- United States

- /

- Communications

- /

- NasdaqGS:AUDC

Undiscovered Gems in the US Market July 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it boasts a 14% increase over the past year with anticipated earnings growth of 15% per annum in the coming years. In this environment, identifying stocks with strong fundamentals and growth potential can be crucial for investors seeking to capitalize on these promising conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Parke Bancorp (PKBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Parke Bancorp, Inc. is the bank holding company for Parke Bank, offering personal and business financial services to individuals and small to mid-sized businesses, with a market cap of $254.04 million.

Operations: Parke Bancorp generates revenue primarily through its community banking segment, amounting to $66.88 million.

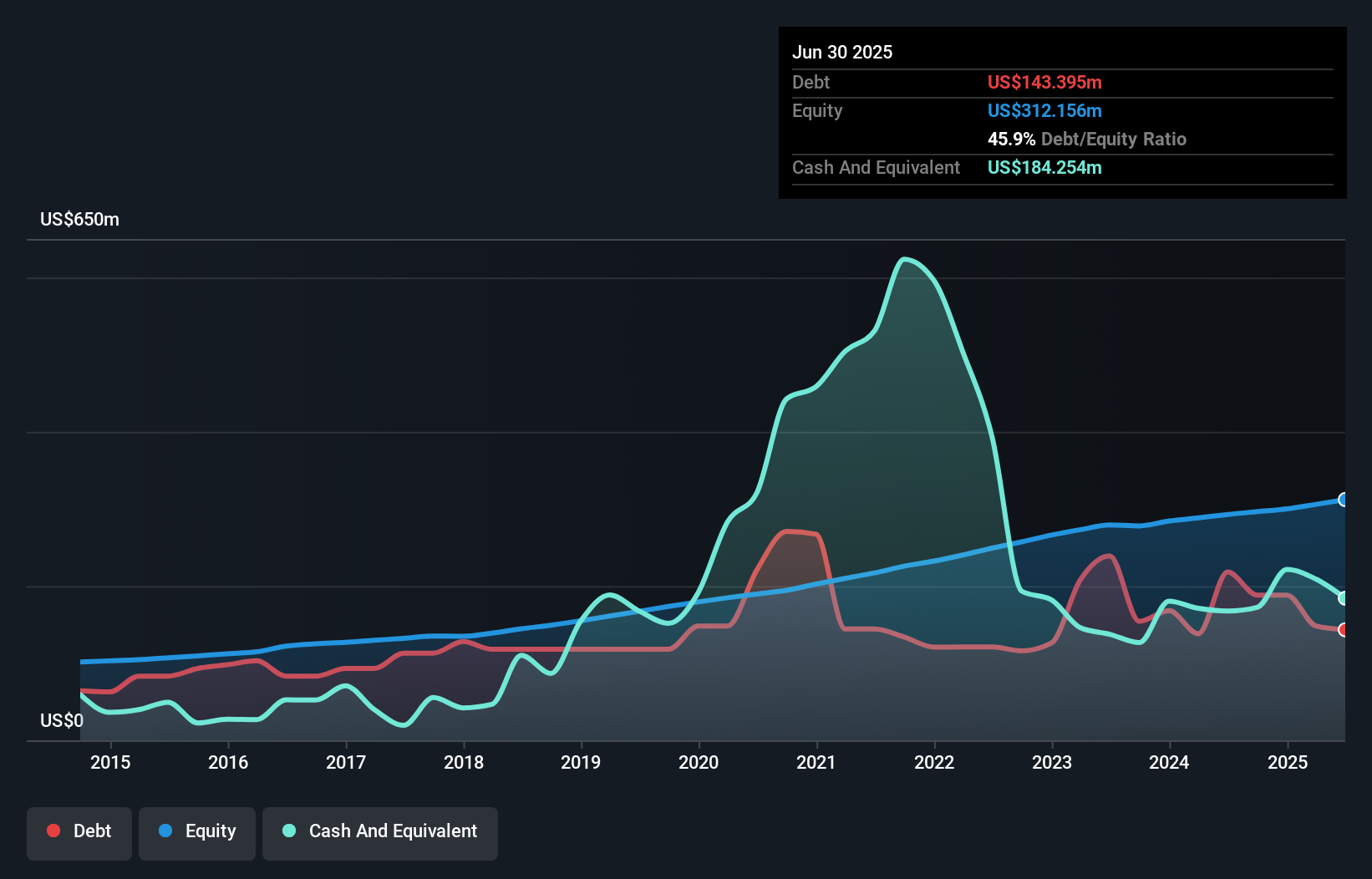

Parke Bancorp, with assets totaling US$2.2 billion and equity of US$312.2 million, operates primarily on low-risk funding sources, with 91% of liabilities stemming from customer deposits. The bank's net interest margin sits at 3%, and it maintains a robust allowance for bad loans at 0.6% of total loans, ensuring financial stability. In recent performance highlights, earnings grew by an impressive 42.1% over the past year despite a five-year annual decline of 3.6%. Trading significantly below its estimated fair value by nearly 58%, Parke Bancorp seems attractively priced for potential investors seeking growth opportunities in the banking sector.

- Click to explore a detailed breakdown of our findings in Parke Bancorp's health report.

Gain insights into Parke Bancorp's past trends and performance with our Past report.

AudioCodes (AUDC)

Simply Wall St Value Rating: ★★★★★★

Overview: AudioCodes Ltd. is a company that offers advanced communications software, products, and productivity solutions for the digital workplace globally, with a market capitalization of approximately $265.85 million.

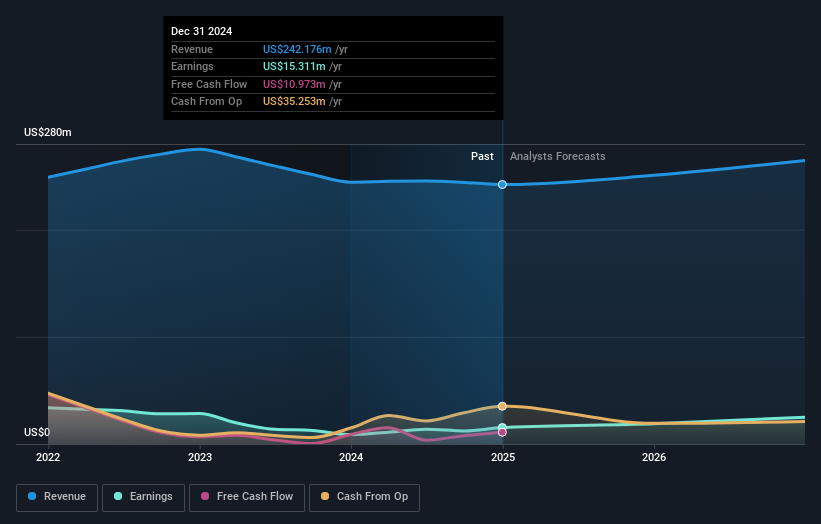

Operations: Revenue from AudioCodes primarily stems from its communications equipment segment, amounting to $242.47 million.

AudioCodes is carving a niche in the communications industry, leveraging AI and strategic partnerships to boost its market presence. With no debt on its books, it has significantly improved from a 3.1% debt-to-equity ratio five years ago. The company's earnings surged by 56% last year, outpacing the industry's 39%. Despite this growth, analysts foresee a challenging future with potential earnings declining by an average of 38% annually over the next three years. AudioCodes recently repurchased shares worth $5.2 million in early 2025 and continues to trade at nearly half its estimated fair value of $10.75 per share, indicating potential undervaluation amidst evolving market dynamics.

DRDGOLD (DRD)

Simply Wall St Value Rating: ★★★★★☆

Overview: DRDGOLD Limited is a South African gold mining company focused on extracting gold from the retreatment of surface mine tailings, with a market capitalization of $1.18 billion.

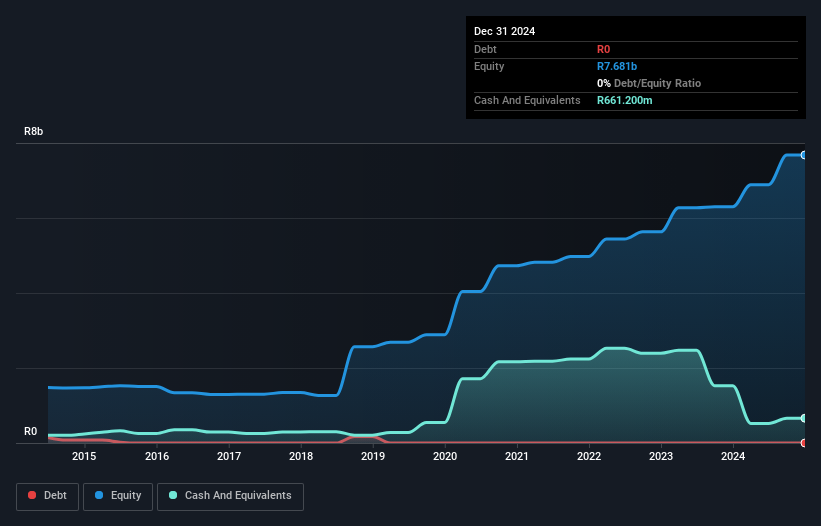

Operations: DRDGOLD generates revenue primarily from two segments: Ergo, contributing ZAR 5.05 billion, and Far West Gold Recoveries (FWGR), adding ZAR 2.02 billion.

DRDGold, a prominent player in the mining sector, stands out with its debt-free status and impressive earnings growth of 28% over the past year. The company’s valuation is appealing, trading at 84.1% below estimated fair value. Despite challenges such as lower tonnages due to wet weather affecting production yield to 0.181 g/t, DRDGold remains resilient with high-quality non-cash earnings. The recent appointment of Ms Henriette Hooijer as CFO Designate signals a strategic shift towards Vision 2028, aiming for sustained growth and operational efficiency amidst an industry grappling with a -13.4% decline in earnings growth.

- Take a closer look at DRDGOLD's potential here in our health report.

Examine DRDGOLD's past performance report to understand how it has performed in the past.

Next Steps

- Dive into all 279 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUDC

AudioCodes

Provides advanced communications software, products, and productivity solutions for the digital workplace worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives