- United States

- /

- Paper and Forestry Products

- /

- NYSE:CLW

If EPS Growth Is Important To You, Clearwater Paper (NYSE:CLW) Presents An Opportunity

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Clearwater Paper (NYSE:CLW). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Clearwater Paper with the means to add long-term value to shareholders.

Our analysis indicates that CLW is potentially overvalued!

Clearwater Paper's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Clearwater Paper grew its EPS from US$0.26 to US$2.56, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company.

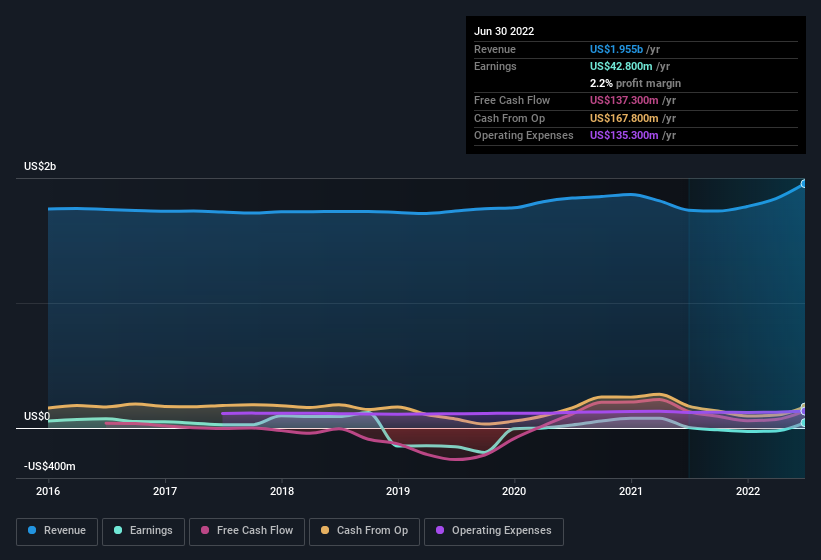

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Clearwater Paper remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 12% to US$2.0b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Clearwater Paper's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Clearwater Paper Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Clearwater Paper shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Michael Murphy, the Senior VP of Finance & CFO of the company, paid US$29k for shares at around US$28.66 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Recent insider purchases of Clearwater Paper stock is not the only way management has kept the interests of the general public shareholders in mind. Namely, Clearwater Paper has a very reasonable level of CEO pay. For companies with market capitalisations between US$400m and US$1.6b, like Clearwater Paper, the median CEO pay is around US$4.0m.

Clearwater Paper offered total compensation worth US$3.5m to its CEO in the year to December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Clearwater Paper To Your Watchlist?

Clearwater Paper's earnings per share have been soaring, with growth rates sky high. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Clearwater Paper may be at an inflection point. For those attracted to fast growth, we'd suggest this stock merits monitoring. We should say that we've discovered 3 warning signs for Clearwater Paper (1 is potentially serious!) that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, Clearwater Paper isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CLW

Clearwater Paper

Manufactures and supplies bleached paperboards in the United States and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives