- United States

- /

- Chemicals

- /

- NYSE:DOW

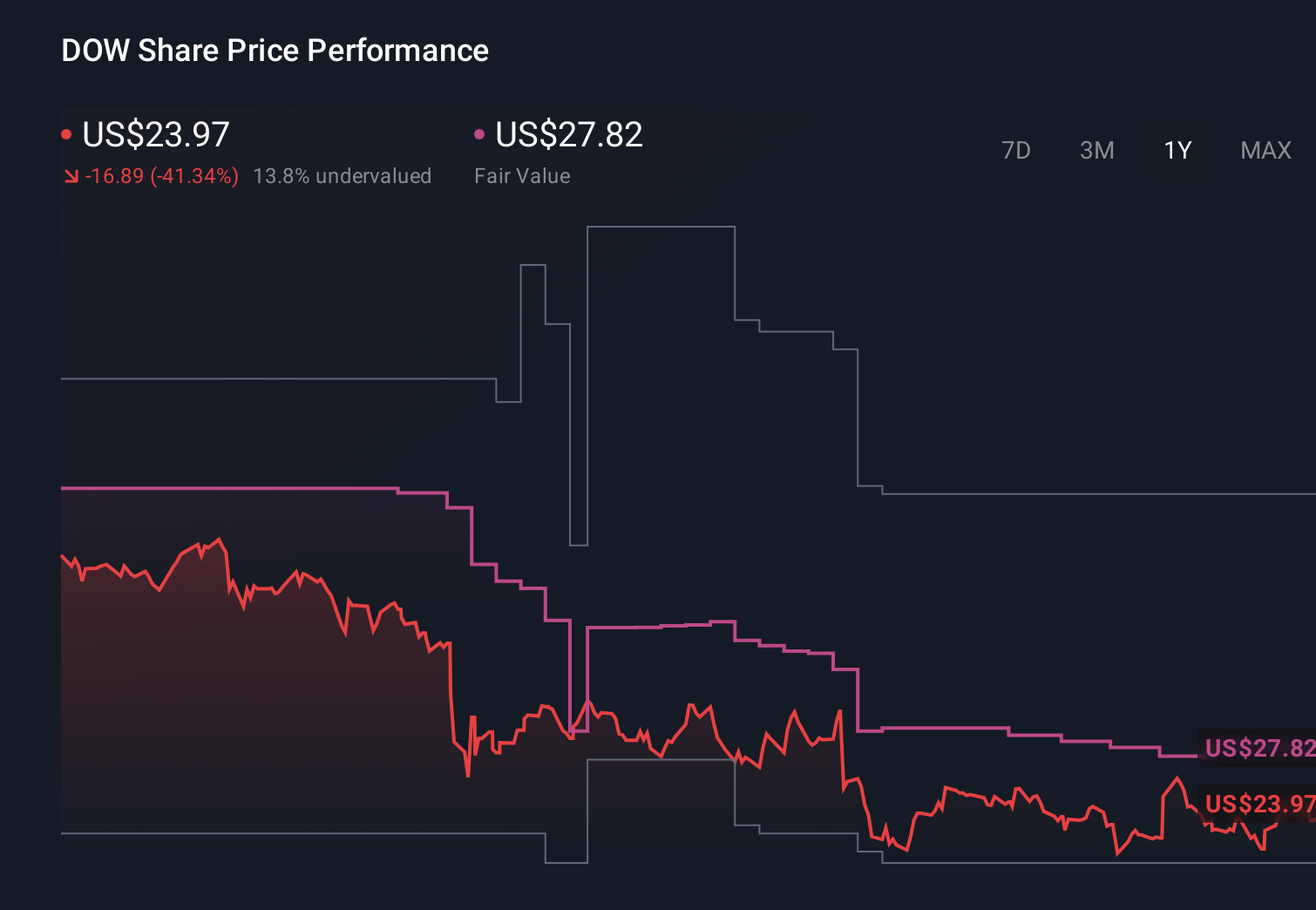

Does Dow’s (DOW) Share Buyback Strategy Justify Its Shift From Profit to Loss?

- Dow Inc. has reported past fourth-quarter 2025 sales of US$9,460 million, down from US$10,405 million a year earlier, and moved from a small prior-year loss to a much larger net loss of US$1,543 million, while completing a share repurchase of 38,539,462 shares for US$2,069.24 million under its April 2022 program.

- For full-year 2025, Dow’s sales fell to US$39.97 billion from US$42.96 billion and it shifted from prior-year net income of US$1,116 million to a net loss of US$2,623 million, highlighting a sharp reversal in profitability despite returning capital through buybacks.

- We’ll now examine how Dow’s swing from annual profit to loss, alongside completed share repurchases, shapes the company’s investment narrative.

Find 52 companies with promising cash flow potential yet trading below their fair value.

What Is Dow's Investment Narrative?

To own Dow today, you have to be comfortable with a chemicals leader that is currently unprofitable but still returning cash through dividends and a completed US$2,069.24 million buyback program. The latest results, with full-year 2025 swinging from a US$1,116 million profit to a US$2,623 million loss on softer sales, sharpen the focus on near term earnings recovery and cash generation as the key catalysts. The completed repurchases modestly tighten the share base but do little to offset the immediate earnings hit or concerns that the 2025 dividend cut signals more cautious capital allocation. With the share price having rallied strongly in recent months, the new information around deeper losses makes execution risk on any profit recovery plan more front and center than before.

However, one risk in particular stands out as something investors should not overlook. Dow's shares have been on the rise but are still potentially undervalued by 40%. Find out what it's worth.Exploring Other Perspectives

Explore 9 other fair value estimates on Dow - why the stock might be worth 31% less than the current price!

Build Your Own Dow Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dow research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dow's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The future of work is here. Discover the 29 top robotics and automation stocks leading the charge in AI-driven automation and industrial transformation.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- We've uncovered the 14 dividend fortresses yielding 5%+ that don't just survive market storms, but thrive in them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOW

Dow

Through its subsidiaries, provides various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion