- United States

- /

- Metals and Mining

- /

- NYSE:CLF

How Cleveland-Cliffs' Rare Earth Push and New Supply Deals Will Impact CLF Investors

Reviewed by Sasha Jovanovic

- Cleveland-Cliffs announced plans to explore rare earth mineral production at its Michigan and Minnesota mines and reported new multi-year supply contracts with major automotive manufacturers and the U.S. Department of Defense.

- This expansion aligns the company with U.S. efforts to strengthen supply chains for critical minerals and highlights Cleveland-Cliffs' potential role in national security and industrial supply.

- We'll examine how Cleveland-Cliffs' entry into rare earth mining could reshape its investment narrative and long-term industry positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Cleveland-Cliffs Investment Narrative Recap

To be a Cleveland-Cliffs shareholder today, you need confidence in the company's ability to capitalize on U.S. steel demand and protectionist policies as core drivers, while managing cost pressures from legacy operations. The recent news on rare earth minerals exploration and multi-year supply deals captures market attention but does not materially shift the immediate risk: Cliffs' ongoing reliance on steel tariffs remains the main short-term catalyst and risk to watch.

Among the latest announcements, Cleveland-Cliffs' multi-year contracts with major automotive manufacturers and the U.S. Department of Defense stand out. These agreements support revenue visibility and underline the company's strategic role in national supply chains, but the risk tied to Section 232 steel tariffs remains front and center for investors.

By contrast, investors should be mindful of how quickly tariff policy changes could reshape Cliffs’ cost structure and profit outlook...

Read the full narrative on Cleveland-Cliffs (it's free!)

Cleveland-Cliffs' outlook projects $22.5 billion in revenue and $590 million in earnings by 2028. This requires 6.8% annual revenue growth and a $2.29 billion earnings increase from current earnings of -$1.7 billion.

Uncover how Cleveland-Cliffs' forecasts yield a $12.17 fair value, a 9% downside to its current price.

Exploring Other Perspectives

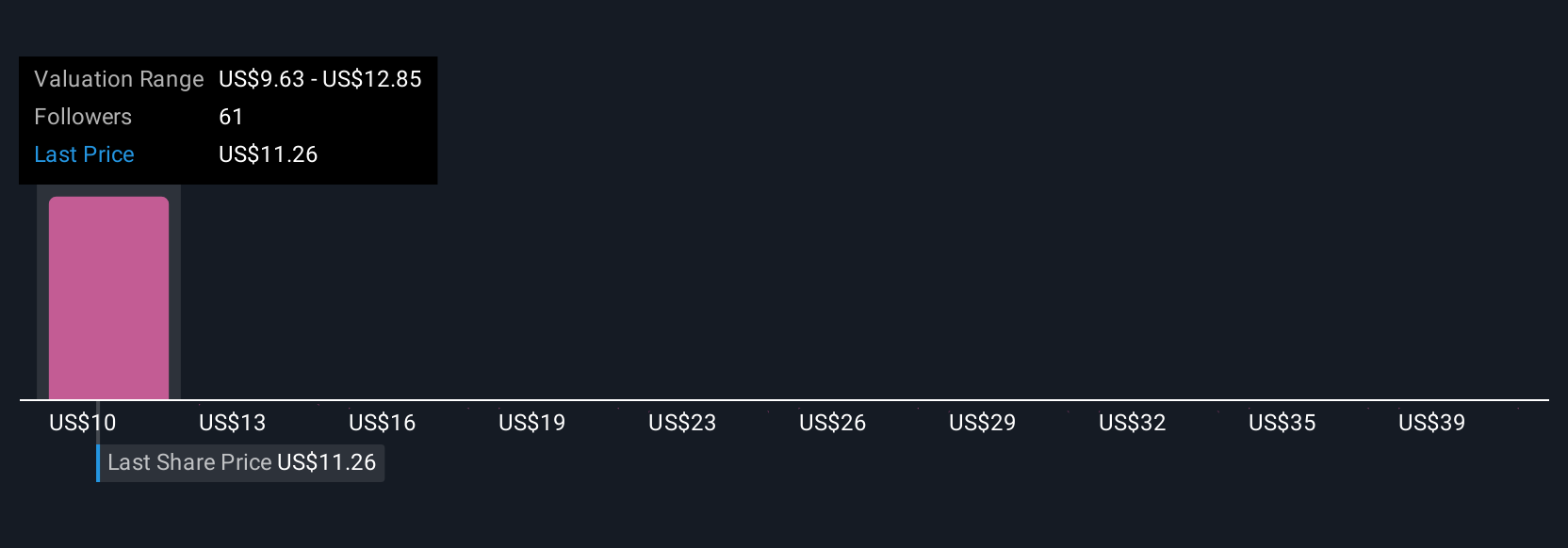

Ten members of the Simply Wall St Community set fair value estimates for Cleveland-Cliffs ranging from US$1.90 to US$64.86 per share. While opinions vary widely, the key risk remains whether current U.S. steel tariffs will persist, affecting both revenue and margins over time.

Explore 10 other fair value estimates on Cleveland-Cliffs - why the stock might be worth less than half the current price!

Build Your Own Cleveland-Cliffs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cleveland-Cliffs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cleveland-Cliffs' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives