- United States

- /

- Metals and Mining

- /

- NYSE:CMC

Commercial Metals (CMC): Assessing Valuation After Jefferies Downgrade Despite Strong Earnings and Insider Buying

Reviewed by Simply Wall St

Commercial Metals (CMC) shares slipped 3% after Jefferies downgraded the stock, citing concerns about valuation and reduced capital returns following recent acquisitions. This comes after positive earnings and notable insider buying activity.

See our latest analysis for Commercial Metals.

Despite the recent 3% slide after Jefferies' downgrade, Commercial Metals has had an impressive run this year, with year-to-date share price return of nearly 24% and a one-year total shareholder return of 19%. Strong earnings and insider buying point to a company with operational momentum, but after several acquisitions and a major buyback, some investors may be reassessing risk and value in the near term. Broadly, the long-term trend remains robust, with a five-year total shareholder return topping 200%. However, after this rally, momentum may be pausing as the market weighs new growth drivers against capital return shifts.

If you’re in the mood to explore beyond today’s headlines, now is the perfect time to broaden your investing radar and discover fast growing stocks with high insider ownership

With shares pulling back after a surge and analysts split on future returns, investors are left to decide whether Commercial Metals is now undervalued or if the market has already priced in its next stage of growth.

Most Popular Narrative: 5.2% Undervalued

Commercial Metals’ most-followed narrative puts its fair value at $64.20, slightly above the latest close of $60.87. This suggests some headroom for upside, but also reflects shifting assumptions in growth and industry dynamics since previous updates.

CMC's strategic initiatives, particularly the Transform, Advance, and Grow (TAG) program, are projected to generate an additional $25 million in benefits over the rest of fiscal 2025 and promise further enhancements in the coming years. These improvements are likely to permanently improve margins and increase earnings.

Curious why this narrative hints at a valuation above the current market price? The secret is a powerful combination of future profit margin growth, new capacity expansions, and big bets on structural change. Want to know what bold projections drive this call? You’ll have to dig deeper into the numbers that shape this surprisingly optimistic forecast.

Result: Fair Value of $64.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic uncertainty or unexpected construction slowdowns could quickly derail these optimistic growth projections for Commercial Metals.

Find out about the key risks to this Commercial Metals narrative.

Another View: What Do the Multiples Say?

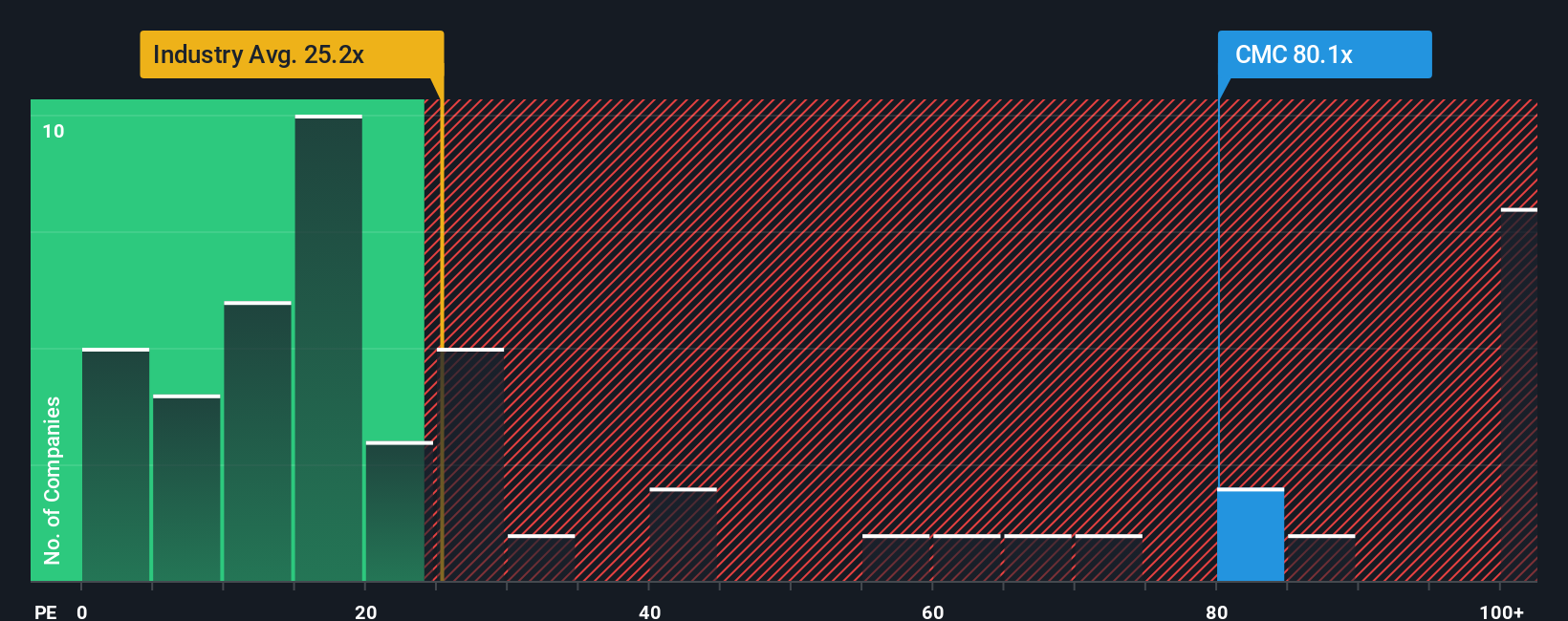

Looking at valuation from another angle, Commercial Metals trades at a price-to-earnings ratio of 79.8x, making it much more expensive than both its industry average of 24.3x and its peers at 31.9x. This is also well above the fair ratio of 33.8x, which suggests a premium investors are paying for future growth. Does this high valuation signal untapped promise, or does it raise the stakes if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commercial Metals Narrative

If you think there’s more to the story, or want to crunch the numbers and draw your own conclusions, you can build a tailored thesis in just a few minutes. Do it your way

A great starting point for your Commercial Metals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your research to just one company when you can target fresh opportunities? Boost your investing strategy and get ahead of the crowd with these stock ideas:

- Unlock potential in breakthrough medical technology by checking out these 33 healthcare AI stocks. This area is paving the way for smarter healthcare solutions and next-level innovations.

- Tap into reliable income streams by reviewing these 17 dividend stocks with yields > 3%, which offers attractive yields over 3 percent for income-focused portfolios.

- Ride the momentum of artificial intelligence with these 27 AI penny stocks. Here you will find game-changing companies making waves in automation and digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMC

Commercial Metals

Manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives