- United States

- /

- Metals and Mining

- /

- NYSE:CMC

Is Commercial Metals (CMC) Trading Below Fair Value? A Fresh Look at the Latest Valuation Narratives

Reviewed by Simply Wall St

Commercial Metals (CMC) shares have hovered in a tight range lately, catching the eye of investors who track the broader steel and materials sector. The company’s recent performance provides some interesting context for those considering exposure to cyclical industries.

See our latest analysis for Commercial Metals.

CMC’s share price momentum has been solid this year, with a 20% year-to-date gain reflecting improved optimism around construction demand and resilient earnings. However, the total shareholder return over the last twelve months was just 0.77%. Investors seem cautiously positive following steady quarterly results and ongoing sector tailwinds. Longer-term holders have enjoyed substantial compounding, as CMC’s five-year total return exceeds 200%.

If you’re interested in what else is gaining traction in the industrials and materials space, now’s the perfect time to see what’s possible with our fast growing stocks with high insider ownership.

But with a modest twelve-month return and shares trading about 13 percent below analyst targets, investors are left to decide whether CMC is trading at a discount or if the market has already accounted for its future growth.

Most Popular Narrative: 11.2% Undervalued

The most widely followed valuation narrative puts Commercial Metals’ fair value at $66.45, about 11% above the recent closing price of $58.98. This suggests the analyst consensus sees room for appreciation based on underlying growth catalysts and future earnings potential.

CMC's strategic initiatives, particularly the Transform, Advance, and Grow (TAG) program, are projected to generate an additional $25 million in benefits over the rest of fiscal 2025 and promise further enhancements in the coming years. These improvements are likely to permanently improve margins and increase earnings.

What bold financial assumptions justify this high fair value? The story hinges on how future profit margins and market positioning unlock surprising gains that few expect today. Discover which aggressive targets drive analysts’ optimism in the complete narrative!

Result: Fair Value of $66.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing interest rate shifts or a sudden slowdown in new construction awards could challenge Commercial Metals’ growth assumptions in the near term.

Find out about the key risks to this Commercial Metals narrative.

Another View: What Do Market Ratios Say?

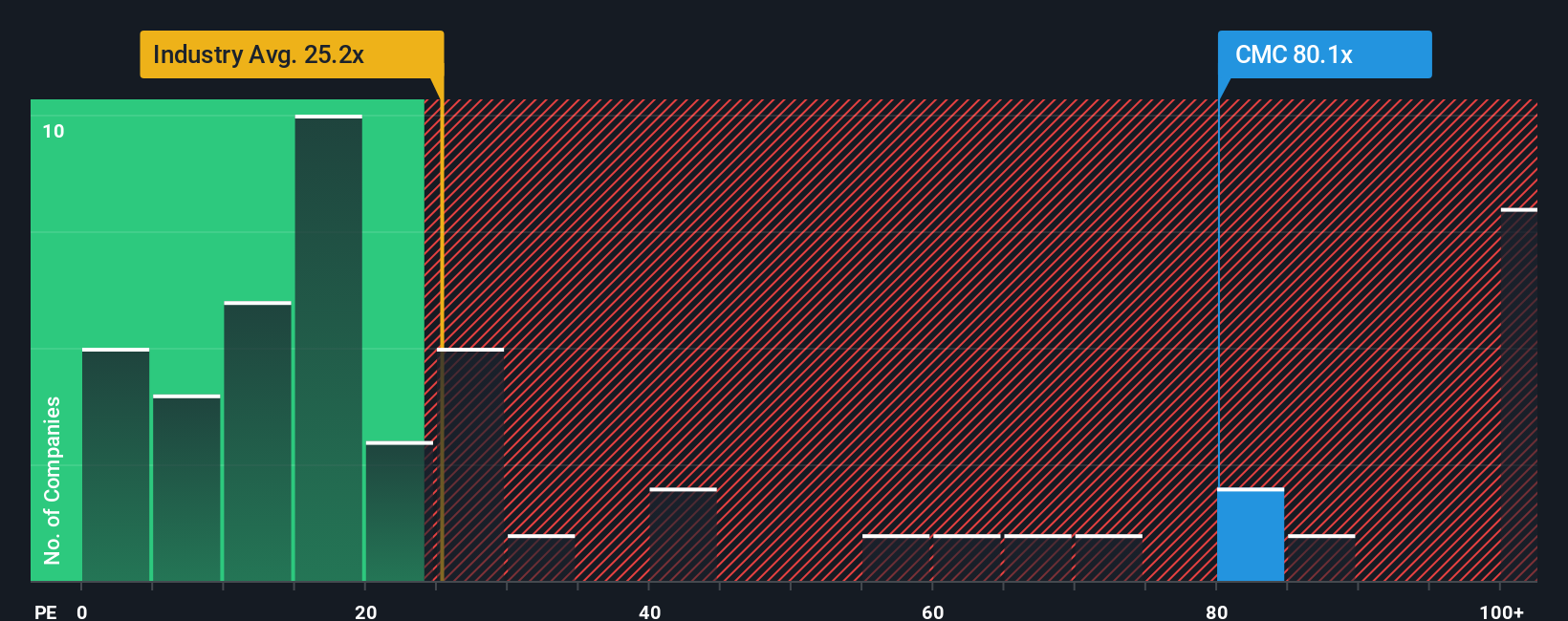

Looking at share price through the market's favored ratio, Commercial Metals trades at 77.3x earnings. This is dramatically higher than both the industry average of 23.7x and the peer average of 45.3x. Even compared to the fair ratio of 29.6x that the market could trend toward, CMC looks expensive. Could this premium signal untapped future growth, or is it a risk that investors might be overpaying for?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commercial Metals Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own Commercial Metals story in just a few minutes, your way. Do it your way.

A great starting point for your Commercial Metals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your opportunities? Get ahead of the crowd with actionable insights on standout stocks. Don’t miss out on these dynamic ways to expand your watchlist. See what’s moving right now.

- Snap up attractive yields and see which companies are delivering consistent income through these 16 dividend stocks with yields > 3%.

- Capitalize on the AI revolution by checking out these 25 AI penny stocks setting new standards in innovation and digital transformation.

- Unearth remarkable value by targeting these 879 undervalued stocks based on cash flows that could be positioned for strong upside based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMC

Commercial Metals

Manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives