- United States

- /

- Metals and Mining

- /

- NYSE:CMC

A Fresh Look at Commercial Metals (CMC) Valuation Following Strong YTD Performance and Earnings Momentum

Reviewed by Simply Wall St

Commercial Metals (CMC) has caught the attention of many investors lately, particularly because of its performance this year and its steady revenue growth. The company’s recent earnings and consistent demand for steel products are in focus as the sector evolves.

See our latest analysis for Commercial Metals.

This year, Commercial Metals' stock has shown clear strength, with a year-to-date share price return of nearly 30 percent. This has helped build positive momentum around recent earnings and industry demand. Despite broader market ups and downs, the company’s 1-year total shareholder return sits a bit higher than breakeven. Its impressive 5-year total return of over 240 percent signals that patient investors have been well rewarded.

If you’re eager to see what else the market has to offer in the industrials and materials space, you can broaden your search and discover fast growing stocks with high insider ownership

With solid returns and ongoing growth in both revenue and net income, investors are left weighing whether the current price reflects all of Commercial Metals’ prospects or if there is still a true buying opportunity.

Most Popular Narrative: 6% Undervalued

The most followed narrative places Commercial Metals' fair value at $67.85, a modest premium over its last close at $63.78. This spread has caught attention as investors weigh the company’s recent buybacks and ongoing sector changes.

CMC's strategic initiatives, particularly the Transform, Advance, and Grow (TAG) program, are projected to generate an additional $25 million in benefits over the rest of fiscal 2025 and promise further enhancements in the coming years. These improvements are likely to permanently improve margins and increase earnings.

Curious what future scenarios analysts are betting on to back this value? The driving force here is a combination of cost leverage, long-term expansion bets, and a bold acceleration in profitability. Think there is a hidden lever behind the upgraded targets? Only a deep dive into the popular narrative reveals how these assumptions are stacked up.

Result: Fair Value of $67.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing legal battles and rising costs could challenge Commercial Metals’ growth outlook. These factors may potentially shift investor sentiment if not swiftly addressed.

Find out about the key risks to this Commercial Metals narrative.

Another View: What Do the Multiples Say?

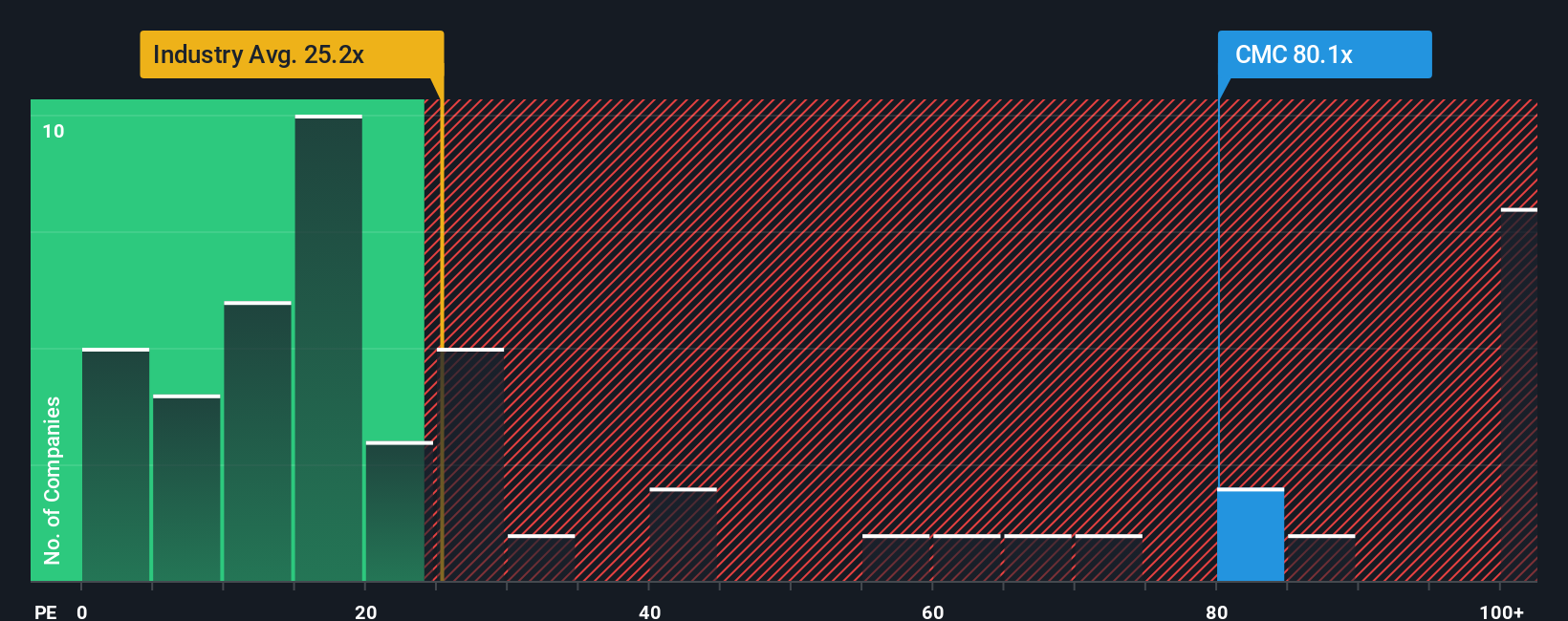

Looking at Commercial Metals through the lens of price-to-earnings, the stock appears pricey. Its current ratio stands at 83.6x, noticeably higher than both industry peers (45.1x) and the sector average (22.2x). With a fair ratio estimated at 31.3x, this premium points to a valuation risk that cannot be ignored. Are investors paying too much for future growth, or is something being missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Commercial Metals Narrative

If you want to dig deeper or reach your own conclusion, the tools are here. Craft your own view of Commercial Metals in just a few minutes with Do it your way.

A great starting point for your Commercial Metals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great investors know the best opportunities aren’t just found in one stock. Go beyond the obvious with these handpicked screens. They make it easy to uncover standouts you may have missed.

- Unlock consistent income potential by tracking these 15 dividend stocks with yields > 3% that routinely offer yields above 3 percent.

- Capture tomorrow’s tech trendsetters by analyzing these 25 AI penny stocks reshaping industries with breakthrough artificial intelligence solutions.

- Find value hiding in plain sight as you review these 913 undervalued stocks based on cash flows. Don’t let overlooked bargains slip through your fingers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CMC

Commercial Metals

Manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026