- United States

- /

- Chemicals

- /

- NYSE:CTVA

Corteva (NYSE:CTVA) Q1 Earnings Rise With US$652 Million Net Income

Reviewed by Simply Wall St

Corteva (NYSE:CTVA) recently reported strong earnings for the first quarter of 2025, showcasing a net income increase to $652 million from $419 million in the previous year, alongside EPS growth from $0.53 to $0.97. This solid financial performance and reaffirmation of positive corporate guidance amidst a broader positive market sentiment likely contributed to Corteva's share price rise of 12% over the past month. The company's moves were reinforced by the U.S. reaching a trade agreement with the U.K., which boosted market confidence, potentially adding weight to Corteva's overall positive return during this period.

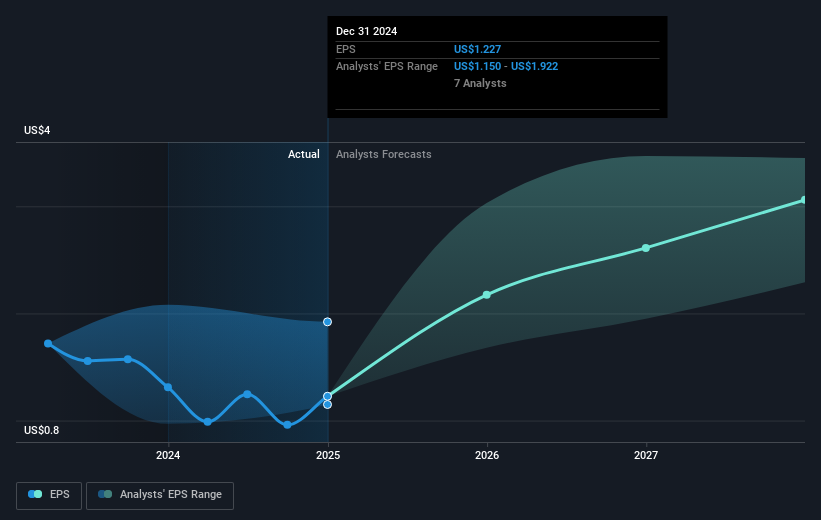

Corteva's recent financial results, reflecting a net income increase to US$652 million and EPS growth, have further solidified its growth trajectory. The positive shift in share price by 12% can be primarily associated with these earnings, alongside the supportive market sentiment boosted by the U.S.-U.K. trade agreement. This news provides additional optimism for Corteva's focus on launching new seed hybrids and expanding market presence in Brazil. Analysts' growth expectations could see incremental improvements in future revenue and earnings, pointing toward potential growth beyond the US$18.4 billion revenue and US$2.3 billion earnings they forecast by 2028.

Over a five-year period, Corteva's total shareholder return, including share price movements and dividends, was 185.66%, showcasing significant long-term gains. In comparison, over the past year, Corteva outperformed the US Market's 7.2% return and the US Chemicals industry, which saw a decline of 10.4%. Despite recent challenges, this highlights the company's capacity to sustain growth over extended periods.

The current share price standing at US$62.45 remains approximately 9.7% below the consensus analyst price target of US$69.12. This valuation leaves room for potential appreciation if Corteva achieves its projected earnings and revenue targets. The reaffirmation of corporate guidance and robust market positioning further instills confidence in its medium-term forecast, although attention must be given to potential risks like currency fluctuations and competitive pricing pressures. This sets a promising albeit watchful outlook for investors.

Gain insights into Corteva's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Corteva, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives