- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Does Cleveland-Cliffs’ New Automaker Deals Change the Stock’s Outlook for 2025?

Reviewed by Bailey Pemberton

Trying to figure out if Cleveland-Cliffs deserves a spot in your portfolio? You're certainly not alone, especially now. After months of market churn, the stock has snapped back in a big way, up 18.0% over the past 30 days and riding a 39.6% gain year-to-date. But the journey hasn't been all sunshine. Even with that rally, shares still sit 4.4% below where they were a year ago, and the longer three-year view shows a decline of 18.5%. The last five years, though, look considerably stronger, with returns of 53.6%, hinting at the potential for significant long-term growth if you play your cards right.

Much of this volatility has revolved around shifting trade policy and the tug-of-war over tariffs. Ongoing tensions, such as new U.S. steel tariffs sticking around in Canada and Washington's steady ramp of levies on imported steel and aluminum, have shaken up supply chains and shifted risk perception for companies like Cleveland-Cliffs. Yet, beneath the headlines, there’s a different story taking shape. The company recently inked multi-year, fixed-price contracts with several U.S. automakers, building in earnings stability that most steel makers would envy, especially as the industry wrestles with global oversupply concerns.

So, what about value? On a straightforward scorecard, six checks and Cleveland-Cliffs ticks the box for undervaluation in three, notched a value score of 3. That’s a sign there’s room to run, but also that plenty of investors are still on the fence. Let’s break down these numbers and dig into how Cleveland-Cliffs stacks up on common valuation approaches, and, more intriguingly, set the stage for a way to look at value that goes beyond the usual methods.

Why Cleveland-Cliffs is lagging behind its peers

Approach 1: Cleveland-Cliffs Discounted Cash Flow (DCF) Analysis

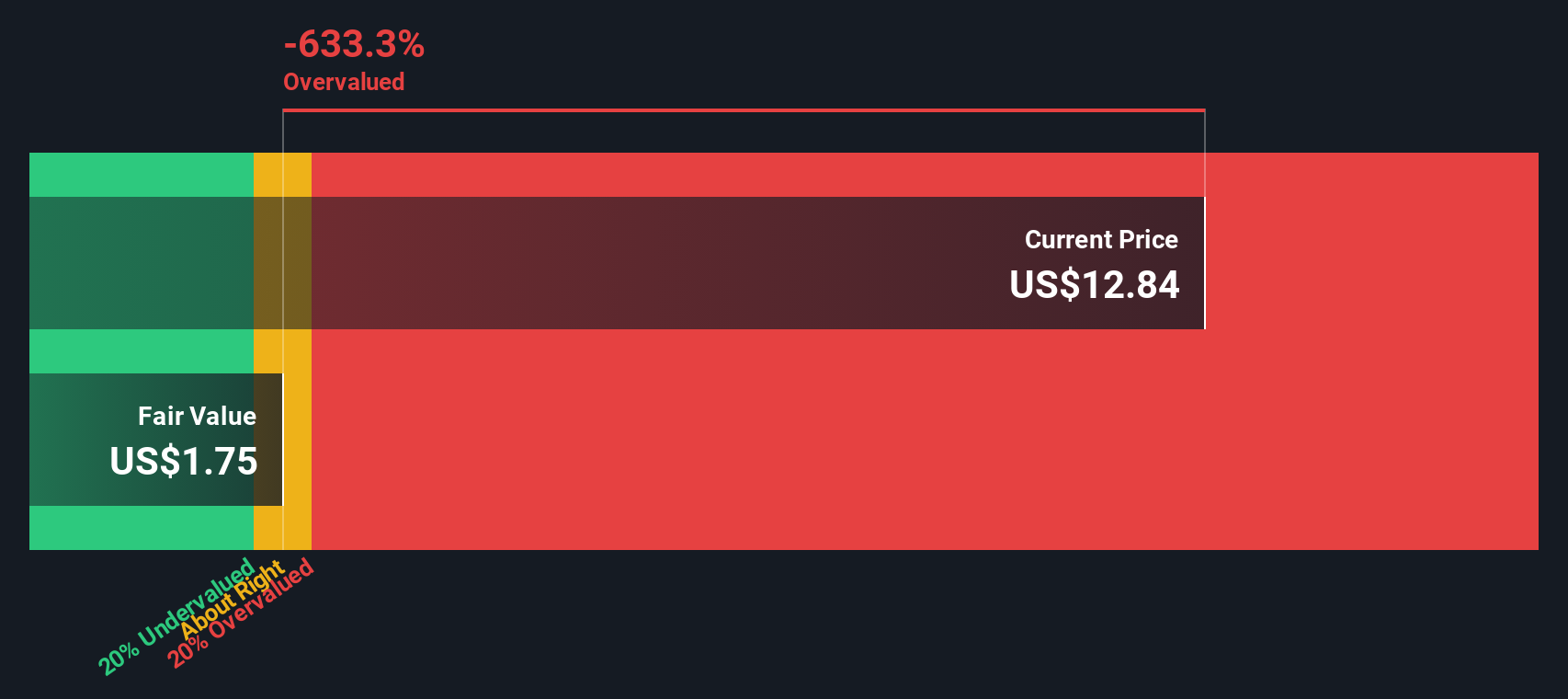

The Discounted Cash Flow (DCF) valuation model estimates a company’s intrinsic worth by projecting future cash flows and discounting them back to today’s value. This approach evaluates whether the current market price makes sense based on what Cleveland-Cliffs is expected to generate in free cash flow over the years ahead.

In the most recent twelve months, Cleveland-Cliffs reported free cash flow of -$1.49 billion, a negative figure reflecting current industry headwinds. Looking forward, analysts estimate the company’s free cash flow will swing positive, reaching approximately $428 million in 2026 and $122 million by 2027. Simple Wall St extrapolates these estimates even further, projecting steadily declining free cash flow through 2035, where it is expected to sit just above $6.8 million.

Comparing these projections to the market price, the DCF calculation arrives at an intrinsic value that is dramatically below where shares currently trade. Cleveland-Cliffs is estimated to be 1,013.9% overvalued according to this model, a stark indication that, on a pure cash flow basis, the stock’s price is running well ahead of the company’s likely ability to generate cash in the future.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cleveland-Cliffs may be overvalued by 1013.9%. Find undervalued stocks or create your own screener to find better value opportunities.

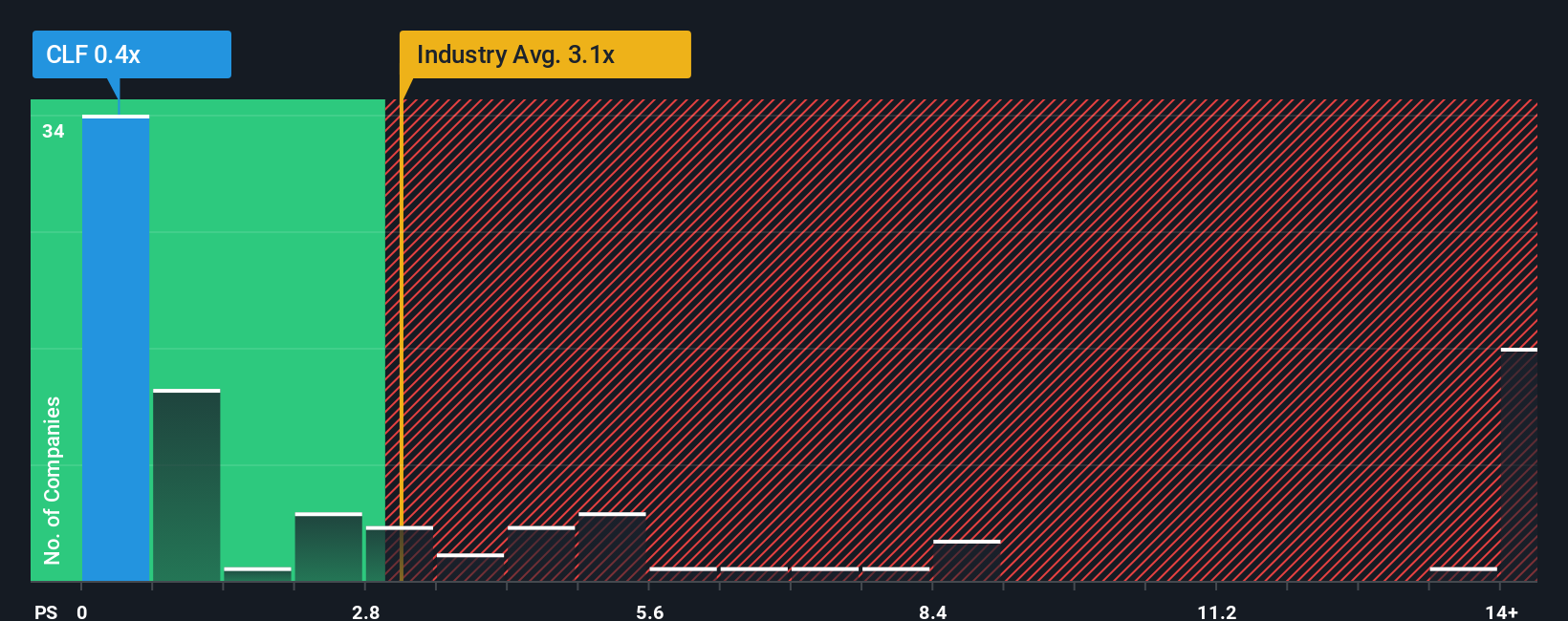

Approach 2: Cleveland-Cliffs Price vs Sales

The Price-to-Sales (P/S) ratio is a popular valuation tool, especially for companies in cyclical industries like steel where profits can swing widely from year to year. Unlike price-to-earnings, P/S focuses on the company's revenues, making it a more reliable metric for evaluating businesses that may not always report steady profits but maintain robust sales figures.

Generally, a "normal" or "fair" P/S ratio reflects both growth expectations and the risks inherent in the business. Fast-growing, stable companies tend to warrant a higher P/S ratio, while those with more uncertainty or lower margins typically deserve a discount. Keeping those benchmarks in mind, Cleveland-Cliffs is currently trading at a P/S ratio of just 0.36x. This represents a significant discount to both the Metals and Mining industry average of 3.11x and its peer group’s average of 1.27x.

Simply Wall St’s “Fair Ratio” goes a step further than simple averages by factoring in Cleveland-Cliffs’ unique mix of growth outlook, profitability, risk, industry, and market cap to calculate a custom benchmark. For Cleveland-Cliffs, that Fair Ratio comes in at 0.83x. This proprietary metric is designed to reflect what would be reasonable given the company’s specific situation, avoiding the pitfalls of one-size-fits-all comparisons.

Since Cleveland-Cliffs’ actual P/S ratio is materially lower than its Fair Ratio, this method indicates that the stock is undervalued based on its sales and fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cleveland-Cliffs Narrative

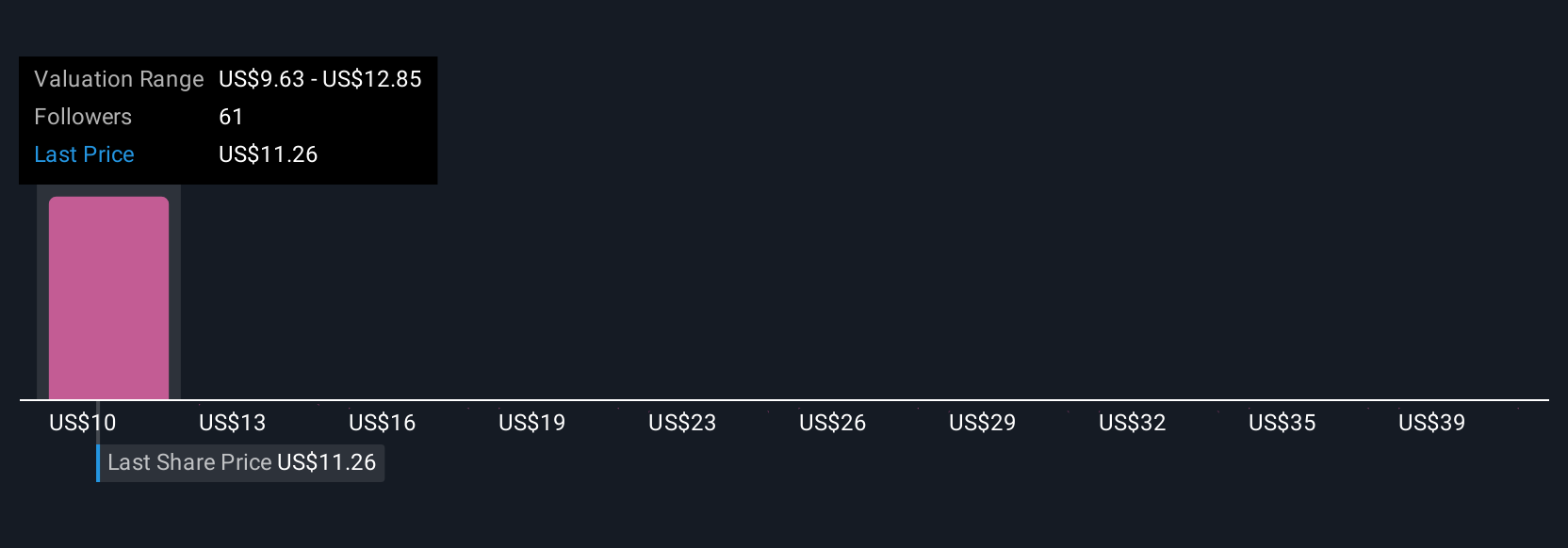

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your point of view, a story about what the numbers mean for Cleveland-Cliffs that blends your personal financial forecasts and fair value estimates with the company's real-world business developments and risks.

Rather than being just a number crunching exercise, Narratives let you connect Cleveland-Cliffs' journey, such as the impact of tariffs or new contracts, directly to a financial outlook and a fair value estimate. These stories are easy to create and explore on Simply Wall St’s Community page, a tool trusted by millions of investors.

With a Narrative, you can compare your fair value to the current market price, helping you confidently decide if it's time to buy, hold, or sell. Your Narrative is updated automatically when news breaks, earnings are announced, or the outlook shifts, so you stay in sync with the latest developments.

For example, some investors' Narratives see Cleveland-Cliffs benefiting from strong domestic demand and set price targets as high as $14.00; others focus on structural risks and peg fair value much lower, at just $5.00. Using Narratives empowers you to shape your own view, make decisions grounded in evidence, and react quickly as the story evolves.

Do you think there's more to the story for Cleveland-Cliffs? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives