- United States

- /

- Chemicals

- /

- NYSE:EMN

Does FTSE Index Exit and S&P Outlook Shift Challenge Eastman Chemical’s (EMN) Recovery Story?

Reviewed by Sasha Jovanovic

- Eastman Chemical was recently removed from the FTSE All-World Index and received a Negative outlook from S&P Global Ratings, highlighting trade and demand challenges for the company.

- While index exclusion can prompt near-term shifts in liquidity and ownership, Eastman continues to prioritize innovation in sustainable materials to support long-term growth.

- We’ll examine how this change in S&P’s outlook may alter Eastman’s investment narrative and prospects for recovery.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Eastman Chemical Investment Narrative Recap

To be a shareholder in Eastman Chemical, you’re likely betting on the company’s ability to drive long-term growth through innovation in sustainable materials, even as it faces current headwinds. The recent FTSE All-World Index exclusion and S&P’s Negative outlook may influence near-term ownership and share price volatility, but these changes don’t materially alter the most important short-term catalyst: recovering demand in key end markets. Persistent uncertainty around global trade flows and soft customer demand remains the biggest risk to Eastman’s business model.

Among recent company announcements, Eastman’s Gemini packaging launch with Toly, featuring high recycled content and strong sustainability credentials, stands out. This move underscores Eastman’s emphasis on high-value product innovation that could support margin resilience, especially as the company navigates external shocks and near-term demand volatility.

But in contrast to the focus on innovation, there are key trade and demand risks that investors should not overlook…

Read the full narrative on Eastman Chemical (it's free!)

Eastman Chemical's outlook anticipates $9.6 billion in revenue and $904.5 million in earnings by 2028. This scenario assumes a 1.0% annual revenue decline, with earnings growing by $72.5 million from the current $832.0 million.

Uncover how Eastman Chemical's forecasts yield a $76.35 fair value, a 19% upside to its current price.

Exploring Other Perspectives

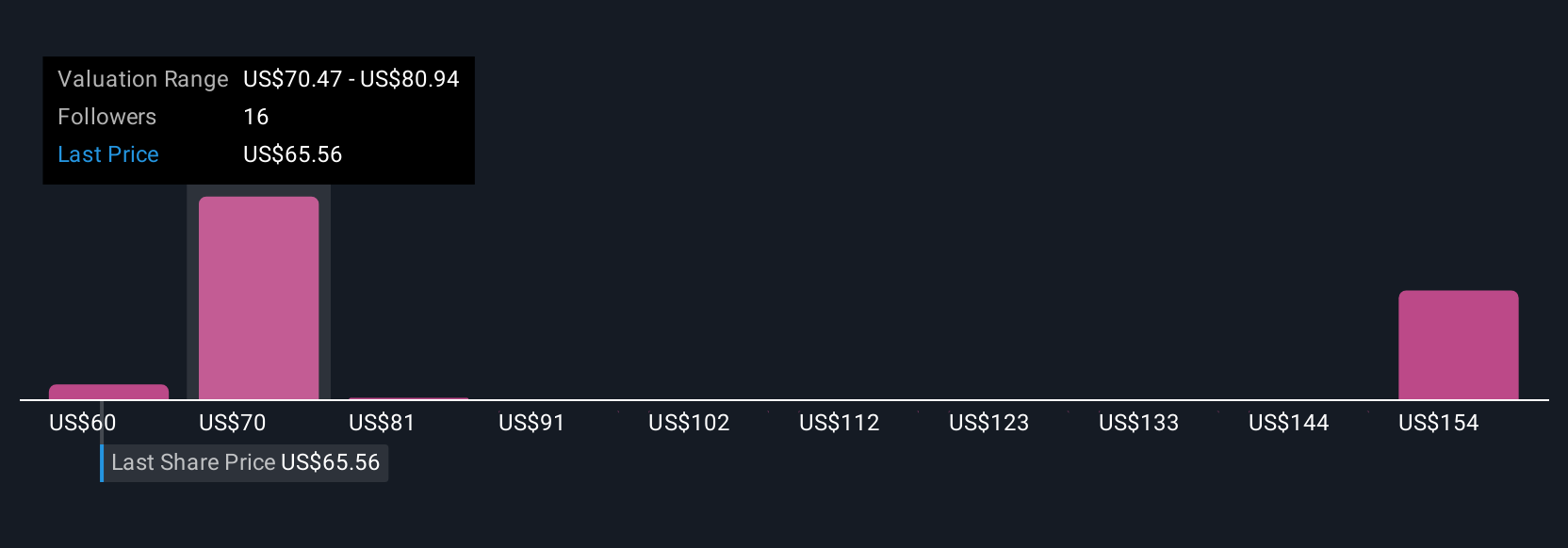

The Simply Wall St Community generated nine fair value estimates for Eastman Chemical, spanning from US$46.21 to US$161.50 per share. As you weigh these diverse views, keep in mind that continuing uncertainty in end-market demand and trade conditions could influence both the company’s trajectory and future shareholder outlook, so it pays to review several perspectives.

Explore 9 other fair value estimates on Eastman Chemical - why the stock might be worth over 2x more than the current price!

Build Your Own Eastman Chemical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eastman Chemical research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eastman Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eastman Chemical's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastman Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EMN

Eastman Chemical

Operates as a specialty materials company in the United States, China, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives