- United States

- /

- Basic Materials

- /

- NYSE:CRH

Does CRH’s (CRH) Growth and Margin Ambition Signal a New Era for Its Investment Story?

Reviewed by Sasha Jovanovic

- CRH recently unveiled ambitious medium-term financial targets at its Capital Markets Day, including average annual revenue growth of 7% to 9% and plans to boost adjusted EBITDA margins to between 22% and 24% by 2030, alongside the completion of its US$2.1 billion acquisition of Eco Material Technologies.

- The company's focus on sustainable construction materials and increased presence in the North American market has significantly expanded its investor base and operational outlook in recent years.

- We'll assess how CRH's new medium-term growth and margin targets may influence its investment narrative and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

CRH Investment Narrative Recap

To be a shareholder in CRH right now is to believe in the company’s ability to tap into sustained US infrastructure spending and capitalize on demand for sustainable construction materials, all while executing a fast-paced acquisition strategy. The recent unveiling of ambitious medium-term financial targets, alongside share price momentum, puts investor focus squarely on whether CRH can deliver consistent earnings and margin expansion amid integration of new assets and shifts in US infrastructure funding priorities, the most important current catalyst and risk, respectively. So far, the new guidance appears to reinforce rather than materially alter these short-term drivers.

Among the recent announcements, the completion of the US$2.1 billion Eco Material Technologies acquisition stands out as directly relevant to CRH’s strategic focus on sustainable construction and margin improvement. With this move, CRH significantly extends its reach in the fast-growing market for lower-carbon building materials, reinforcing the business case for continued growth even as execution and integration risks remain top of mind for investors.

In contrast, the political risk tied to US infrastructure funding remains something investors should be aware of, especially since ...

Read the full narrative on CRH (it's free!)

CRH's outlook anticipates $43.1 billion in revenue and $4.9 billion in earnings by 2028. This is based on a forecasted annual revenue growth rate of 5.9% and represents a $1.6 billion increase in earnings from the current $3.3 billion level.

Uncover how CRH's forecasts yield a $122.10 fair value, in line with its current price.

Exploring Other Perspectives

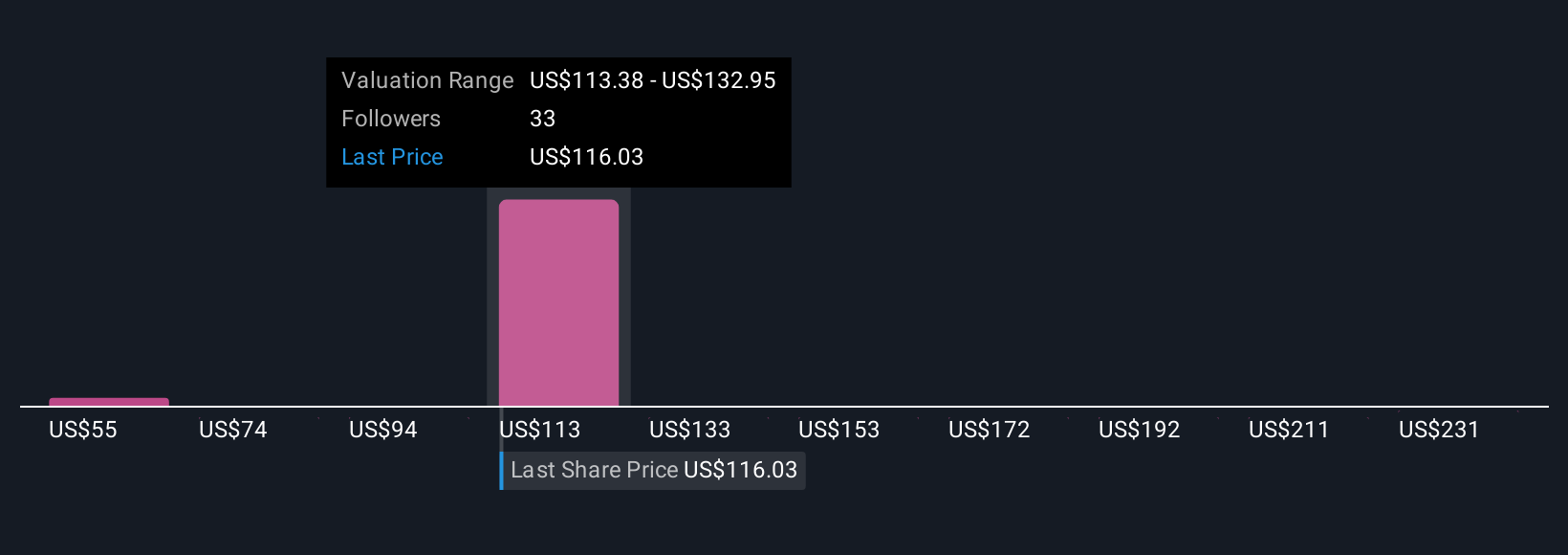

Fair value estimates for CRH from six Simply Wall St Community members range from US$54.67 to US$250.38 per share. While you consider these distinct viewpoints, keep in mind that heavy reliance on US public infrastructure funding could impact the outlook for continued revenue growth.

Explore 6 other fair value estimates on CRH - why the stock might be worth less than half the current price!

Build Your Own CRH Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CRH research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CRH research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CRH's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRH

CRH

Provides building materials solutions in Ireland, the United States, the United Kingdom, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives