- United States

- /

- Chemicals

- /

- NYSE:EMN

We Ran A Stock Scan For Earnings Growth And Eastman Chemical (NYSE:EMN) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Eastman Chemical (NYSE:EMN). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Eastman Chemical with the means to add long-term value to shareholders.

Check out our latest analysis for Eastman Chemical

How Quickly Is Eastman Chemical Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Eastman Chemical's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 47%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

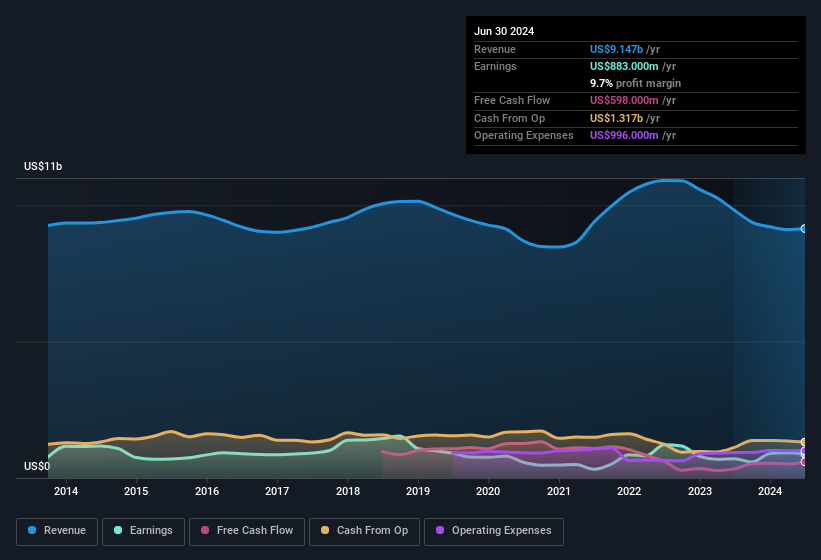

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While Eastman Chemical may have maintained EBIT margins over the last year, revenue has fallen. While this may raise concerns, investors should investigate the reasoning behind this.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Eastman Chemical's future profits.

Are Eastman Chemical Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$11b company like Eastman Chemical. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Given insiders own a significant chunk of shares, currently valued at US$75m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Should You Add Eastman Chemical To Your Watchlist?

Eastman Chemical's earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, Eastman Chemical is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Still, you should learn about the 2 warning signs we've spotted with Eastman Chemical.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Eastman Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EMN

Eastman Chemical

Operates as a specialty materials company in the United States, China, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives