- United States

- /

- Metals and Mining

- /

- NYSE:CMC

Is Now the Right Time to Reassess Commercial Metals After a 10.8% Share Price Surge?

Reviewed by Bailey Pemberton

- Wondering if Commercial Metals is trading at a bargain or riding high on investor optimism? You are not alone. The search for value is front of mind for many right now.

- In just the past week, shares have jumped 10.8%, adding to a strong year-to-date gain of 30.0% and an impressive 236.8% surge over the past five years.

- These jumps are set against an industry-wide spotlight, as recent news highlights the global demand for infrastructure projects boosting metals companies. Meanwhile, positive sentiment continues to swirl around steelmakers due to ongoing legislation and investment in U.S. manufacturing.

- Despite all this momentum, Commercial Metals scores only 1 out of 6 on our valuation checks, so there is more to dig into. We will look at different ways to measure value, but stick around. There is an even more insightful approach waiting for you at the end of this article.

Commercial Metals scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Commercial Metals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach is especially useful for understanding what the business could be worth based on its expected ability to generate cash in the future.

For Commercial Metals, the current Free Cash Flow (FCF) is $290.9 million. Analyst estimates suggest FCF will grow steadily, with projections reaching $540.1 million by 2028. Simply Wall St extrapolates these forecasts further out, with the model showing annual FCF rising to approximately $606.1 million by 2035. These projections are based on the 2 Stage Free Cash Flow to Equity model and reflect both analyst expectations and future trend estimates.

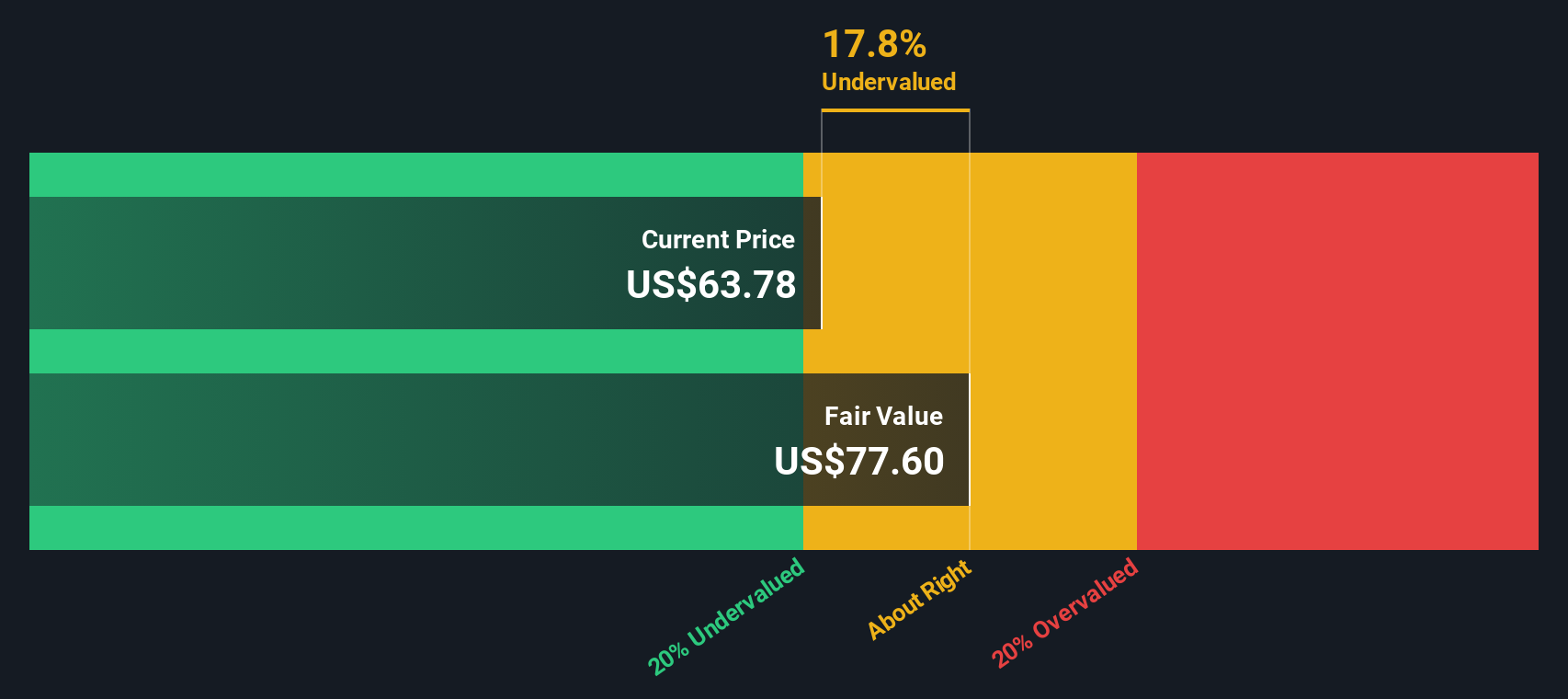

Bringing these figures together, the DCF model calculates an intrinsic value of $77.89 per share. This price suggests that Commercial Metals is trading at an 18.0% discount compared to its current market price.

This suggests that, by the numbers, the stock appears undervalued based on its expected future cash flow growth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Commercial Metals is undervalued by 18.0%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Commercial Metals Price vs Earnings

Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies, as it helps investors understand how much they are paying for each dollar of a company's earnings. A higher PE ratio can indicate that investors expect stronger growth ahead, but it might also reflect higher risk or over-optimism. Conversely, a lower PE ratio could signal undervaluation or concerns about a company’s future prospects.

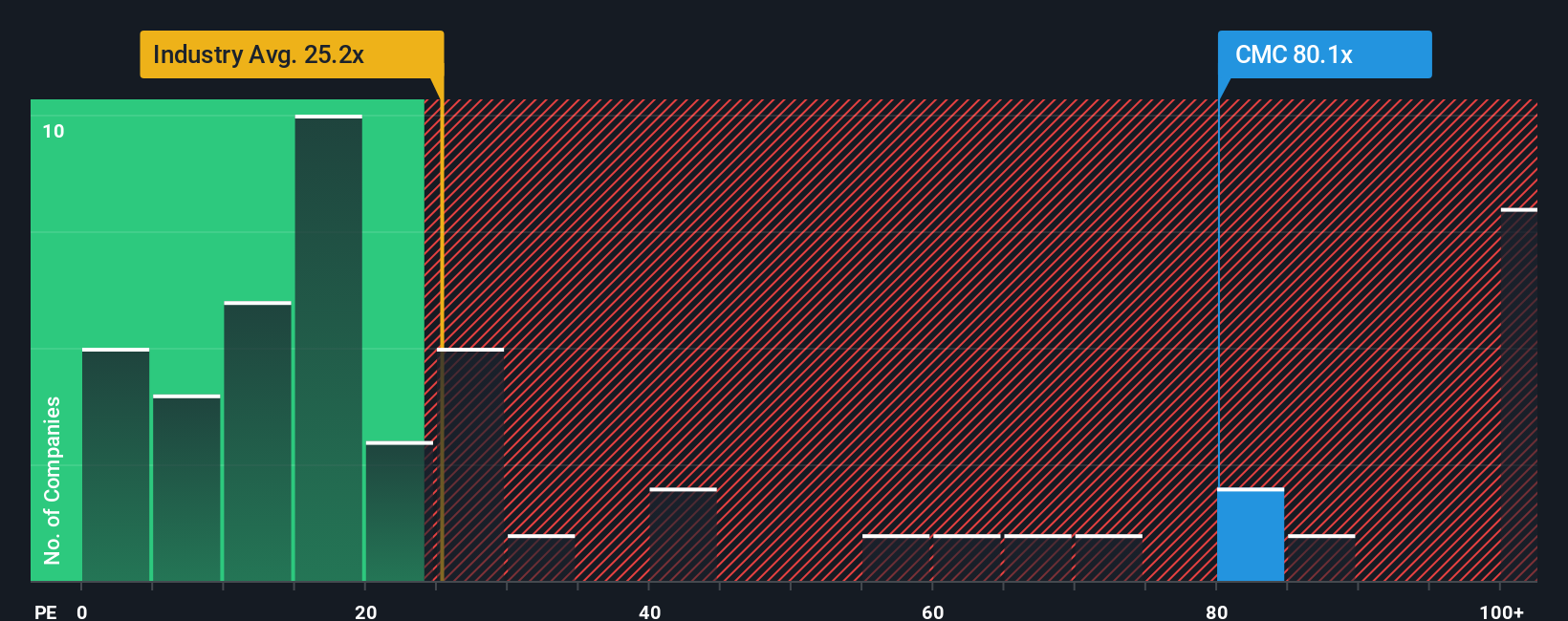

Commercial Metals currently trades at a PE ratio of 83.73x. This is significantly higher than the Metals and Mining industry average PE of 22.11x, and is also above the average PE of its peers at 45.31x. At face value, this premium suggests that investors are pricing in either robust growth or greater certainty of future earnings.

However, using Simply Wall St’s “Fair Ratio”, which holistically weighs factors like Commercial Metals’ expected earnings growth, industry dynamics, profit margins, market cap, and risk profile, the fair PE ratio for the stock is calculated to be 31.79x. This tailored benchmark provides a more nuanced valuation compared to simple industry or peer comparisons, since it is customized to the company’s specific situation.

Comparing Commercial Metals’ actual PE ratio of 83.73x to its fair ratio of 31.79x, the stock appears to be trading at a substantial premium, implying that it is currently overvalued based on these measures.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Commercial Metals Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story that connects the numbers you see, such as fair values, revenue forecasts, and profit margins, with your view of Commercial Metals' business outlook. Narratives let you link the company's story to your predictions for how its finances will develop, resulting in your own fair value estimate.

This approach is both accessible and dynamic, and is available to everyone on Simply Wall St’s Community page, already used by millions of investors. Narratives do more than just crunch numbers as they help you decide when to buy or sell by comparing your calculated Fair Value to the current market Price, and update automatically as new news or earnings data arrives.

For instance, some investors might believe that Commercial Metals’ recent expansion projects and sustained demand for infrastructure will drive margins above 10% and justify a bullish price target as high as $67.0. Others may worry about rising costs and global competition, leading them to a much more cautious target of $47.0. Narratives allow you to see and compare these different perspectives, so you can make truly informed decisions tailored to your own outlook.

Do you think there's more to the story for Commercial Metals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMC

Commercial Metals

Manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success