edge with companies screened for attractive cash flow pricing by checking out our undervalued stocks based on cash flows.

- Supercharge your portfolio with pioneering forces in artificial intelligence. See which innovative businesses our AI penny stocks highlights today.

- Strengthen your income potential by targeting shares with robust and reliable payouts using our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Element Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESI

Element Solutions

Operates as a specialty chemicals company in the United States, China, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives