- United States

- /

- Metals and Mining

- /

- NYSE:CMC

Commercial Metals (CMC): Assessing Valuation and Growth Narrative After Recent Share Price Gains

Reviewed by Simply Wall St

Commercial Metals (CMC) shares have been navigating a mixed patch, with recent price moves showing modest declines over the past week and month. However, there has been a gain of 6% in the past 3 months. Investors are weighing these changes against the company’s performance metrics and longer-term growth.

See our latest analysis for Commercial Metals.

Commercial Metals’ share price has gained momentum this year, posting a strong year-to-date share price return of nearly 17%. However, the 1-year total shareholder return is down about 5%, so while recent price appreciation hints at renewed optimism, longer-term holders are still awaiting a more sustained recovery.

If you're searching for your next opportunity, now is a great moment to broaden your sights and discover fast growing stocks with high insider ownership

With recent gains but a muted one-year return, the key question now is whether Commercial Metals is trading below its intrinsic value or if the current price already reflects future growth prospects for investors.

Most Popular Narrative: 13.6% Undervalued

With Commercial Metals closing at $57.44 and the most widely followed narrative suggesting a fair value of $66.45, sentiment points to meaningful upside. The market’s current stance sits close to analyst projections; however, the story behind this gap is anything but ordinary.

Significant expansion projects such as the Arizona 2 micro mill and the upcoming Steel West Virginia site are expected to boost production volumes and profitability starting late 2025 and beyond. This will directly impact revenue growth as new capacity comes online and improves earnings as economies of scale are achieved.

Curious how these big projects will turn into profit? The narrative hinges on rapid improvement in margins, futuristic earnings forecasts, and a shift toward industry-beating efficiency. The path to that higher fair value relies on bold assumptions about what Commercial Metals can deliver. But just what are those assumptions? Uncover the details and see exactly what underpins this valuation.

Result: Fair Value of $66.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic uncertainty and the risk of falling margins could still derail Commercial Metals' projected growth story in the coming years.

Find out about the key risks to this Commercial Metals narrative.

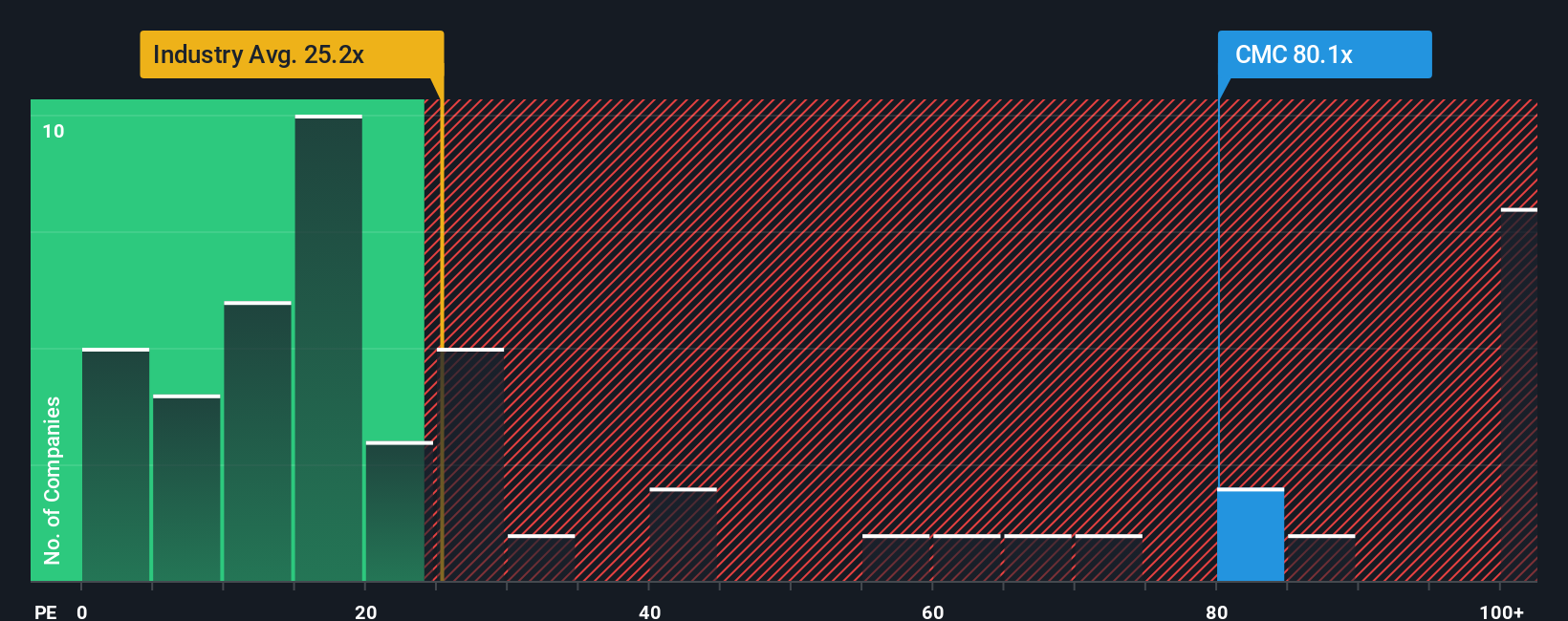

Another View: Looking Through the Multiples Lens

Not everyone agrees with the upside in the fair value estimate. Looking at the common market ratio, Commercial Metals trades at a price-to-earnings ratio of 75.3x, which is much higher than the US Metals and Mining industry average of 22.3x and its peers at 46.1x. The fair ratio, the level the market could move toward, is estimated at 28.6x. This significant gap puts valuation risk firmly on the radar for investors, even if growth picks up. When will the story play out? Will high multiples hold or is there a reset coming?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commercial Metals Narrative

If you see things differently or enjoy digging into the numbers yourself, you can craft your own perspective quickly and easily in just a few minutes. Do it your way

A great starting point for your Commercial Metals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their options open. Unlock new opportunities and stay ahead of the pack by checking potential winners you might otherwise overlook.

- Boost your portfolio's income potential and scan for high-yielding stocks with these 17 dividend stocks with yields > 3% to find solid returns and stable payouts.

- Capitalize on industry disruption and explore these 25 AI penny stocks that are driving advancements in automation, machine learning, and next-level intelligence.

- Catch the momentum in digital assets by spotting exciting prospects through these 82 cryptocurrency and blockchain stocks as blockchain and cryptocurrencies continue to reshape the financial landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMC

Commercial Metals

Manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives