- United States

- /

- Chemicals

- /

- NYSE:ECVT

We Ran A Stock Scan For Earnings Growth And Ecovyst (NYSE:ECVT) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Ecovyst (NYSE:ECVT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Ecovyst with the means to add long-term value to shareholders.

Check out our latest analysis for Ecovyst

Ecovyst's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. We can see that in the last three years Ecovyst grew its EPS by 6.1% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

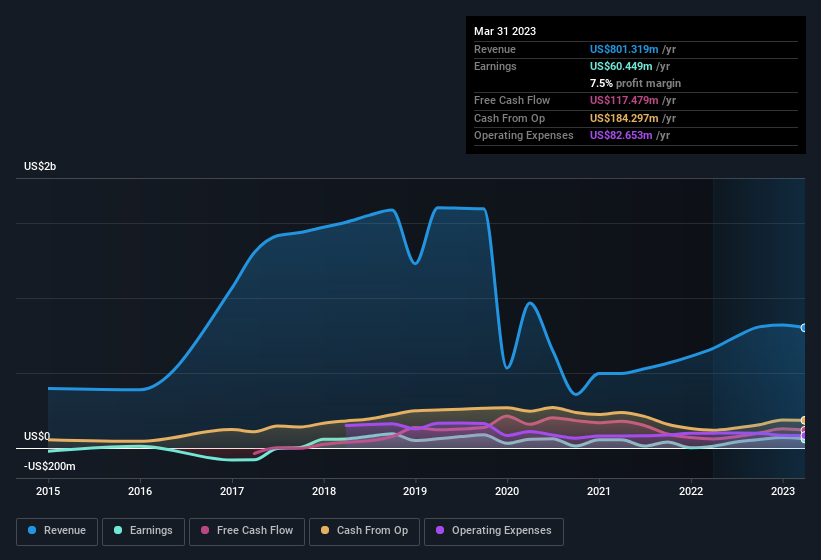

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Ecovyst shareholders can take confidence from the fact that EBIT margins are up from 12% to 14%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Ecovyst's future EPS 100% free.

Are Ecovyst Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that Ecovyst insiders spent a whopping US$1.8m on stock in just one year, without so much as a single sale. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. We also note that it was the Independent Director, Jonny Ginns, who made the biggest single acquisition, paying US$367k for shares at about US$9.09 each.

On top of the insider buying, it's good to see that Ecovyst insiders have a valuable investment in the business. Indeed, they hold US$41m worth of its stock. This considerable investment should help drive long-term value in the business. Despite being just 3.3% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Kurt Bitting is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Ecovyst, with market caps between US$1.0b and US$3.2b, is around US$5.2m.

Ecovyst offered total compensation worth US$4.4m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Ecovyst To Your Watchlist?

As previously touched on, Ecovyst is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Before you take the next step you should know about the 1 warning sign for Ecovyst that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Ecovyst isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Ecovyst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ECVT

Ecovyst

Offers specialty catalysts and services in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026