- United States

- /

- Metals and Mining

- /

- NYSE:CSTM

A Fresh Look at Constellium (NYSE:CSTM) Valuation After a 50% Year-to-Date Gain

Reviewed by Kshitija Bhandaru

Constellium (NYSE:CSTM) has seen steady gains this year, up 50% year to date. This has caught the attention of investors focused on long-term returns. With solid revenue growth and improving net income, the stock’s trajectory is worth a closer look.

See our latest analysis for Constellium.

Constellium’s strong year-to-date share price return of 50% stands out, especially as recent months have brought a steady uptrend with improving revenue and net income. Short- and long-term total shareholder returns remain healthy, which signals that positive momentum is building around the stock’s growth outlook and valuation story.

If Constellium’s surge has you looking for more potential winners, this could be the perfect time to expand your search and discover fast growing stocks with high insider ownership

But with such a strong run already, is Constellium still undervalued with room to run? Or have investors already priced in most of the future growth? Is there still a buying opportunity here?

Most Popular Narrative: 15.7% Undervalued

With Constellium closing at $15.44, the latest widely followed narrative sets a higher fair value, suggesting more potential upside than the current price reflects. The methodology builds on optimistic revenue and margin projections, while also factoring in a specific discount rate tied to analyst consensus.

Ongoing operational improvements, particularly at the Muscle Shoals facility, along with robust cost controls under the Vision 25 program, are improving manufacturing efficiencies and reducing input costs. These changes should enhance gross and net margins over time. Positive effects from trade tariffs and regionalization trends are making Constellium's domestically produced products more competitive in the U.S. and protecting market share, potentially boosting contracted volumes and strengthening revenue stability.

Curious what’s driving this bullish price target? The underlying logic hinges on a dramatic shift in margins and a projected earnings surge. One set of bold assumptions could be the catalyst for a valuation shock. If you want to see which future estimates are fueling the highest conviction in years, you’ll want to explore the full narrative for all the surprising details.

Result: Fair Value of $18.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent demand weakness in key end markets or rising European input costs could challenge Constellium’s growth story if conditions worsen unexpectedly.

Find out about the key risks to this Constellium narrative.

Another View: What Do Earnings Ratios Say?

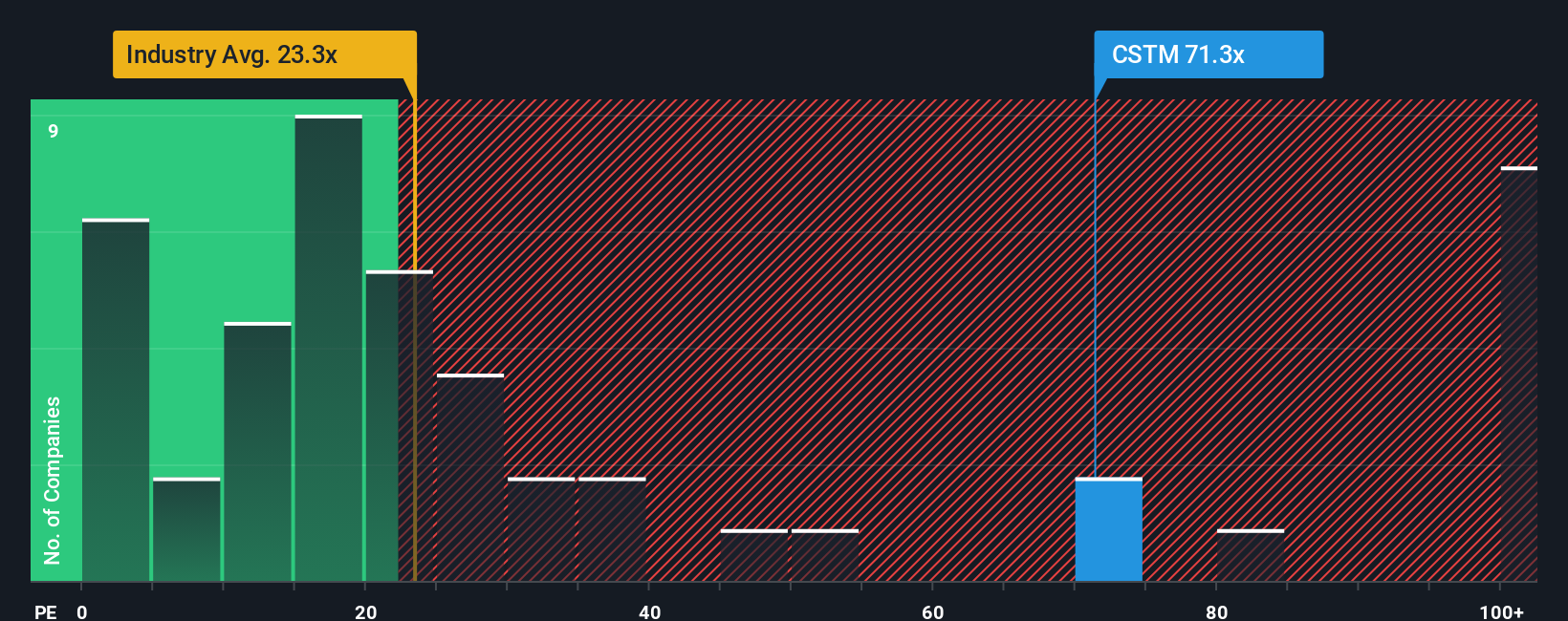

Looking at where the market is pricing Constellium right now, its price-to-earnings ratio stands at 67.3x, which is much higher than the US Metals and Mining industry average of 24.6x and the peer average of 53.9x. The fair ratio, based on market patterns, sits closer to 47.8x. When a stock is trading above these benchmarks, it could indicate extra optimism or increased valuation risk. Could this be a sign that investors are getting ahead of themselves, or is there justification for the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Constellium Narrative

If you see things differently or want to dig into the numbers on your own terms, you can build your own story in just a few minutes with Do it your way.

A great starting point for your Constellium research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next big winner slip through your fingers. Take advantage of fresh opportunities by tapping into unique lists focused on tomorrow’s top stocks.

- Unlock the upside of untapped markets and spot value potential with these 896 undervalued stocks based on cash flows, which are primed for future growth.

- Accelerate your portfolio’s tech edge and move ahead of the curve by evaluating these 24 AI penny stocks, which are transforming entire industries.

- Capture steady income streams while benefiting from market resilience by checking out these 19 dividend stocks with yields > 3%, which offer attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CSTM

Constellium

Engages in the design, manufacture, and sale of rolled and extruded aluminum products for the aerospace, packaging, automotive, commercial transportation, general industrial, and defense end-markets.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives