- United States

- /

- Metals and Mining

- /

- NYSE:DRD

DRDGOLD (NYSE:DRD): Assessing Valuation After Recent Share Price Surge

Reviewed by Kshitija Bhandaru

DRDGOLD (NYSE:DRD) stock continues to draw attention as investors gauge its performance over recent months. Its share price is up 39% over the past month and 123% over the past 3 months, standing out among mining peers.

See our latest analysis for DRDGOLD.

The surge in DRDGOLD’s share price has caught the market’s attention, especially given its rally over the past year. With momentum clearly building, a year-to-date share price return of 230.71% and a 1-year total shareholder return of 209.27% highlight just how dramatic the shift in sentiment has been for this gold miner. In both the near and long term, DRDGOLD’s stock has delivered outsized results. This reflects renewed optimism around its growth prospects and changing risk perceptions.

If you’re curious what other fast-moving companies are gaining ground, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

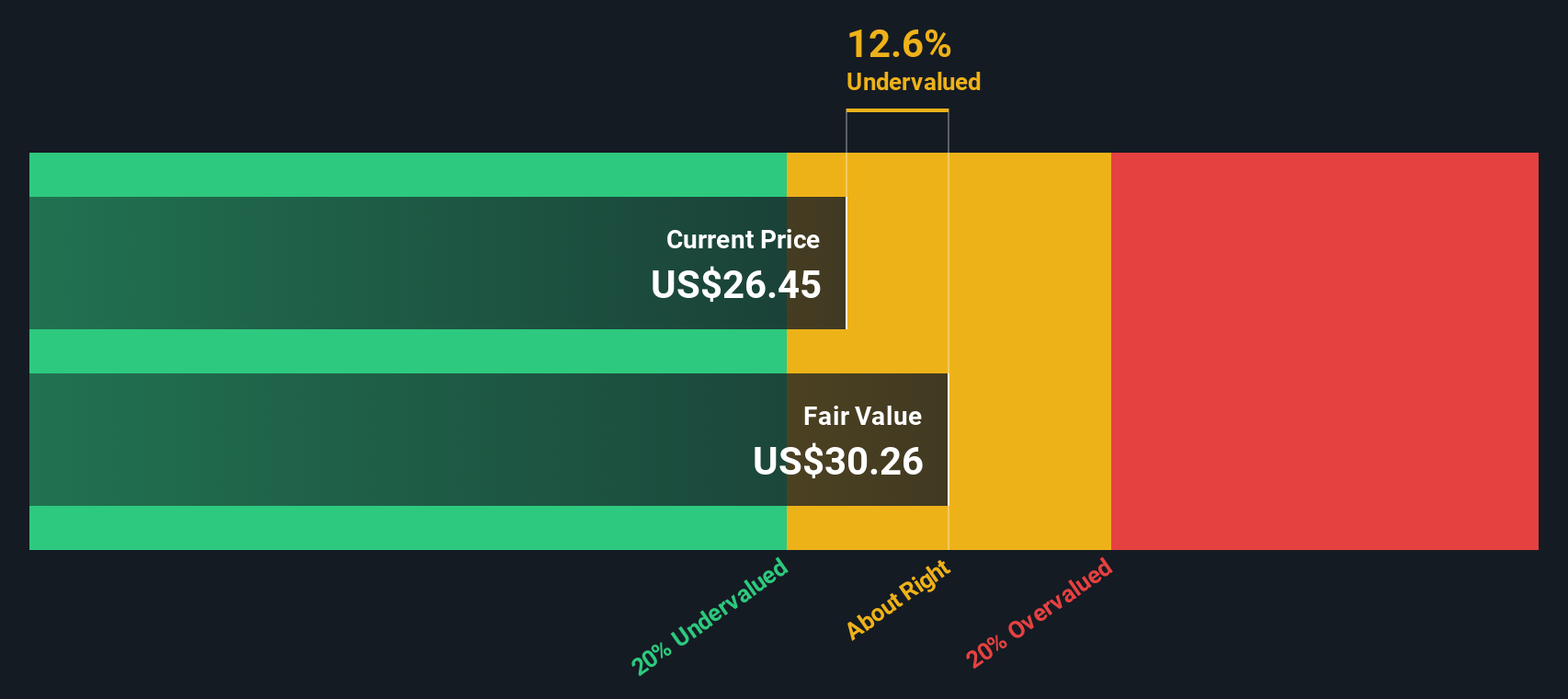

With such explosive gains in recent months, investors are now questioning DRDGOLD’s true value. Could there still be room for upside, or has the market already priced in every bit of its future growth potential?

Price-to-Earnings of 19.7x: Is it justified?

At a price-to-earnings ratio of 19.7x, DRDGOLD trades well below its sector average and that of its closest peers. This suggests it may be undervalued relative to them.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay today for each dollar of earnings the company generates. For a gold mining company like DRDGOLD, the P/E ratio reflects both current profitability and the market's outlook for future earnings under variable commodity price cycles.

With DRDGOLD’s P/E significantly below the industry average of 23.5x and even further below the peer average of 33.4x, the market appears to be discounting its growth potential or pricing in more risk than competitors. If DRDGOLD continues to outperform in earnings growth, investors could potentially re-rate the stock closer to these sector norms over time.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 19.7x (UNDERVALUED)

However, risks remain if gold prices soften or if DRDGOLD’s revenue growth slows. These factors could quickly reverse recent positive momentum.

Find out about the key risks to this DRDGOLD narrative.

Another View: Discounted Cash Flow Perspective

While the price-to-earnings ratio suggests DRDGOLD could be undervalued compared to sector peers, our DCF model presents an even more striking picture. The SWS DCF model estimates DRDGOLD’s fair value at $63.52 per share, which is more than double its recent trading price. This highlights a potentially significant value gap for investors.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DRDGOLD for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own DRDGOLD Narrative

If you want to dig deeper into DRDGOLD’s story or draw your own conclusions, it only takes a few minutes to build a personal perspective. Do it your way

A great starting point for your DRDGOLD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Your next smart move could be just one click away. Uncover high-potential opportunities and fresh portfolio ideas tailored for today’s market innovators.

- Tap into cutting-edge breakthroughs and advancements in medicine by checking out these 32 healthcare AI stocks which is making waves across the healthcare industry.

- Start building income potential for your portfolio with these 19 dividend stocks with yields > 3%, a screener that consistently offers yields above 3%.

- Seize early opportunities with these 3572 penny stocks with strong financials that show real financial strength and set the stage for remarkable growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRD

DRDGOLD

A gold mining company, engages in the extraction of gold from the retreatment of surface mine tailings in South Africa.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives