- United States

- /

- Chemicals

- /

- NYSE:ECL

Does Ecolab’s Strong 2025 Run and Sustainability Push Leave Much Upside Ahead?

Reviewed by Bailey Pemberton

- Wondering if Ecolab is still worth buying after its strong run, or if the upside has already been priced in? Here is a closer look at what the current share price might really be telling you.

- The stock has pulled back about 3.9% over the last week after a steady 2.7% gain over the past month, but it is still up 14.5% year to date and about 84.6% over three years, which keeps it firmly on growth investors radars.

- Recent headlines have focused on Ecolab expanding its water treatment and hygiene solutions to support industrial customers push for stricter sustainability and efficiency. They have also highlighted its role in helping large facilities reduce water usage and chemical waste. This kind of steady, mission critical demand helps explain why markets have generally been comfortable rewarding the stock with a premium over time, even when short term sentiment wobbles.

- Despite that, Ecolab currently scores just 0/6 on our valuation checks, which means it does not screen as undervalued on any of the standard metrics we track. Next we will unpack what different valuation approaches say about the stock, and then finish with a more nuanced way to think about its true worth beyond the usual ratios.

Ecolab scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ecolab Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to their present value.

For Ecolab, the model uses a 2 stage Free Cash Flow to Equity approach, built on last twelve months free cash flow of about $1.71 billion. Analyst forecasts are available for the next few years, with free cash flow expected to reach roughly $2.46 billion by 2027. Simply Wall St then extrapolates this trajectory out to 2035, with projected free cash flow rising to just over $4.02 billion.

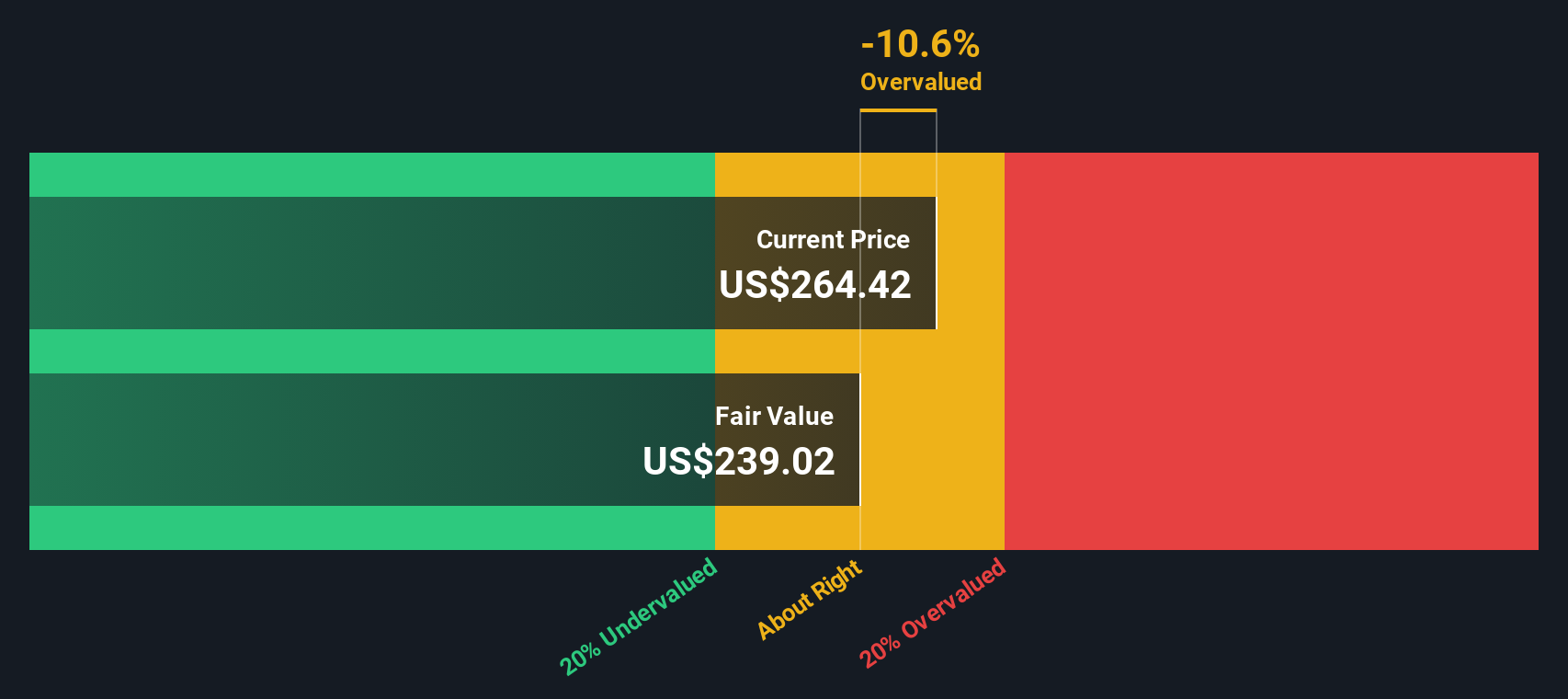

When all those future cash flows are discounted back, the DCF model arrives at an estimated intrinsic value of about $239.41 per share. Compared with the current share price, this implies Ecolab is roughly 10.4% overvalued, suggesting the market is already pricing in a robust growth path.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ecolab may be overvalued by 10.4%. Discover 916 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Ecolab Price vs Earnings

For a mature, profitable business like Ecolab, the price to earnings, or PE, ratio is a useful way to judge whether investors are paying a reasonable price for each dollar of current profit. In general, faster growth and lower risk justify a higher PE ratio, while slower growth or higher uncertainty tend to pull a normal or fair PE down.

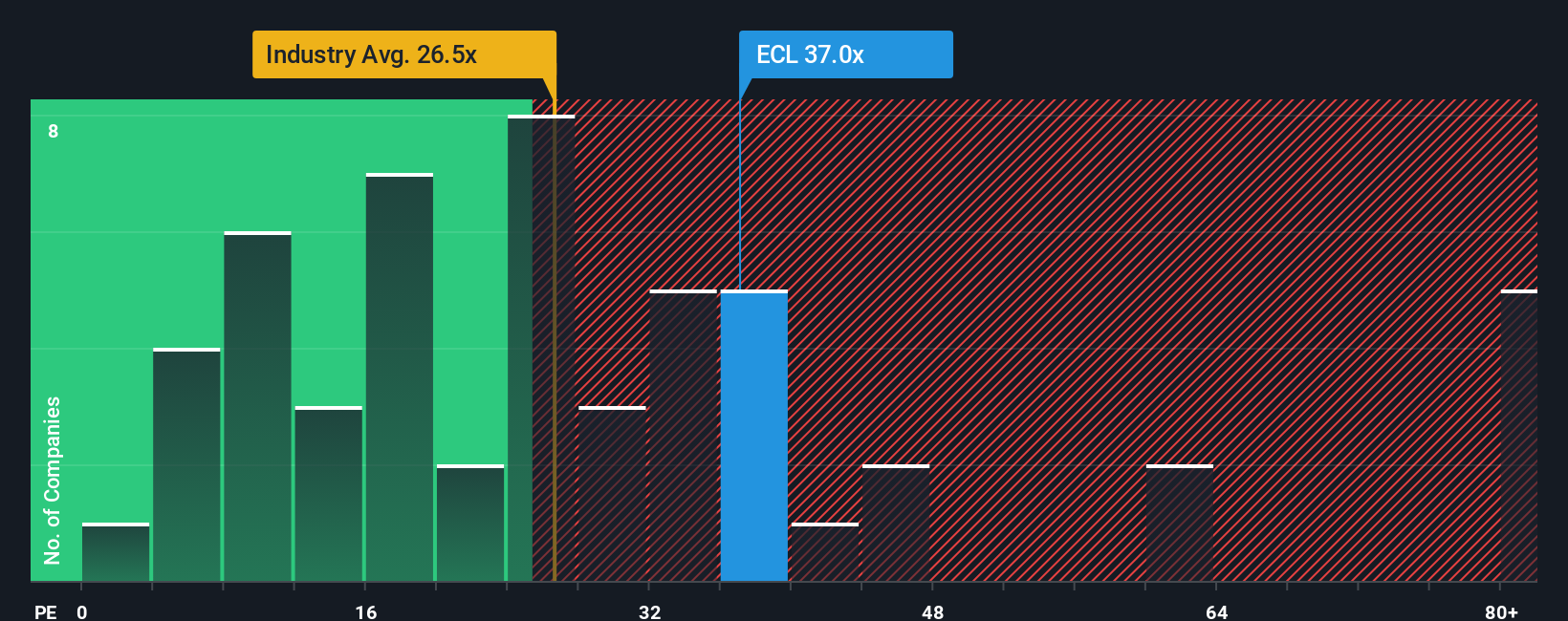

Ecolab currently trades on a PE of about 37.7x, well above the broader Chemicals industry average of roughly 23.0x and also higher than the average of its listed peers at around 23.3x. To go a step further than these simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what PE you would expect for Ecolab given its specific earnings growth outlook, profitability, industry, market cap and risk profile.

Because the Fair Ratio of 25.4x incorporates these company level drivers, it is a more tailored benchmark than a blunt industry or peer average. With the market currently valuing Ecolab at 37.7x earnings, meaningfully above this Fair Ratio, the stock screens as expensive on an earnings multiple basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

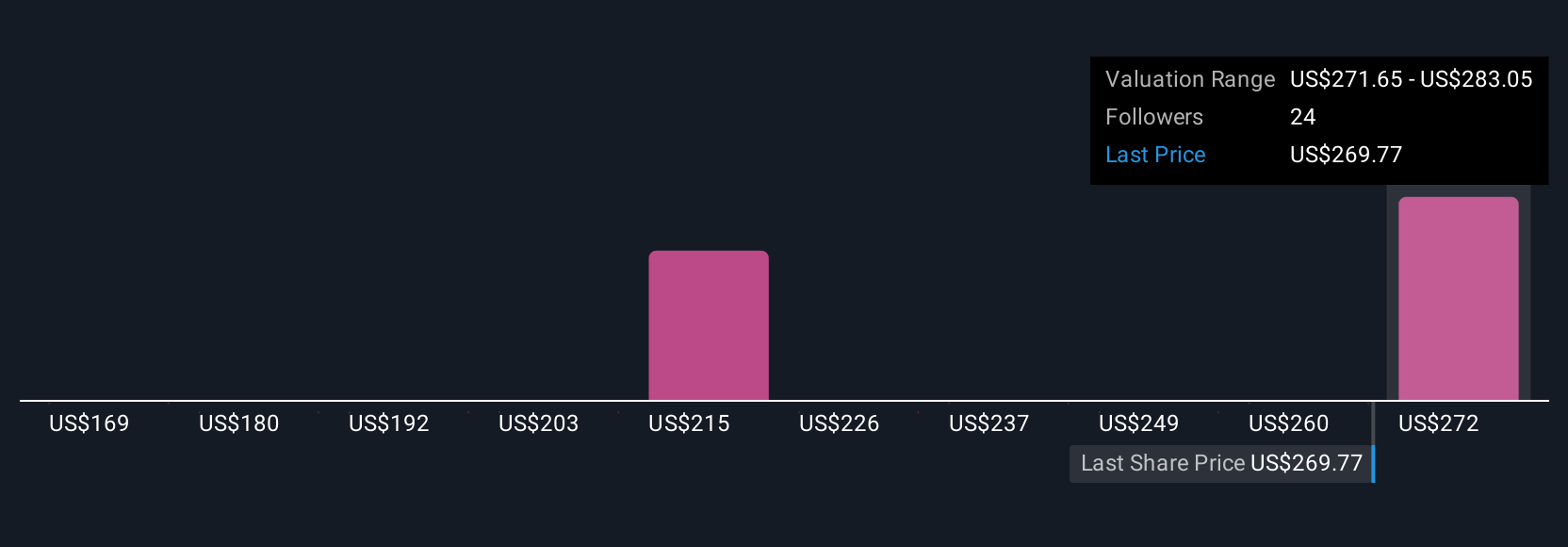

Upgrade Your Decision Making: Choose your Ecolab Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, an approach that lets you connect your view of Ecolab's story with a concrete forecast and a fair value number. A Narrative is simply your own investment story, where you spell out what you think will happen to Ecolab’s revenue, earnings and margins, and then see what fair value those assumptions imply. On Simply Wall St, Narratives are built into the Community page, making it easy for millions of investors to turn their qualitative views into numbers they can compare with the current share price to decide whether to buy, hold or sell. Narratives update dynamically as new news, earnings or guidance comes in, so your fair value can evolve with the facts instead of staying fixed. For Ecolab, for example, a bullish investor might build a Narrative around continued margin expansion and assign a fair value near the high analyst target of $325, while a more cautious investor, worried about tariffs and weaker demand, might lean closer to the low target of $243, and both perspectives can be tracked and refined over time.

Do you think there's more to the story for Ecolab? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026