- United States

- /

- Chemicals

- /

- NYSE:EMN

Eastman Chemical (EMN): How Index Removal and a New Green Initiative Are Shaping Valuation

Reviewed by Kshitija Bhandaru

Eastman Chemical (EMN) was just dropped from the FTSE All-World Index, a move that tends to get the attention of investors and institutions alike. At the same time, the company is making headlines in a much different way, teaming up with Toly to launch Gemini, a luxury beauty compact featuring Eastman’s recycled PET material. These contrasting developments are reshaping the narrative around Eastman, raising fresh questions about how market participants are viewing the company’s risk and long-term growth profile.

Looking at the bigger picture, Eastman Chemical’s share price performance over the past year has been underwhelming, down nearly 38%. Momentum has steadily faded in recent months even as the company invests in major recycling capacity and rolls out new sustainable products. While the removal from a major index is never going to help near-term sentiment, milestones like the Gemini launch and progress in recycling technology are signaling that the story is not just about today’s numbers, but also about how the company is positioning itself for tomorrow.

So after a year marked by share price declines and big strategic pivots, does Eastman Chemical offer an undervalued entry point, or is everything already reflected in the current price?

Most Popular Narrative: 15.7% Undervalued

According to the most widely followed narrative, Eastman Chemical is presently trading below what analysts see as its fair value, with the stock estimated to be undervalued by nearly 16% based on future earnings expectations and risk assumptions specific to the sector.

"Implementation of cost reduction initiatives ($75M-$100M in ongoing savings), strategic asset optimization (such as the ethylene to propylene project), and disciplined portfolio management is likely to lead to improving net margins and higher ROIC. This is especially relevant as end-market demand recovers and utilization rates normalize."

Want to know what powers this bold valuation? The narrative hinges on margin growth, expanding recycling programs and ambitious projections for both revenue and profits over the next several years. Curious what assumptions underpin the path to a higher price target? Explore the underlying financial forecasts and see what analysts believe could set this stock apart.

Result: Fair Value of $76.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing trade tensions and weaker-than-expected demand in key markets could quickly undermine these optimistic forecasts for Eastman Chemical.

Find out about the key risks to this Eastman Chemical narrative.Another View: Discounted Cash Flow Perspective

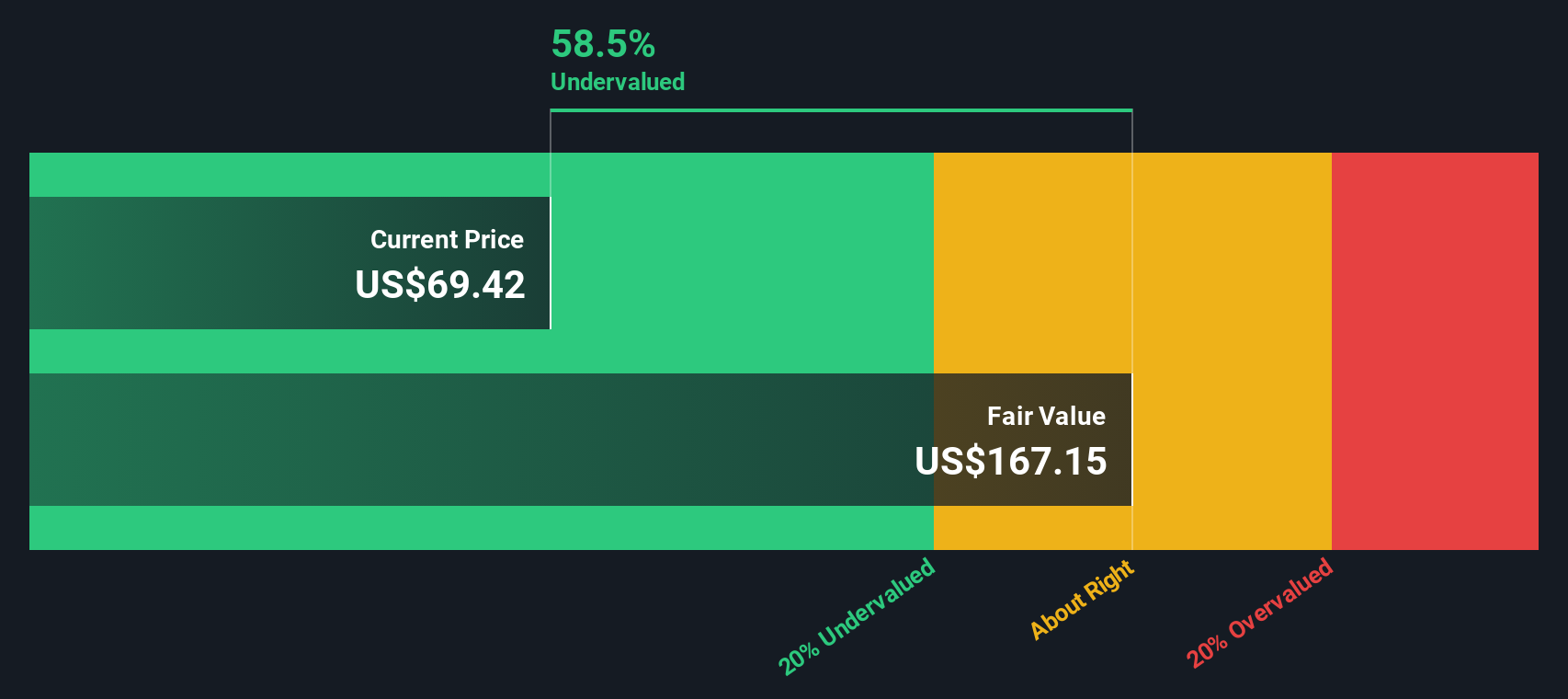

Our SWS DCF model offers a different perspective. Based on projected future cash flows, this approach suggests Eastman Chemical may be significantly undervalued when considering long-term fundamentals instead of current market sentiment. Could the market be overlooking something important?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Eastman Chemical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Eastman Chemical Narrative

If you'd rather challenge these perspectives or want to dig into the numbers on your own terms, you can shape your own view in just a few minutes. Do it your way.

A great starting point for your Eastman Chemical research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't stick to a single playbook when powerful opportunities are within reach. Explore these unique investment picks and get one step ahead of the crowd today:

- Tap into game-changing technology by reviewing AI penny stocks in artificial intelligence. Innovation in this field is fueling tomorrow’s leaders and reshaping entire sectors.

- Reimagine your income strategy by checking out high-yield choices with dividend stocks with yields > 3% that offer consistent returns in a volatile market.

- Expand your portfolio’s potential by spotting fresh value with undervalued stocks based on cash flows. These options are designed for those ready to seize overlooked bargains before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastman Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMN

Eastman Chemical

Operates as a specialty materials company in the United States, China, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives